Download a PDF of this report here.

Public opinion polling shows that the idea that corporations and the wealthy are not paying their fair share of taxes has gained wide currency in the United States.1 It is a view grounded in real and demonstrable patterns. The tax burden of the wealthiest in the country has indeed followed a dramatic downward trend from the 1950s to the present.2 Even where the specifics of this pattern elude public view, a number of recent high-profile examples of corporations like Amazon, Netflix, and Chevron paying no federal income tax has garnered media attention, and attracted public scrutiny.3

Given the widespread view that corporations and the wealthy pay too little, we might assume certain other beliefs and preferences follow. If a large percentage of survey respondents say that corporations are not paying their fair share, one might expect that a similar share (or more) would say they support reforms to make corporations pay more. We might further expect this share to believe higher corporate taxes would benefit society, the economy, and/or themselves and others like them.

On the other hand, existing literature shows considerable ambivalence and complexity in the public’s views on taxes in the U.S. It is fairly well established, for example, that support for policies to increase taxes on the most well off do not track consistently with individuals’ income (or presumed economic self-interest). One popular explanation for why significant shares of lower-income Americans oppose increasing taxes on the wealthy is that many anticipate that they or their family will be wealthier in the future.4 But this “prospect of upward mobility” explanation has lost traction, especially as research shows how strongly individuals’ partisan and ideological identities predict their taxation preferences.5 Other recent work highlights how notions of fairness—both the view that economic success through hard work should not be “punished,” and expressions of resentment towards perceived beneficiaries of redistribution (e.g. welfare recipients)—also mitigate support across income groups for increasing taxes on the highest earners.6

This literature is illuminating, but leaves unanswered some questions of critical interest to the fields of civic engagement and organizing. If partisanship drives views on progressive taxation, what of true non-partisans, especially those who are disaffected or inconsistently engaged? Are there differences in the prevalence of ambivalent views across racial or ethnic groups? And do the bases or rationales for that ambivalence vary across these different communities?

This brief has two main goals. The first is to examine whether and for whom ambivalent—even seemingly contradictory—views on corporate taxation hold among Californians. To do this, we analyze data from the California Survey on Othering and Belonging, a statewide survey conducted in December 2017 by the Othering & Belonging Institute.7 The second goal is to understand what lies beneath these ambivalent views, looking especially for the narratives that hold them together. What accounts for the gaps where the opinion that corporations are not paying their fair share does not translate into support for increasing taxation on them? To answer this, we broaden our analysis by bringing in qualitative data collected through focus groups and interviews carried out in the summer and fall of 2019.

Getting a handle on the size and composition of what we call the “tax-confidence gap” is relevant to a number of critical conversations taking place in California today. The most obvious is that these findings position us to better gauge where tax legislation and propositions are likely to gain traction and support, and where skepticism prevails. In doing so, our findings also call on us to reassess conventional wisdom about who are California’s “swing voters.” The image of the swing voter that has prevailed nationally for decades is a voter who is consistently engaged, ideologically moderate, and (at least implicitly) white. Our findings challenge that characterization on all fronts, pointing to very different groupings of “swing voters.” Finally, our engagement with the words and narratives of Californians who are rarely centered in opinion research on tax policy provides a view into what are indeed coherent stories about power and inequality—and stories with which civic engagement groups have only begun to grapple. We hope that this brief will call attention to the urgent need for a strategy to transform them.

The brief begins in the following section with an overview and breakdowns of Californians’ opinions on whether corporations are paying their fair share of taxes, and what they think would be the impact of increasing those taxes. By comparing these opinions, we reveal the extent of the tax-confidence gap. Next, we examine which Californians are most likely to be found in that gap, in terms of demographic and other characteristics. We then describe qualitative research carried out with Californians fitting the profile most represented in the tax-confidence gap. The results of this research include a set of four core narratives or logics that hold seemingly contradictory views on corporation taxation together. Our analysis concludes with critical lessons that should inform organizing efforts and campaigns concerned with mobilizing support for progressive tax reforms.

Californians’ Views on Corporations and Taxation

Despite largely successful efforts by conservatives to brand California as an over-taxing state, more than two thirds of Californians share the view that corporations are not contributing enough to the tax base. The California Survey on Othering and Belonging found that 68 percent of respondents statewide said “big businesses and corporations” are “paying too little” in state taxes, while just 15 percent said they are paying too much, and 17 percent said they pay “their fair share.” This breakdown is mostly consistent across lines of race/ ethnicity, gender, region, and even income level.

