Paper accepted December 2019; Revised July 2020

Download a PDF of this paper here.

By Ángel Mendiola Ross

The Inland Empire of Southern California is one of the fastest growing regions in the country. Home to nearly 4.5 million residents—up from 3.2 million in 2000—the region is also experiencing historic job growth. The July 2019 jobs numbers show that the Inland Empire (or the IE) added 35,300 jobs over the year, outpacing neighboring Orange County by over 10,000 jobs.1 In the past 30 years, it has also transformed into one of the most diverse regions in the nation, going from 73 percent non-Hispanic white in 1980 to majority people of color within two decades.

But for nearly every sign that one might lift up as evidence of economic progress in the IE, there is a contrary sign of rising inequality. Poverty is increasing, many communities are still struggling to recover from the Great Recession and the ensuing decline in homeownership, and local resource decisions hardly appear motivated by a spirit of belonging. Job growth has been concentrated in low-wage retail, food, and warehouse work. Substantial gains in homeownership in the region, especially among Black and Latinx households, were completely wiped out by the foreclosure crisis. Black homeownership in the Inland Empire, for example, grew from 48.6 percent in 2000 to 50.4 percent in 2010 before dropping 8 percentage points to 42.2 percent just five years later. 2

Increases in poverty and renters have been unevenly spread across local jurisdictions, and each community has responded differently to these changes. Local responses range from easing restrictions on street food vending to more punitive policies that criminalize poverty. Data on the share of municipal spending devoted to police suggest that cities are focusing more energy on the punitive side: the average share of spending on police among IE cities increased from 20.6 percent in 2003 to 24.8 percent in 2016, before dropping to 20.4 percent in 2018. During this time frame, however, total city expenditures increased by $2.1 billion, indicating substantial increases in police budgets over this time period.

This paper examines changes in poverty and housing tenure (from homeowner to renter) across IE cities and places as well as the responses of municipalities to these changes. In the context of both increasing poverty and renters (two processes that are highly differentiated by race), cities have chosen to invest more in policing than in interventions that support and incorporate residents, such as enacting strong worker and renter protections. First, I show that while the most extreme poverty remains concentrated in a handful of Coachella Valley and desert communities, poverty has increased by double digits since 2000 in outer-lying jurisdictions like Barstow and Adelanto. I then describe the interrelated rise in renters across the region and how the foreclosure crisis’s disproportionate impact on Black and Latinx homeowners contributed to significant losses in homeownership among these two groups in particular. Finally, I assess the policy responses to these trends and show how rather than providing relief or support to vulnerable populations, cities have largely limited their efforts to law enforcement-centered strategies. In fact, data suggests that cities are devoting an increasing share of their limited budgets to policing.

Key Findings:

- Poverty has increased in the vast majority of cities in the Inland Empire since 2000—in 24 places, the poverty rate increased by more than 5 percentage points.

- The increase in poverty is strongly associated with an increase in the share of renters relative to homeowners as more than a dozen IE cities and unincorporated communities experienced a double-digit increase in the share of renters.

- The average share of spending on police among IE cities increased 4 percentage points from 2003 to 2016 before dropping to 20.4 percent in 2018.

- By 2018, IE cities were spending more than $1 billion annually on police.

Data and methods

Unless otherwise noted, demographic data presented in this paper draw on place-level data from the 2000 Decennial Census and the 2017 American Community Survey five-year estimates from the U.S. Census Bureau. While I use the federal poverty level (FPL) as the measure of poverty, it’s important to note that this measure is often critiqued for being too low and for not taking into account local and regional cost of living. The federal poverty level in 2019 was just under $12,500 for one person and $25,750 for a family of four. Foreclosure rates and high cost loan estimates come from the U.S. Department of Housing and Urban Development (HUD). For the analysis on police spending and violent crime, I rely on the California State Controller's Office Local Government Financial Data and the Uniform Crime Reporting Statistics from the Department of Justice, respectively.

