Introduction

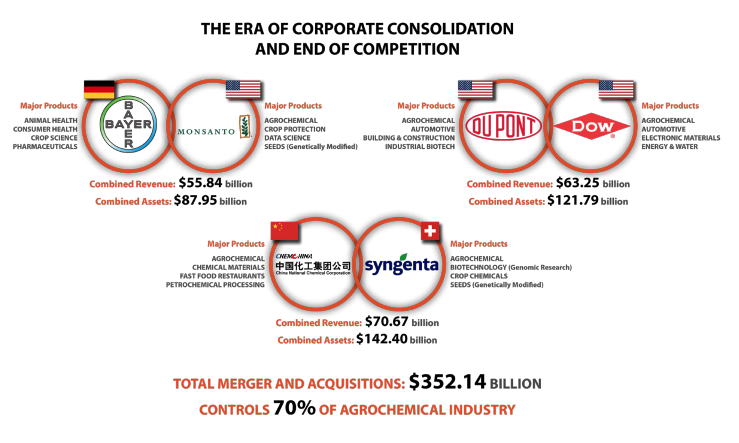

IN THE PAST TWO YEARS ALONE, three major corporate mergers have begun to reshape what was an already concentrated international market for agricultural chemicals, seeds, and fertilizers. If the mergers gain approval from their relevant regulatory agencies, these six multinational corporations would fold into three (Dow-DuPont, Bayer-Monsanto, and ChemChina-Syngenta), and have a profound impact on the future of global agriculture. The mergers would drastically reduce competition in the areas of crop protection, seeds, and petrochemicals; further consolidate the agrochemical market; reduce procompetitive research and development (R&D) collaborations; and, most urgently, pose a critical danger to ecosystem sustainability and exacerbate the global climate crisis.1

n the first case, in September 2016, the German multinational life sciences, pharmaceutical, and chemical company Bayer bought out Monsanto, the US multinational agrochemical and agricultural biotechnology conglomerate known for producing genetically modified (GM) seeds. On March 21, 2018, Bayer won antitrust approval by the European Union’s European Commission for its $62.5 billion bid for Monsanto, and on May 29, the US Justice Department approved the acquisition,2 with the companies’ joint assets now amounting to $87.95 billion, and a total combined revenue of $55.84 billion.3

n the second case, in April 2017, DuPont, the US chemicals company that works in agricultural, advanced materials, electronics, and bio-based industries, merged with Dow Chemical, the US multinational chemical conglomerate developing products for agricultural, automotive, construction, consumer, electronics, packaging, and other industrial markets. In April 2017, the European Commission conditionally approved the $130 billion merger between the two US companies.4 The two companies will have combined assets of $121.79 billion, and a total revenue of $63.25 billion.5

In the third case, the Chinese state-owned chemical and seed company ChemChina purchased Syngenta, the Swiss agricultural company which produces seeds and agrochemicals. In April 2017, the $43 billion merger won US antitrust approval, though it remains contingent on approval from China, Europe, India, and Mexico. Their joint assets would amount to $142.4 billion, with a $70.67 billion total revenue if it receives final approval.7

Altogether, the combined assets across the three new companies would amount to $352.14 billion and their combined total revenue would be $189.76 billion. These deals alone will place as much as 70 percent of the agrochemical industry and over 60 percent of commercial seeds in the hands of only three companies.8

These mergers are emblematic of rampant market concentration across a number of global agricultural input industries. Between 1994 and 2013, the four firms (BASF, Bayer-Monsanto, Dow-DuPont, and ChemChina-Syngenta) combined market share jumped from 21.1 percent to 44 percent in crop seed and biotechnology; from 28.5 percent to 62 percent in agrochemicals; from 28.1 percent to 56 percent in farm machinery; and from 32.4 percent to 55 percent in animal health.9

A Global Food System in Disarray

THE NEGATIVE EFFECTS of such mergers can be felt on a much finer scale too, with merger-favorability being relatively dismal among producers themselves. With regard to Bayer’s plans to acquire Monsanto, a 2016 survey found that 67 percent of farmers felt the move was negative, with only 10 percent indicating it was positive. With regard to ChemChina’s plans to acquire Syngenta, a 2016 survey found that more than 80 percent of farmers had a negative or very negative opinion of the merger. Such opinions suggest that the vast majority of farmers have had a negative experience of increasing corporate consolidation and corporate power, despite the pro-farmer narrative put forth by such corporations themselves.10

From the “Big Six” to the “Big Four”

The trend toward concentration of power among agricultural, pharmaceutical, and chemical firms has been longstanding. During the 1990s there were numerous mergers between such firms that aimed to take advantage of potential synergies and secure even greater corporate profit and strength. But since the mergers took place within the globalized market where most agricultural, pharmaceutical, and chemical markets exist across different countries, these expected synergies were ultimately not realized.