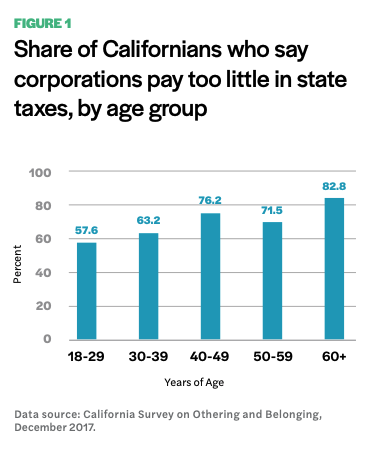

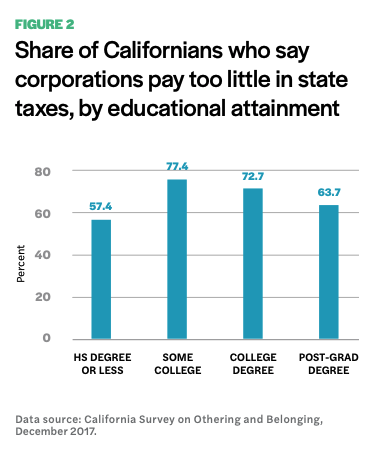

Not surprisingly, Californians who identify as Democrats are much more prone to say corporations pay too little (74.4 percent) than are Republicans (61.1 percent). A more unexpected finding is that younger Californians ages 18-29 years are the least likely of any age group to say that corporations pay too little, with 58 percent saying so, compared to over 75 percent of Californians ages 50 and up (see figure 1).8 There are also notable gaps in views by educational attainment. Californians with at least some college experience say at much higher rates that big businesses and corporations are paying too little, as figure 2 shows. These variations notwithstanding, a large majority of 60-70 percent of respondents across most socio-demographic sub-groups believe big businesses and corporations pay too little in taxes.

Californians’ beliefs about the corporate tax burden also differed in relation to other particular attitudes and experiences. First, there was a modest but significant relationship between reports of being hard hit by the 2008-2009 Great Recession and the belief that corporations pay too little in taxes. But even more significant to predicting which Californians see corporate taxes as too low is their views on immigrants. Using a composite anti-immigrant resentment score derived from responses to four survey items,9 we found that low resentment towards immigrants is strongly predictive of the view that corporations are not paying their fair share. Another way of saying this is that those who have strong anti-immigrant sentiment are more likely to side with big businesses and corporations on the issue of taxes. Finally, the strongest effect we found outside of partisan identity was respondents’ religiosity—or, the reported frequency with which they attend religious services. High religiosity makes a Californian less likely to say corporations pay too little, with slightly more predictive force than even anti-immigrant resentment.

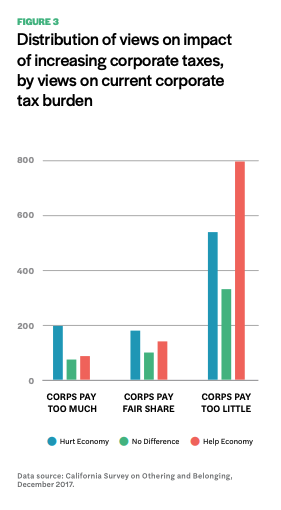

Though overall the view that corporations pay too little in taxes is strong and widespread among Californians, markedly fewer take the next step of expressing comfort and approval for tax increases. Immediately following the question asking whether big businesses and corporations are paying their fair share, the California Survey on Othering and Belonging asked respondents whether increasing taxes on corporations would help, hurt, or make no difference to the state’s economy. In contrast to the large majority that said corporations pay too little, only a 42 percent plurality of Californians said that making them pay more would help. The next largest share, at 37 percent, said that higher corporate taxes would hurt the economy, and 21 percent said that it would make no difference.