The changing geography of poverty

The suburbanization of poverty has drawn increasing attention in urban studies research and policy discussions across the country. In California, activists and academics stress the interconnectedness of processes of displacement and gentrification in coastal cities with growing inland poverty. This more integrated “megaregional” analysis views displacement from the more expensive, urban core as a key driver of regional resegregation.3 Importantly, the increase in suburban poverty is due to both downward mobility of longer-term suburban residents and the in-migration of poor residents pushed out of coastal cities.4 The poverty rate in the city of Los Angeles, for example, declined from 2000 to 2017, but the Inland Empire saw an increase in poverty of two percentage points. While existing public data sources make tracking the movement of people across county or city lines over time nearly impossible, examining changes in poverty across place shows a changing regional reality.

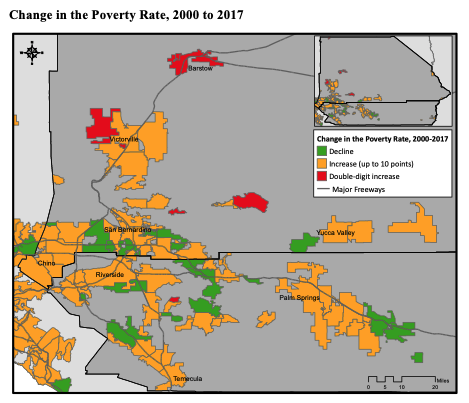

Though nearly all IE places saw an increase in poverty since 2000, the severity of its growth is unevenly spread across the region. Of the California cities that saw the greatest increases in poverty in that time, two IE cities top the list: Barstow and Adelanto. Eight places in the region saw a double-digit increase in the poverty rate (shown in red in the map below). Though these places are largely located in San Bernardino County, Lakeview CDP in Riverside County saw an increase in poverty of more than 20 percentage points (from 17 percent in 2000 to 38 percent in 2017). These communities are located outside of the denser part of the region, far from the principal cities (Riverside, San Bernardino, and Ontario), where the already limited social services networks in the region are concentrated. As poverty spreads to the fringes of the region, residents are forced to make longer commutes not only to the job-rich areas but also to access vital social services. This increase in low-income residents farther out from the core of the region also poses serious challenges to building community power.

While the vast majority of places in the region experienced an increase in poverty since 2000, eight cities and 12 Census-designated places (CDPs), sometimes called unincorporated communities, experienced declines in poverty (shown in green in the map above). This group includes cities that had a relatively high poverty rate in 2000 like Beaumont in Riverside County which saw an 8 percentage-point decline in poverty, as well as places like San Antonio Heights in San Bernardino County which had one of the lowest poverty rates in 2000 and saw a further decline of 3 percentage points. Importantly, the experience of poverty in the region is highly racialized. Between 2010 and 2015, the Black poverty rate increased 6 percentage points to nearly 26 percent and Latinx poverty grew by four and half percentage points to 23 percent. Meanwhile, white poverty grew by two and a half percentage points to just under 12 percent.5 Although there is no one single cause of these changes in poverty across the region, previous research emphasizes the housing-related factors including the aging post-war suburban housing stock, the growth of Housing Choice Voucher recipients in the suburbs, and—arguably the most important—the foreclosure crisis.

From homeowner haven to renter resurgence

The Inland Empire is commonly portrayed as a relatively affordable suburban region, home to many new and old communities of single-family homes. And despite considerable growth in condos and multifamily homes over the last decade, the region remains predominately comprised of single-family detached homes, which account for 70 percent of all housing units (compared with just 37 percent of housing units in the city of Los Angeles).7 Contrary to popular associations of single-family homes and homeownership, however, the majority of renters in the region also live in single-family homes. Overall, the share of renter households relative to homeowners has increased considerably in the IE: from 33 percent in 2000 to 38 percent in 2017.