Instead the result was the spinoff of numerous agricultural divisions: Monsanto, for example, merged with Pharmacia and Upjohn before a new Monsanto division—now focusing on agriculture— separated to form an altogether different entity. Syngenta began with the merger between the agribusiness divisions of Novartis and Zeneca. However, AstraZeneca, which focuses on pharmaceuticals, remains a separate company. Bayer acquired the agribusiness operations of Aventis, yet Sonofi-Aventis remained a financially distinct pharmaceutical company.

By the 2000s, six companies that focused on agricultural, pharmaceutical, and chemical products held control over a majority of the global proprietary (i.e. brand-name) seed and agrochemical market: BASF (the German chemical company and the largest producer in the world with subsidiaries and joint ventures in more than 80 countries), Bayer, Dow Agrosciences, DuPont, Monsanto, and Syngenta.

Together, these corporations from the US, Germany, and Switzerland constitute what many have called the “Big Six.” They have been called this because they have had a dangerous chokehold on the global agricultural market, with effectively unrivaled national and international political influence. For example, in 2013, these six companies accounted for almost $23 billion in sales of seeds and biotech traits and $38.5 billion in sales of agrochemicals, for a total of $61.5 billion per annum, ultimately maintaining control of 63 percent of the commercial seed market and 75 percent of the agrochemical market.11

These corporations were also called the “Big Six” because of their overwhelming influence with regard to the global agricultural research agenda. For example, in 2013, these companies collectively spent $4.7 billion annually for research on seeds and pesticides—75 percent of all such private sector research.12

With these and other mergers, however, the “Big Six” in the agricultural seed, chemical, and traits area are rapidly becoming the “Big Four”: BASF, Bayer-Monsanto, Dow-DuPont, and ChemChina-Syngenta. A number of other mergers in recent years—most involving these corporations— have also characterized this trend in consolidation. As of April 2017, Sinochem and ChemChina were in merger talks to create the world’s largest industrial chemicals firm. In October 2017, BASF announced that it is acquiring a large portfolio of seeds and herbicides from Bayer for $7 billion, making BASF a major player in the seed market. At the same time as its merger with Dow, DuPont agreed to sell its crop protection portfolio to FMC, while in turn acquiring FMC Health and Nutrition; and in September 2017, the Canadian companies Agrium and PotashCorp announced they are merging to create the largest fertilizer company in the world.

Yet the massive mergers of Monsanto and Bayer (the first and third largest biotechnology and seed firms in the world, respectively), the merger of Dow and DuPont (the fourth and fifth largest biotechnology and seed firms in the world, respectively), and the merger of ChemChina and Syngenta (China’s largest chemical company and the world’s largest crop chemical producer) dominate the scene.

A Deceitful Narrative

DOW-DUPONT, BAYER-MONSANTO, and ChemChina-Syngenta portray their respective mergers as milestones in agricultural and chemical innovation, productivity, and sustainability. Yet their narrative greatly differs from the sad reality of these mergers.

Dow-DuPont

Dow-DuPont, in making the case for the merger, and while committed to “market-driven research and development, backed by world-class engineering capabilities,” states that they will be better equipped to not only “deliver differentiated products and solutions,” but also “uphold sustainability” and “use science and innovation to tackle world challenges.” They would do so, the company added, while maintaining a “best-in-class safety culture.” Appealing to investors in particular, Dow-DuPont has outlined its plan to create three independent companies that will be “more competitive than either company could be on its own and well equipped for science-driven, profitable, long-term growth.13

Bayer-Monsanto

Similarly, Bayer-Monsanto states that the merger will build upon a “strong culture of innovation, sustainability and social responsibility” and help them “produce sufficient, safe, healthy and affordable food.” Repeating the familiar and seemingly selfless pro-farmer narrative, they state that the merger is also “good for our growers... because A Deceitful Narrative they have better choices to increase yields in a sustainable way.” Similarly appealing to and reassuring investors, Bayer-Monsanto states that “this step will significantly strengthen our position as a leading life science company in the world.”14