On this question there was some variation by race and region. Californians who identified as Black or African American were more likely to say that increasing corporate taxes would help the economy, with half saying so. Slightly below average shares of Latinxs and Asian Americans and Pacific Islanders (AAPIs) said that increasing corporate taxes would help the economy (40 percent each); but this was because more said it would “not make a difference.” Regionally, residents of the Inland Empire of Southern California were considerably more pessimistic about increasing corporate taxes, with just 35 percent saying it would help the economy and 48 percent saying it would hurt (compared to 42 percent and 37 percent statewide, respectively). As with views on whether corporations pay too little, Californians with at least some college or a 2-4 year degree more often said that raising taxes on corporations would “help,” but not nearly at the rates that said corporations pay too little today. Finally, the trend line by age group on the expected impact of increasing corporate taxes differed from that reported above. Though older Californians were more likely to say corporations pay too little, they were less likely to say that increasing their taxes would help—and more likely to say it would hurt— the California economy.

Though much more might be said of these variations, what is of most interest to this brief are the signs of a widespread “tax-confidence gap,” wherein Californians think corporations pay too little in taxes, but may not support making them pay more. Statewide, the share of Californians saying that increasing taxes on corporations would help the economy is 26 percentage points lower than the share saying that corporations currently pay too little. By cross-tabulating responses to the questions, we find that over half of those who say corporations pay too little also say that if corporations paid more, it would either hurt (31.85 percent) or make no difference to (20.3 percent) the state’s economy (see figure 3).

Out of all respondents to the California Survey on Othering and Belonging, more than one in three express the seemingly incongruous views that corporations pay too little in taxes but that increasing their taxes would not help the economy. One might reasonably question how incongruous these views really are. Does the idea that increasing taxes would not help “the economy” mean opposition to doing it? What comes to respondents’ minds when asked to consider “the California economy”? The survey data cannot answer these questions, nor is there existing literature that can offer reliable interpretive guidance. There is a body of literature on how state and expert knowledges produce and substantiate the idea of “the economy,”10 and another on how lay people understand how economic phenomena work.11 But there is little on how non-experts understand what “the economy” is—what is held within the concept— and nothing on this question in the context of U.S. opinion surveys.

We appreciate the question here about validity,12 while still finding a provocative puzzle in the frequency with which Californians say that corporations pay too little in taxes but that their paying more would not be helpful. The question in fact motivated the design and approach that our research team took to subsequent qualitative data collection discussed later in this brief. But before proceeding to those culminating findings, we should look more closely at which Californians are most likely to hold the seemingly incongruous views on corporate taxation. Thanks to their large numbers as a sub-sample in our survey—868 respondents— further statistical analysis of this group can reliably identify patterns in the socio-demographic characteristics most common to them.

Describing the Gap: Who Holds Ambivalent Views on Corporate Taxation?

The sheer size of the group who adhere to what we are calling the tax-confidence gap—more than one third of Californians in a representative statewide sample—tells us that this set of ambivalent views is not isolated to any group of Californians. Still, by using the statistical model of logistic regression, we can estimate how different characteristics impact the likelihood that a person holds this combination of views. We are thereby able to say which socio-demographic groups are most represented in the tax-confidence gap.

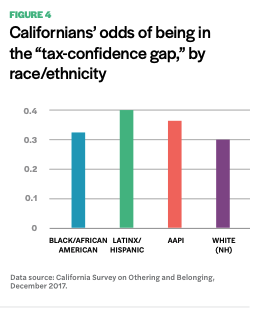

Overall, our analysis finds that Californians’ race/ ethnicity is a significant factor in who holds views that corporations are paying too little in taxes, and yet that increasing those taxes would not “help the economy.” People of color—those identifying as Black/African American, Latinx/Hispanic, or AAPI—are more likely to hold this combination of views than are whites, with Latinxs the most likely (see figure 4). Simultaneously, Californians who identify as Democratic partisans are much less likely to be represented in the tax-confidence gap.13 Age, income, educational attainment, and homeownership have much smaller and non-significant effects on the likelihood of holding this combination of views when we account for partisan identity.