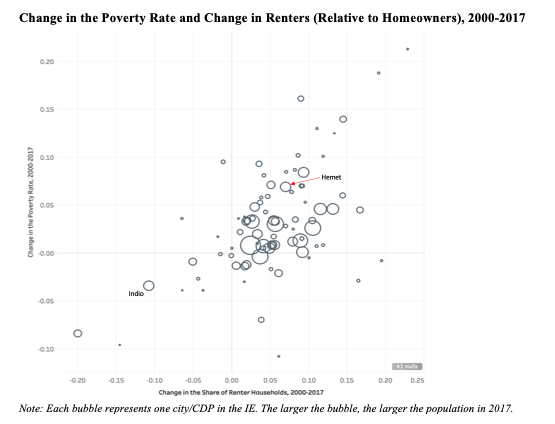

Increases in poverty are strongly associated with increases in the share of renters among the region’s cities and unincorporated communities (see graph below). The city of Indio, for example, home to nearly 87,000 people, saw an 11 percentage-point decrease in the share of renters from 2000 to 2017 and a three percentage-point decline in the poverty rate. The city of Hemet, on the other hand, home to nearly 84,000 people, saw a seven percentage-point increase in both the share of renters and the poverty rate. One of the key drivers of these trends was the foreclosure crisis. The IE was among the regions hardest hit by foreclosures, and years after the housing crash had mostly run its course, the region had the highest foreclosure rate out of the country’s 50 largest metro areas.8

Other researchers have shown that growing regional gaps between rich and poor are no longer expressed cleanly as a central city/suburban phenomenon, but as uneven development and increasing inequality between suburbs.9 In the Inland Empire, while the average estimated foreclosure rate of cities was 9 percent, rates varied considerably. The cities of Adelanto, Coachella, San Bernardino, and Perris, for example, experienced a high-cost loan rate between 42 and 44 percent and a subsequent foreclosure rate of 12 percent. Loans originating in Chino Hills and Palm Desert, on the other hand, were 2.5 times less likely to be high cost and their subsequent foreclosure rates were just 5 percent.

These spatial discrepancies in the IE’s subprime mortgage and foreclosure crisis have clear demographic corollaries. Black and Latinx households were disproportionately exposed to significant losses of housing value and wealth.10 In fact, the percent of a city’s population that is Black and the percent Latinx in 2000 are strongly and positively associated with the estimated foreclosure rate in 2008. Nationwide, Black and Latinx borrowers, who were formerly exposed to explicit discriminatory lending practices, were significantly more likely to receive nontraditional and predatory loans than comparable white borrowers (meaning racial disparities continue even when controlling for borrower income and risk profiles).11 It is thus unsurprising that homeownership rates in the region declined most among Black and Latinx households, wiping out previous gains.12

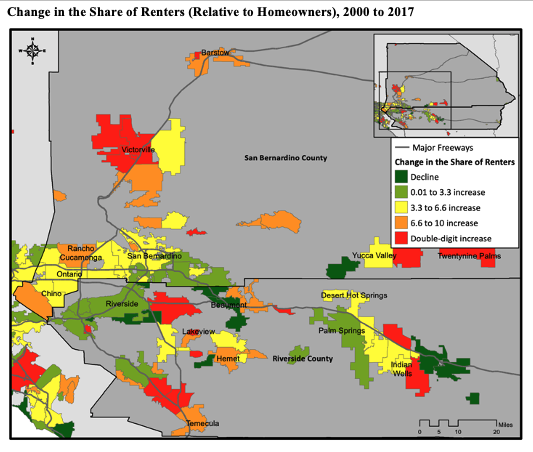

A decline in homeownership, by definition, means a rise in the share of renters. Regionwide, renters make up 38 percent of all households, but are the majority of Black households. Roughly 58 percent of Black households are renters, as are 44 percent of Latinx households.13 Renters also make up the majority of households in 17 IE cities and unincorporated communities, up from just five places in 2000. From Barstow to Cabazon and Twentynine Palms, majority renter cities are growing across the region. Moreover, 17 IE cities and unincorporated communities saw double-digit increases in the share of renters (shown in red in the map below), including several places that are still majority homeowner. Lakeview, the same unincorporated community mentioned above that saw a 21 percentage-point increase in the poverty rate, also saw a 23 percentage-point increase in the share of renters and was 45 percent renter in 2017. And the share of renters more than doubled in the city of Wildomar to nearly 31 percent renters in 2017.