ChemChina-Syngenta

Finally, ChemChina-Syngenta’s merger echoes that of the other heavy-hitters, mixing claims of increased revenue and market control with social and environmental responsibility: “The company aims to profitably grow market share through organic growth and collaborations, and is considering targeted acquisitions with a focus on seeds. The goal is to strengthen Syngenta’s leadership position in crop protection and to become an ambitious number three in seeds. Key drivers for the next phase of growth will be further expansion in emerging markets, notably China, the stepping up of digital agriculture tools, and ongoing investment in new technologies to increase crop yields while reducing CO2 emissions and preserving water resources.”15

Yet, apart from profitability for investors and the corporations themselves, the narrative of these mergers as milestones in agricultural and chemical innovation, productivity, and sustainability that has been proffered by these corporations cannot be further from the truth.

The Dismal Truth

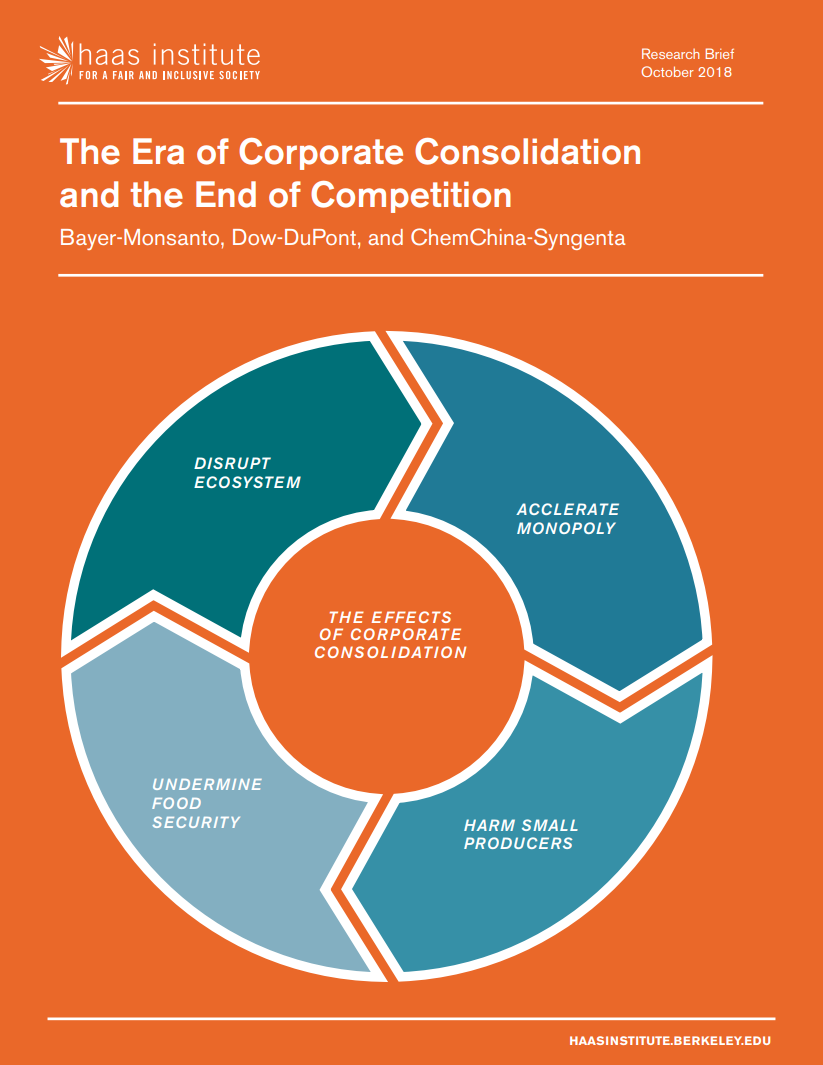

CONTRARY TO THEIR NARRATIVES that promise environmental sustainability, better choices and increased profitability for farmers, and greater scientific and technological innovations in food and agriculture, the effects of such mergers are devastating and far-reaching and can be recognized in several key ways.

Consolidation and Collaboration, Not Market Competition

Firstly, while these agribusinesses promise increasingly “differentiated products and solutions,” the concentrated market produced by such mergers is instead one that fosters—and thrives off of—dangerous alliances that actually undermine differentiated products and solutions. Specifically, such mergers help eliminate head-to-head competition in agricultural biotechnology innovation, crop seeds, and chemical markets. For example, these seed and agrochemical firms reinforce their market power by agreeing to cross-license proprietary germplasm and technologies, consolidate research and development efforts, and terminate costly patent litigation battles.16 In other words, consolidation and collaboration—not competition— are the order of the day.