We also find evidence that tends to push back against the “prospect of upward mobility” hypothesis mentioned previously. Where Californians reported in 2017 that they were doing “about the same” or “better off” than they were prior to the 2008-2009 Great Recession, it had a significant negative effect on their likelihood of being represented in the tax-confidence gap. The same was also true for those who said that they anticipated being “about the same” or “better off” a year into the future (though here the effect was not statistically significant). It may be that neither of these is a perfect measure of individuals’ perception that they might someday ascend to the highest tax brackets. Still, in both cases, we find that Californians who express that they are headed in the right direction financially are less likely to be among those with ambivalent views on progressive taxation. Thus, it is race/ethnicity that stands out as a critical factor in who holds such views, making ethno-racial identity a key coordinate for deeper, qualitative investigation into what underlies them.

Why a Tax-Confidence Gap?: Examining the Evidence

The previous sections have described an apparent incongruity in the views of a significant share of Californians with respect to corporations and taxation, and a puzzle around who holds those incongruous views. The ambivalence lies in the simultaneous beliefs that (1) corporations pay too little in state taxes and (2) increasing taxes on corporations would not be beneficial. The puzzle is in the fact that many of those inhabiting this tax-confidence gap do not appear positioned to be directly harmed by increasing corporate taxes, and would even be likely to benefit from a corresponding increase in public services.

The Othering & Belonging Institute sought to unravel this puzzle by incorporating targeted subject-recruitment and data-collection strategies into a wider qualitative study it carried out in the Inland Empire of Southern California in JuneNovember 2019. This study was comprised of five focus groups with a total of 46 participants from across San Bernardino and Riverside counties, followed by in-depth, one-on-one interviews with 26 additional residents of the region. The study engaged these participants on questions about their sense of community and in-group/out-group identities, views on government’s role in society, and beliefs about economic inequality and fairness.

One of the Inland Empire focus groups was especially designed to grant insights into the (corporate) tax-confidence gap identified in the 2017 California survey data.14 This group was composed of all Latina women who expressed in a screener questionnaire that they believed corporations are paying too little in taxes, but were also skeptical of raising taxes, even to support “services in areas such as health and education.”15 The focus group setting allowed the nine women convened to articulate and discuss their views in their own words and narratives, and in doing so, disclose the connections by which the taxconfidence gap is held together.16 From there, the research team continued to explore these views with other Inland Empire residents through one-onone interviews. Below we lay out the most common lines of thinking that prevent even those who say corporations pay too little in taxes from supporting an increase to their tax burden.

1. Corporations wouldn’t pay more because they know how to “work the system,” within the law.

It was a common refrain among Latinx and Black study participants in the Inland Empire that, even if laws could be changed to increase taxes on corporations, they would not in the end pay more. A first version of this skeptical view was grounded in the idea that corporations know the “tricks of the trade” to subvert taxation. Here participants invoked “loopholes,” write-offs, deductions, and arcane “insider” knowledge of how to “work the system” that people like themselves do not possess. They pointed as evidence to the current tax system, and reasoned that if corporations know how to avoid taxation within the letter of the law now, they will find ways to do so if taxes are increased. Indeed, increasing taxes gives them even more incentive to find workarounds.

“They not writing [tax] checks to nobody. They writing checks to they neighbor’s son’s school.”

2. Corporations wouldn’t pay more because they have the power to flout the law.

A second version of the view that corporations would not pay more even if taxes were increased was that corporations can violate tax laws with impunity. Again, perceptions of current corporate practices were the basis for skepticism—even fatalism—about tax reform. Study participants spoke of corporations lying about their profits, and sending money offshore or otherwise “hiding” it. These narratives diverged from those above by shifting to a view of corporations as actual lawbreakers. Still, they were no less critical of “the system.” In the previous paragraph’s version of skepticism, laws were depicted as practically set up for corporations to take advantage; this second version described a system that does not enforce the laws with respect to the most economically privileged. Notably, numerous Black and Latinx study participants pointed as an example to Donald Trump. Here we see evidence that awareness of Trump’s flouting of norms and laws exacerbates the sense that law puts no constraint on corporations or the extremely wealthy.17 But the most critical point here is that these views do not culminate in a mobilizing outrage at elite lawbreakers. Instead, they lead to resignation, and reinforce disillusionment and disaffection from a system that fails to hold those elites accountable.

SPEAKER 1: No. It doesn’t work that way. Just—that’s not the way it works. They are able to hide... they’re able to send money out of the country; money’s filtered through different ways. I mean they are allowed to, you know,…

SPEAKER 2: Like this. [mimes a shell game]

SPEAKER 3: Hide!