Understanding the context of local responses

Despite this notable increase in poverty and renters in cities across the region, few jurisdictions have adopted inclusive, renter-friendly policies. As a result, many renters are struggling to manage increasing and unaffordable rents. Among the region’s more than 500,000 renter households, 59 percent are “rent burdened”—paying more than 30 percent of their income on housing costs (compared with 56 percent of renters statewide). In some places, such as Lakeview, median rents have increased by nearly $370 from 2000 to 2017, leaving a striking 79 percent of renter households rent burdened.14 In fact, the majority of renters are rent burdened in 95 IE cities and unincorporated communities, and only two have less than a third of renters burdened by housing costs. Even in a relatively affordable region by California standards, low wages, long commutes, and limited resources translate to continued economic insecurity for thousands of families across the IE in the face of broader economic growth and prosperity.

The IE’s two counties also had the highest eviction rates in the state in 2016.15 With limited local action to support and protect renters, recent statewide legislation provides some optimism for IE renters, but with important caveats. AB 1482, sometimes referred to as the “anti-rent-gouging bill”, will limit annual rent increases to 5 percent plus inflation. The law will also extend just-cause eviction protections to tenants, requiring landlords to provide proof of documented lease violations before an eviction. But the law does not take effect until January 2020, and some tenant advocates have been noting an uptick in evictions since the law’s passage in September.16 While cities like Los Angeles, Pasadena, and Pomona have passed emergency moratoriums on no-cause evictions until the law takes effect, no IE city has followed suit.

Importantly, the rent cap law will not apply to apartments built in the last 15 years or to single family homes—where the majority of IE renters live—unless they are corporate-owned. Public data on single-family homes owned by institutional investors is fairly limited. But if the share of cash sales is an approximate indicator of corporate-owned properties, there are likely many corporate landlords throughout the IE.17 Another law signed by the governor in October will expand protections against source of income discrimination for Section 8 voucher holders—a policy that had already been passed by the Los Angeles City Council but that had not been taken up by any IE cities. Once it takes effect, landlords will not be able to deny housing to a potential tenant solely because of their status as a voucher holder.

While IE cities have not responded to changing demographics with stronger renter protections, some cities are adopting a program under the guise of reducing crime that ultimately displaces people from their communities. In December 2019, HUD filed a fair housing lawsuit against the city of Hesperia, a majority Latinx high desert exurb home to 93,000 people, alleging that the city, with substantial support from the Sheriff’s Department, enacted a mandatory “crime-free” rental housing ordinance to address a perceived “demographical problem”: the growing population of Black and Latino renters in Hesperia.18 The neighboring city of Adelanto was considering amending its own similar program due to increased pressure from the ACLU, but the program remains mandatory per the city’s website.19

Research in Arizona and San Bernardino County has suggested that the transition from owners to renters can destabilize or disrupt neighborhoods and lead to increasing service calls to police and code enforcement actions in single-family rentals compared to owner-occupied homes.20 This is especially true when investors buy up single-family properties and fail to maintain them or when properties change hands frequently, making it difficult to develop strong community and neighborhood ties. Considering the growth in renters and investor activity in a region comprised largely of single-family detached homes, perhaps an increase in spending on police is to be expected. But an increase in renters does not deterministically translate into neighborhood destabilization or even depressing property values. In fact, the city of Irvine, one of the safest cities in the state,21 saw a 12 percentage-point increase in the share of renters since 2000, with an increase in the median home value more than double the average of all places in the state. A lot of the complaints of long-time homeowners in neighborhoods with a growing share of renters have more to do with absentee landlords not maintaining their properties than with renting families themselves.