One result of a market increasingly dominated by a fewer number of companies is the reduction of suitable options for producers. Although an explosion of new product lines is providing an illusion of innovation in processing and retail, these often amount to little more than the repackaging of existing products.17

Antitrust and Generics

Such mergers do not only encourage the repackaging of existing products but also the reduced availability of existing products. Specifically, although the Federal Trade Commission (FTC) and others have been authorizing such mergers, these The Dismal Truth mergers in particular still risk breaching antitrust law—legislation that aims to prevent controlling trusts or other monopolies and promote competition in business. For example, ChemChina’s proposed merger with Syngenta has faced difficulties as ChemChina’s subsidiary ADAMA sells generic versions of at least three Syngenta products. The FTC is requiring ChemChina to sell ADAMA’s rights to three generic versions of Syngenta products to AMVAC, a California-based agrochemical company. This will effectively eliminate the direct product conflicts for this merger.18

R&D Agenda for Further Consolidation and Agrochemical Dependence

Such mergers and monopolies have an even more insidious impact beyond simply product selection, availability, and cost. Specifically, growth in size also gives companies greater research and development (R&D) capabilities. Such an increase in R&D capacity is fostered either internally or through the acquisition of highly innovative enterprises and start-ups. The result, however, is a reduction of opportunities for procompetitive research and development collaborations. The scope of research and innovation has narrowed as dominant firms have bought out the innovators and shifted resources to more “defensive modes of investment,” and toward continued chemical-intensive industrial modes of production.19 Specifically, through such mergers, the “Big Six” research and development agenda—now the “Big Four” research and development agenda—further promotes genetic engineering, chemical dependence, and monopoly patents that ultimately thwart both public and private sector alternatives and innovation that may be more beneficial for consumers and the environment.20

One impact has been rising seed costs. Between 1994 and 2010, seed prices in the US more than doubled relative to the price farmers received for their harvested crops—more than any other farm input. According to the USDA, this increase was a result of the increase in value-added characteristics developed by private seed and biotech companies through R&D programs, and through technology fees and the cost of seed treatments, which themselves are a function of such mergers.21 In an attempt to predict the impact of the current mergers on seed pricing, a September 2016 Texas A&M study found that the proposed Bayer-Monsanto combination would ultimately raise cotton seed prices by 18.2 percent, corn seed prices by 2.3 percent, and soybean seed prices by 1.9 percent.22

Undermining Farmer and Breeder Rights

Such mergers and monopolies ultimately undermine the rights of farmers and plant breeders given their impact on product selection, availability, and cost, and the cycles of dependency farmers and breeders are pushed into. Specifically, according to the United Nations Conference on Trade and Development (UNCTAD), the privatization and patenting of agricultural innovation—including gene traits, transformation technologies, and seed germplasm—has been supplanting not only traditional agricultural understandings of seed, but also the right to save and replant seeds harvested from the former crop.23 The assertion of proprietary lines on seed technologies and genetic contents has turned farmers from being “seed owners” to mere “licensees” of a patented product.24

A More Restrictive Playing Field

The research and development activities of these and other agribusiness firms in turn allow advances that favor a strengthening of position for large firms at the expense of the principle of fair competition. Specifically, large companies have shifted R&D resources to the least risky modes of investment, and on input traits and major crops promising greater returns on investment. Consolidation trends are also often linked to technological and regulatory developments that lead to an increase in the costs of new products on the market. This increase reinforces the predominance of the big firms, which are more capable of coping with it.25 Together, such firms are focused on protecting patented innovations and creating barriers to entry for other competitors.26

Lobbying and State Power

Agribusinesses have built a vast network of influencers to shape US and European Union laws and safety standards to their benefit. This network includes not only their in-house lobbyists but also public relations companies, trade associations, think tanks, law firms, product defense companies, and lobby consultancies. Ultimately these actors and institutions echo their positions, produce and push studies in the companies’ favor, and provide public relation strategies.27 And the amount spent by the companies involved in the massive mergers of recent years has only increased. Companies such as Dow, DuPont, Bayer, Monsanto, Syngenta, and other agrochemical and seed companies spent $1.6 million more in lobbying in the first quarter of 2017 over the same period the year before, and 2.7 times their expenditures for the first quarter of 2008.28 The Center for Responsive Politics, which tracks the influence of money on public policy, shows massive lobby efforts by each of the agriculture, chemical, and pharmaceutical firms. In 2017, BASF spent $1.8 million in lobbying; Bayer spent $10.5 million; Monsanto spent $4.3 million; Dow spent $11.2 million; DuPont spent $15.9 million; and Syngenta spent $1.5 million.29