SPEAKER 1: ...embezzle!

SPEAKER 4: Yeah, embezzle. [laughs]

3. Even if corporations paid more, people like us would not see benefits from the government.

Not all study participants who were skeptical of corporate tax increases placed their misgivings on the “input” side—that is, with the payment of the taxes. Several also said that if laws were changed so that only corporations and the wealthy paid more, it would not “help” because the study participants’ own communities would never be the ones to see the revenue. Again, these responses came from Latinx and Black residents of the Inland Empire, almost all of them from low- to medium-income households. The doubts communicated here were not about general government inefficiency, but specific government neglect. Though these participants said that corporations currently pay too little in taxes, their experiences led them to predict that any funds appropriated through an increase in corporate taxes would disappear into “the government.” The management of public revenue was depicted as opaque and unaccountable. Residents said that they do not see where their tax dollars go currently, and pointed to past and current disappointments with the state’s support for schools and infrastructure in their communities.18 The message then was: “It may work, but it won’t work for us.”

“I just want to say, we never have transparency about it. Even if I feel like they tax the wealthy more, again… that money is going to come right back at them. It's like, ‘It's going away now, but look over here. Why isn't this program improving if we're taking more away from the top?’ We need to literally see them going to the bank and saying, ‘We're putting it in for this program, and then on Monday you all have what you need,’ or something.”

4. Even if corporations paid more, they would find a way to pass the cost on to people like us.

A final line of tax-skeptical thinking posited that the cost of any increase to corporate taxes would end up being borne by low- and middle-income people. Those who offered this type of narrative did not necessarily subscribe to a single notion of causality. Interestingly, study participants rarely mentioned corporations moving out of the state as the mechanism that would “cost people like us.” It could be that this well-known anti-tax narrative is losing some of its hold. Some participants said that corporations would increase prices on consumer goods, but most made a more diffuse—and defeatist—point about corporate power. They maintained that corporations would find a way. The distribution of the tax burden is not fair the way it is currently, they held, but it is probably safer not to rock the boat. If we did, we don’t know what might be the consequences, but surely they would not favor us.

“Then they’d just figure out a way to sock it to us down below by raising prices on the things we buy, and raising prices on gas.”

The narratives of tax skepticism laid out above emerged initially during our Inland Empire focus groups, and were echoed in several of our oneon-one interviews with others in the region. Having noted their prominence, the research team decided to test what it would take to induce such skepticism in interviews in which it did not come up spontaneously. The purpose here was to gauge whether this skepticism was even more widespread— and easily accessed just below the surface. Thus, when interviewees told interviewers that they would favor reforming taxes to make “only corporations and extremely wealthy pay more,” interviewers followed up with: “Do you think that would work? Would corporations and the wealthy pay more?”

Interviewees’ reactions to this soft prompt reinforced how prevalent skepticism about the effectiveness of increasing taxes on corporations and the wealthy is. A total of 18 interviewees received this verbal nudge and offered a clear response to it. In nine of these 18 cases, the vague prompt was all it took for the participant to respond “no”—that corporations and the rich would not pay more. In two more cases, interviewees got to “no” after the interviewer offered a brief clarifier: Did the interviewee think corporations would pay, or might they instead do “something else” like “find loopholes”? Two other interviewees said that corporations and the wealthy would put up a fight if such a reform was enacted, but said they were unsure who would prevail. Just five of the 18 said that if laws were changed, corporations and the wealthy would indeed pay more.

This pool of interviewees is small, and clearly we cannot claim it is representative. But the findings are provocative. Our interviewees—Black and Latinx residents of the Inland Empire, from low- to middleincome households—were highly prone to adopt a tax-skeptical viewpoint when exposed to minimal signaling. The prompts interviewers gave were broad, vague, and formulated as questions—which would not be the case in a counter-messaging campaign against a real tax reform. Yet even so, more often than not, these soft prompts were all it took to shift interviewees’ attention from positing the desirability of tax reform to disbelief that such a reform would ultimately be beneficial.

INTERVIEWEE (Latina woman, Fontana, CA): Even though we pass—the smaller people, and the lower brackets, the middle class and the lower income— pass these type of propositions, they somehow funnel their money and end up putting down that, “No, I didn’t make a million dollars; I only made $500,000. So that puts me in a smaller bracket, so I’m not part of that one percent.” You know what I mean?... They find their ways. They find their loopholes and until we identify those loopholes and cut them by that umbilical cord, then they’re going to continue to funnel that in.