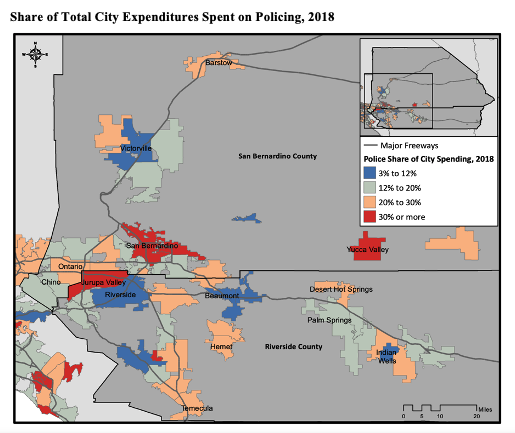

Regardless of the underlying justifications, data show that cities are devoting a greater share of their expenditures to police. By 2018, IE cities were spending over $1 billion annually on police. The city of Jurupa Valley (incorporated in 2011) topped the list in 2018, devoting 37 percent of its budget to police, followed by Canyon Lake, which touts itself as one of only five gated cities in California, and Eastvale (incorporated in 2010), with nearly 34 percent of their budgets.

In total, six cities across the IE directed more than 3 in every 10 dollars spent to police (shown in red in the map below). The city of San Bernardino, for example, devoted 31 percent of their budget, or $74.5 million dollars to police in 2018. That is more than 11 times what the city spent on housing and community development. At the other end of the list is the city of Beaumont, home to 47,000 people and one of the few cities mentioned earlier that experienced a sharp decline in poverty, which devoted only 5 percent of its expenditures to police. Beaumont spent a total of $9.8 million on police in 2018, less than it spent on health, leisure, and community development. Big Bear Lake spent just 8 percent on police, and Indian Wells, one of the whitest cities in the state, spent 9 percent. The 21 cities with their own police departments, which tend to be larger cities in the region, devoted a slightly lower share of their expenses to police (19 percent) than those who contract out with the county sheriff’s department (21 percent). Five years earlier, there was no substantive difference in the police share of city spending between the cities who contract out law enforcement services and those with their own police force.

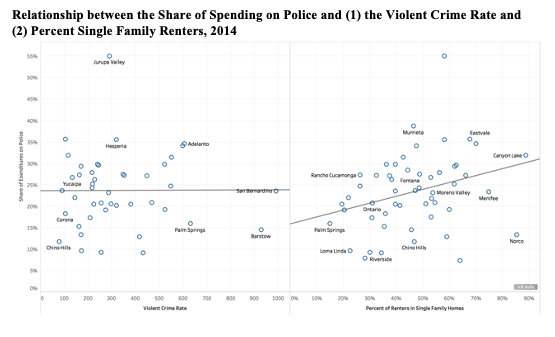

Another factor that one might assume would drive rates of spending on police is violent crime. Interestingly, there is virtually no relationship between the share of spending on police and violent crime among IE cities in 2014 (the most recent year available from the Department of Justice). But, as shown in the chart below, there is a positive relationship between the percent of renters in single-family homes and the share of spending on police, consistent with the research on renters in single-family homes mentioned earlier. Those cities with a higher share of renters in single-family homes also devote a relatively larger share of their spending on police. It is important to note, however, that these associations do not imply causation.

Concluding thoughts

It is plausible that institutional investor-owned properties are driving this relationship and contributing to neighborhood destabilization by failing to maintain their properties or engaging in speculative purchases. But identifying the specific dynamics behind this association is beyond the scope of the paper. Importantly, neither violent crime nor the poverty rate is significantly related to spending on police. While many different factors go into municipal spending decisions, and many cities are struggling with meeting the needs of their residents on relatively limited budgets, the findings from this analysis raise concerns about how IE cities are responding to the changing demographic reality. To build a more inclusive region that fosters the spirit of belonging among all residents, policymakers and leaders across the region must move beyond law enforcement-based strategies and embrace protections and supports for the region’s most vulnerable people.