As ChemChina is not a private corporation but a state-owned enterprise, the current set of mergers and acquisitions highlight a new and critical variable. Such dynamics characteristic of increasing corporate power and control—including increasing consolidation, decreasing ease of rival entry, decreasing ease with which buyers can switch their purchase among sellers, an R&D agenda that further promotes genetic engineering, chemical dependence, and monopoly patents that thwart both public and private sector alternatives and innovation—now have explicit state support from the outset.

The move toward GMOs in China illustrates this point. President Xi Jinping said in a 2013 speech that China must “boldly research and innovate, [and] dominate the high points of GMO techniques... [We] cannot let foreign companies dominate the GMO market.” The GMO promise of dramatically higher crop yields was unavailable to China as long as the country did not have a place within the market. Growing US and European GMO crops would leave China reliant upon foreign sources of seeds, undermining its supposed goal of state-driven food security. Yet with a stateowned enterprise taking control of Syngenta, a leading seed company, China’s incentives with regard to genetically modified crops shifts accordingly. Ultimately, the potential wide adoption of GMO seeds becomes a commercial win for ChemChina and a policy win for the Chinese government.30

Conclusion

If greenlighted by government bodies in the US and abroad, the mergers and acquisitions of large multinational agribusiness industries—such as the merging of Bayer and Monsanto, Dow and DuPont, and ChemChina and Syngenta— will have global ramifications. Such corporate mergers would further undermine food security and poverty reduction plans; disrupt trade flows; and accelerate corporate control, consolidation, and monopolization of global, regional, and local food systems by a few agribusiness corporations. Ultimately, these mergers would come to the detriment of small and mid-size farmers, rural communities, consumers, and societies at large.

- 1While corporate consolidation still matters, that alone is no longer considered to be a sufficient indicator of market power. Other factors, such as the ease of rival entry and the ease with which buyers can switch their purchases among sellers, paint a more complete picture. James M. MacDonald, “Mergers and Competition in Seed and Agricultural Chemical Markets,” Farm Economy (Washington D.C.: USDA Economic Research Service, April 3, 2017), https://www.ers.usda.gov/amber-waves/2017/april/mergers-and-competition…

- 2Patrick Mooney, Chantal Clement, and Nick Jacobs, “Too Big To Feed: Exploring the Impacts of Mega-Mergers, Consolidation and Concentration of Power in the Agri-Food Sector,” (Brussels: International Panel of Experts on Sustainable Food Systems, October 2017); Foo Yun Chee, “Exclusive: Bayer to Win EU Approval for $62.5 Billion Monsanto Deal,” Reuters, February 28, 2018, https://www.reuters.com/article/us-monsanto-m-a-bayereu-exclusive/exclu… Kendall, Brent, and Jacob Bunge. “U.S. to Allow Bayer’s Monsanto Takeover.” Wall Street Journal, April 9, 2018, sec. Business. https://www.wsj.com/articles/justice-department-to-allow-bayers-acquisi….

- 3“Bayer’s Annual Report,” Bayer Global, 2017, http://www.annualreport2017.bayer.com/management-report-annexes/report-…; “Annual Reports,” Monsanto, 2017, https://monsanto.com/investors/reports/annual-reports/.

- 4“Dow, DuPont Complete Planned Merger to Form DowDuPont,” Reuters, September 1, 2017, https://www.reuters.com/article/us-dow-m-a-dupont/dowdupont-complete-pl….

- 5“Dow Historic SEC Filings,” DowDuPont, 2017, https://www.sec.gov/Archives/edgar/data/1666700/000166670018000009/a201…; “DuPont Historic SEC Filings,” DowDuPont, 2017, https://www.sec.gov/Archives/edgar/data/1666700/000166670018000009/a201…

- 7Amie Tsang, “China Moves a Step Forward in Its Quest for Food Security,” The New York Times, April 6, 2017.

- 8Mooney, Clement, and Jacobs, “Too Big To Feed: Exploring the Impacts of Mega-Mergers, Consolidation and Concentration of Power in the AgriFood Sector.