INTERVIEWER: ¿Qué piensas qué harían para no pagar? What do you think they would do to not pay more?

INTERVIEWEE (Latina woman, Rialto, CA): No reportar las cosas. O sea, lo que siempre han hecho—hacen su Mickey Mouse. Not report things. That is, the same as they’ve always done—do their Mickey Mouse.

INTERVIEWER: ¿No cambiaría nada? Nothing would change?

INTERVIEWEE: No, no cambiaría nada. Aunque los obligaran, no cambiaría nada porque serían haciendo sus chanchullos, como decimos nosotros. No, nothing would change. Even if they required them [to pay more], nothing would change because they’ll be running their rackets, as we say

INTERVIEWER: How do you think they would go about that?

INTERVIEWEE (African American woman, Moreno Valley, CA): Not paying more?

INTERVIEWER: Yeah.

INTERVIEWEE: Whatever it took not to pay. That’s how I think they’d go about that.

INTERVIEWER: Do you think it would work if we raised the taxes for them specifically? Like do you think they’d pay it?

INTERVIEWEE (Latino man, San Bernardino, CA): I don’t know. I mean, if they’re in control, it doesn’t matter. They’re always going to find their way.

Conclusions

A large majority of Californians believe that corporations do not pay their fair share of taxes. But this does not mean that they expect that increasing those taxes would solve problems the state faces. Instead, the extreme accumulation of wealth and economic inequality we see in the state tend to further deteriorate people’s faith that it is possible to rein in corporations.

The Othering & Belonging Institute’s qualitative research in the Inland Empire provides clear explanations of what holds together the views we describe as the tax-confidence gap within constituencies we might otherwise expect to be ready supporters of progressive tax reform. It finds that many Latinx and Black community members’ outlook on the prospects for any such reforms are lodged in their analysis and experiences of inequality and power as they function at present. For many of those who would most stand to benefit—at least in theory— from increased social expenditure enabled by taxing corporations and the wealthy, these experiences are defined by disappointment and disillusionment. Longstanding failures to adequately deliver publically funded goods to low-income communities has planted and nourished the seeds of fatalism. This fatalism extends to the very policy levers that would seem best designed to alleviate those failures.

Part of what holds together the tax-confidence gap in these communities is a view of corporate power as almost limitless. Whether with or without a causal narrative attached, many were those who expressed the sentiment that “they” will always win, and “we” will always (continue to) be the ones who get the shaft. Where study participants expressed the narratives described in the previous section, whichever they used positions corporations and the wealthy as deeply entangled with law-making and enforcement mechanisms. This stirred resentment of the rich and corporations, but only to an extent.

More notable is the way that resentment towards economic elites’ power boomerangs back upon “the system”—or government—itself. Existing research tells us that individuals’ degree of trust (or distrust) in government strongly influences preferences around policies that target a beneficiary class of which they are not members, and that come at a cost to themselves.19 But what we heard in the Inland Empire is something different. Here study participants reacted negatively to a hypothetical reform that should cost them nothing, and that aims to correct something that they consider to be a problem (“corporations pay too little in taxes”). Still, lack of faith in government as a willing distributor of goods to their communities, and the view of government as a witting dupe to economic elites, combined to make them withhold support for the hypothetical reform.

Strategy Implications and Recommendations

1. Polls showing that the public believes corporations do not pay their fair share of taxes only tell part of the story.

And it is arguably not the most important part. While it is true that a large majority of respondents to polls and surveys recognize that corporations pay too little, this does not equal support for reforms to increase their taxes. The public’s views on corporations and taxation are multidimensional and complex. Narrative and outreach around increasing corporate contributions to the tax base must extend beyond affirming constituents’ existing view that corporations currently do not pay enough.

2. Potential to grow support for progressive tax reforms in California may be biggest among groups that do not fit the conventional “swing voter” archetype.