- 9Mooney, Clement, and Jacobs, “Breaking Bad: Big Ag Mega-Mergers in Play” ETC Group Communique (ETC Group, December 2015); Keith Fuglie et al., “Rising Concentration in Agricultural Input Industries Influences New Farm Technologies,” Amber Waves (Washington D.C.: USDA Economic Research Service, December 2011); Aleksandre Masashvili et al., “Seed Prices, Proposed Mergers and Acquisitions Among Biotech Firms,” Choices Magazine, Agricultural & Applied Economics Association 31, no. 4 (2016).

- 10Ben Potter, “Farmers Balk at Bayer’s Move for Monsanto,” AgWeb, September 15, 2016, https://www.agweb.com/article/farmers-balk-at-bayersmove-for-monsanto-N….

- 11“Breaking Bad: Big Ag Mega-Mergers in Play”; MacDonald, “Mergers and Competition in Seed and Agricultural Chemical Markets.”

- 12Ibid.

- 13“The DowDuPont Merger: All You Need to Know,” DowDuPont Inc., 2018, http://www.dow-dupont.com/about-dow-dupont/default.aspx

- 14“Bayer and Monsanto to Create a Global Leader in Agriculture,” Bayer News, September 14, 2016, http://www.press.bayer.com/baynews/baynews.nsf/id/ADSF8F-Bayer-and-Mons….

- 15“Syngenta Looks to the Future,” Syngenta Global, June 27, 2017, https://www.syngenta.com/media/media-releases/yr-2017/27-06-2017.

- 16Hope Shand, “The Big Six: A Profile of Corporate Power in Seeds, Agrochemicals & Biotech,” The Heritage Farm Companion (Washington D.C., Summer 2012), https://www.seedsavers.org/site/pdf/HeritageFarmCompanion_BigSix.pdf.

- 17“Breaking Bad: Big Ag Mega-Mergers in Play”; Pat Mooney, “Report: Big Data Is Accelerating Corporate Control of the Global Food Supply,” In These Times: Rural America (blog), October 17, 2017, http://inthesetimes.com/rural-america/entry/20611/agribusiness-mega-mer…

- 18Lindsay King, “Five of the ‘Big 6’ Agricultural Corporations Looking to Merge,” The Fence Post, April 24, 2017, https://www.thefencepost.com/news/five-of-the-big-6-agricultural-corpor….

- 19Patrick Mooney, Chantal Clement, and Nick Jacobs, “Too Big To Feed: Exploring the Impacts of Mega-Mergers, Consolidation and Concentration of Power in the Agri-Food Sector” (Brussels: International Panel of Experts on Sustainable Food Systems, October 2017).

- 20Shand, “The Big Six: A Profile of Corporate Power in Seeds, Agrochemicals & Biotech.

- 21Ibid.

- 22Bartholomew D. Sullivan, “Mega-Mergers in Agriculture Expected to Raise Prices,” USA Today, August 29, 2017, https://www.usatoday.com/story/news/politics/2017/08/29/mega-mergers-ag… D. Sullivan, “Mega-Mergers in Agriculture Raise Concerns About Food Costs, Biodiversity,” USA Today, August 29, 2017, https://www.usatoday.com/story/news/politics/2017/08/29/mega-mergers-ag….

- 23Irene M. Moretti, “Tracking the Trend Towards Market Concentration: The Case of the Agricultural Input Industry” (Geneva: United Nations Conference on Trade and Development (UNCTAD), May 2016), http://repository.un.org/handle/11176/334377.

- 24Ibid.

- 25Sylvie Bonny, “Corporate Concentration and Technological Change in the Global Seed Industry,” Sustainability 9, no. 9 (2017): 1632.

- 26Mooney, Clement, and Jacobs, “Too Big To Feed: Exploring the Impacts of Mega-Mergers, Consolidation and Concentration of Power in the Agri-Food Sector”.

- 27“A Match Made in Hell,” Corporate Europe Observatory, April 27, 2017, https://corporateeurope.org/food-and-agriculture/2017/04/match-made-hell.

- 28Tiffany Stecker, “Dow’s Lobbying Spending Overshadows Competition” (Washington D.C.: The Bureau of National Affairs, April 30, 2017), https://www.bna.com/dows-lobbying-spending-n57982087339/.

- 29“Lobbying Database,” Center for Responsive Politics, 2018, https://www.opensecrets.org/lobby/.

- 30Geoff Colvin, “Inside China’s $43 Billion Bid for Food Security,” Fortune, April 21, 2017, http://fortune.com/2017/04/21/chemchina-syngenta-acquisition-deal/.