Assuming that the belief that corporations and the wealthy are not paying enough in taxes is a necessary starting point for progressive reforms, those individuals found in the taxconfidence gap are the most promising prospective supporters of such reforms. They are the margin to be swung. But contrary to what conventional wisdom would tell us, these swing voters are disproportionately people of color, especially Latinxs. It would be wrong for civic engagement efforts focused on progressive tax reforms to see lowincome communities of color as “birds in hand” to be merely mobilized. Campaigns will instead need to both animate and persuade them.

3. A strategy built around leveraging anger, and villainizing or “breaking” with corporations or the extremely wealthy will not be enough to win tax reforms.

If campaigns or organizers rely narrowly upon stoking dislike, distrust, or resentment towards corporations, their efforts are likely to fail. Narratives positing a stark “us” versus “them” (“breaking”) strategy may resonate, but that does not mean they will mobilize those who identify with them. They may in fact be counterproductive if their core message does not pivot away from depicting economic elites as all-powerful.

4. Expanding support for progressive tax reforms among those on the fence rests in large part on the credibility of government.

Questions about government’s trustworthiness and accountability are front and center in public evaluations of tax increases. This is true for those with a vested economic interest in preventing progressive tax reforms, but also many of those who would not directly “pay” for such reforms. Communities that have been habitually under-resourced may support progressive tax reforms in principle, but are very easily unsettled from this position when mistrust in government is activated. This is true even when they see the target of proposed tax increases (in this case, corporations and the wealthy) as corrupt, dishonest, or “cheats.” Progressive tax reform agendas and advocacy could benefit from foregrounding strong mechanisms of public oversight and accountability in their proposals, which would substantiate the argument that these reforms can in fact be made to benefit the chronically under-served.

5. For large-scale change, those who seek to challenge corporate power and extreme inequality must develop and execute a narrative change strategy with respect to government.

What is government, and what can and should it be? Because ideas about government loom so large in popular explanations of distribution, inequality, and wealth accumulation, these questions cannot be skirted. Messaging strategies that avoid talking about government as such—based on the wellfounded perception that much of the public is put off by government—may see some successes, but will leave intact a formidable barrier to major reform. Failure to articulate a vision of what government could or should be amounts to ceding the popular conversation and narrative to those who benefit from the de-legitimation of, and disaffection from, government.

In sum, proponents of progressive tax reform need to convey a new vision and story of what’s possible if they are to grow support among those who already believe corporations aren’t paying their fair share. It is one that must articulate a new relationship between government and under-served communities that diverges from what these communities have until now experienced. It must posit a government that is disentangled from corporate power, and able and committed to reining in corporations’ hold over critical policy decisions. For this aspirational vision to be plausible, it must be driven by a large “we” collective identity that reclaims and takes back government. Advancing that story and identity will better equip Californians to move from achieving episodic victories to the kind of major overhauls to taxation and distribution systems that the people of the state so desperately need.

- 1As one example, see the results from Gallup polls for the past 15 years at: Gallup, “Topics A to Z: Taxes,” https://news.gallup.com/poll/1714/taxes.aspx.

- 2Emmanuel Saez and Gabriel Zucman, The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay, W.W. Norton & Co., 2019.For a powerful visualization of the change in tax rates by income group since 1950, see David Leonhardt, “The Rich Really Do Pay Lower Taxes than You,” The New York Times, October 6, 2019, www.nytimes.com/interactive/2019/10/06/opinion/income-tax-rate-wealthy….

- 3One study found that sixty Fortune 500 companies paid no federal income tax in 2018. Matthew Gardner, Steve Wamhoff, Mary Martellotta, and Lorena Roque, “Corporate Tax Avoidance Remains Rampant Under New Tax Law,” Institute on Taxation and Economic Policy, April 2019. To their credit, a handful of billionaires have chosen to call public attention to how little they pay in taxes, and to support reforms to increase their tax burden.

- 4Roland Bénabou and Efe A. Ok, “Social Mobility and the Demand for Redistribution: The POUM Hypothesis,” The Quarterly Journal of Economics 116(2): 447-487 (2001).

- 5That is, increasingly we see that identification as a Democrat is a major driver of support for redistribution across income levels, and Republican identity is a major driver of opposition to redistribution. Arthur Lupia, Adam Seth Levine, Jesse O. Menning, and Gisela Sen, “Were Bush Tax Cut Supporters ‘Simply Ignorant’? A Second Look at Conservatives and Liberals in ‘Homer Gets a Tax Cut’,” Perspectives on Politics 5(4): 773-784 (2007); and William Franko, Caroline J. Tolbert, and Christopher Witko, “Inequality, Self-Interest, and Public Support for ‘Robin Hood’ Tax Policies,” Political Research Quarterly 66(4): 923-937 (2013).

- 6Cameron Ballard-Rosa, Lucy Martin, and Kenneth Scheve, “The Structure of American Income Tax Policy Preferences,” The Journal of Politics 79(1): 1-16 (2017).

- 7The California Survey on Othering and Belonging was completed by 2,440 adult residents of the state, with over-sampling to ensure statistically reliable results for several geographic regions and self-identified ethno-racial identities (Black/African American, Latinx/Hispanic, non-Hispanic white, and Asian American and Pacific Islander). For more information on the survey, see Othering & Belonging Institute, “California Survey on Othering and Belonging: Views on Identity, Race and Politics,” April 18, 2018, https://belonging.berkeley.edu/california-survey-othering-and-belonging.

- 8 This is consistent with findings from the Othering & Belonging Institute’s statewide surveys in Florida and Nevada, where it was also people age 50 and up who most frequently said that corporations have too much influence on politics and are paying too little in state taxes. See Sonam Kotadia, “Young Voters, Inequality, and Identity: Views from Rapidly Diversifying States,” Othering & Belonging Institute, October 11, 2019, https://belonging.berkeley.edu/young-voters-inequality-and-identity.

- 9The anti-immigrant resentment survey items and scale are analyzed in detail in Cristina Mora and Tianna Paschel, “Immigrant Resentment in California,” Haas Institute for a Fair and Inclusive Society, University of California, Berkeley, CA, October 2019.

- 10Timothy Mitchell, “Fixing the Economy,” Cultural Studies 12(1): 82-101 (1998); and Hannah Appel, “Toward an Ethnography of the National Economy,” Cultural Anthropology 32(2): 294-322 (2017).

- 11Some examples include: Maureen R. Williamson and Alexander J. Wearing, “Lay people’s cognitive models of the economy,” Journal of Economic Psychology 17(1): 3-38 (1996); Katharina Gangl, Barbara Kastlunger, Erich Kirchler, and Martin Voracek, “Confidence in the economy in times of crisis: Social representations of experts and laypeople,” The Journal of Socio-Economics 41(5): 603-614 (2012); and David Leiser and Yhonatan Shemesh, How We Misunderstand Economics and Why It Matters, Routledge, 2018.

- 12Again, the question is about whether we can gauge respondents’ support for increasing corporate taxes through an item that asks whether doing so would help, hurt, or make no difference to the state economy

- 13This is notable in relation to the finding on race/ethnicity, since recent trends show large majorities of voters of color casting their ballots for Democrats in any given election.

- 14Recall from an earlier section that inland Southern California is the region most pessimistic about the impact of increasing corporate taxes, according to the 2017 California Survey on Othering and Belonging.

- 15We included among the skeptical a mix of individuals who expressing moderate to low support—specifically a “1” to “5” on a 7-point scale.

- 16See for example, Lia Litosseliti, Using Focus Groups in Research, Bloomsbury Publishing, 2003.

- 17 The women in the Latina focus group expressed views on tax law’s power that diverged sharply depending on who was under scrutiny. As their discussion of corporations wound down, one woman noted, “There’s so many people who don’t pay their taxes,” just like “deadbeat dads” who “don’t even pay child support.” Now with attention shifting away from the economically elite, the other participants’ responses changed completely. In relation to a non-elite lawbreaker, the women depicted the system as almost all powerful: “At some point, they’re going to have to pay. They’re going to get caught. And they’re going to have to pay. At some point.”

- 18The example of the lottery came up, as it often does in focus groups in California regarding revenue increases. There is a widespread misperception in the state that the lottery would—or promised to—solve public school budget shortfalls. The fact that it has not done so feeds into distrust of the state government’s management of funds. See, John Myers, “Lottery won’t be a big win for California schools; never has, never will,” Los Angeles Times, January 13, 2016.

- 19Marc J. Hetherington and Suzanne Globetti, “Political Trust and Racial Policy Preferences,” American Journal of Political Science 46(2): 253-275 (2002).