Ángel Mendiola Ross is a Ph.D. student in the Sociology Department at the University of California, Berkeley

- 1Margot Roosevelt, “California Job Growth Is Outpacing the Nation’s,” Los Angeles Times, August 16, 2019, https://www.latimes.com/business/story/2019-08-16/california-job-growth….

- 2According to data from the National Equity Atlas accessed in December 2019: https://nationalequityatlas.org/indicators/Homeownership/By_race~ethnic…

- 3Tony Roshan Samara, “Race, Inequality, and the Resegregation of the Bay Area” (Urban Habitat, 2016), https://urbanhabitat.org/sites/default/files/UH Policy Brief2016.pdf; Philip Verma et al., “Rising Housing Costs and Re-Segregation in the San Francisco Bay Area” (UC Berkeley’s Urban Displacement Project and the California Housing Partnership, 2019), https://www.urbandisplacement.org/sites/default/files/images/bay_are_re….

- 4Scott W. Allard, Places in Need: The Changing Geography of Poverty, 1st edition (New York: Russell Sage Foundation, 2017).

- 5According to data from the National Equity Atlas accessed December 2019: https://nationalequityatlas.org/indicators/Poverty/Trend:40241/Riversid…

- 7California Department of Finance, Demographic Research Unit.

- 8See for example, https://www.nbcnews.com/businessmain/cities-most-homes-foreclosure-7945…

- 9Alex Schafran, The Road to Resegregation: Northern California and the Failure of Politics, First edition (University of California Press, 2018). Carolina K. Reid et al., “Revisiting the Subprime Crisis: The Dual Mortgage Market and Mortgage Defaults by Race and Ethnicity,” Journal of Urban Affairs 39, no. 4 (2017), https://www.tandfonline.com/doi/full/10.1080/07352166.2016.1255529.

- 10Carolina K. Reid et al., “Revisiting the Subprime Crisis: The Dual Mortgage Market and Mortgage Defaults by Race and Ethnicity,” Journal of Urban Affairs 39, no. 4 (2017), https://www.tandfonline.com/doi/full/10.1080/07352166.2016.1255529.

- 11Reid et al.

- 12Deirdre Pfeiffer, “Has Exurban Growth Enabled Greater Racial Equity in Neighborhood Quality? Evidence from the Los Angeles Region,” Journal of Urban Affairs 34, no. 4 (October 1, 2012): 347–71, https://doi.org/10.1111/j.1467-9906.2011.00596.x. and data from the National Equity Atlas accessed December 2019 https://nationalequityatlas.org/indicators/Homeownership/By_race~ethnic…

- 13Note: These groups are not necessarily mutually exclusive categories in the American Community Survey summary data. These numbers reflect Latinx householders of any race.

- 14Note: increases in median rent are inflation adjusted and reported in 2017 dollars.

- 15Based on unlawful detainer evictions data from Tenants Together and the Anti-Eviction Mapping Project: https://antievictionmap.com/uds-in-ca.

- 16See, for example, https://mustangnews.net/council-passes-last-minute-protections-for-rent…; https://californiaglobe.com/section-2/california-cities-find-themselves…; and https://www.kqed.org/news/11786677/evictions-continue-to-surge-as-tenan….

- 17Matt Levin, “Data Dig: Are Foreign Investors Driving up Real Estate in Your California Neighborhood?,” CalMatters (blog), March 7, 2018, https://calmatters.org/housing/2018/03/data-dig-are-foreign-investors-d…. See the lawsuit here: https://www.justice.gov

- 18See the lawsuit here: https://www.justice.gov/crt/case-document/file/1223276/download

- 19Garrett Bergthold, “ACLU Challenges Adelanto’s Crime-Free Rental Law,” Victor Valley Daily Press, March 19, 2019, https://www.vvdailypress.com/news/20190319/aclu-challenges-adelantos-cr….

- 20Alana Semuels, “The Places That May Never Recover From the Recession,” The Atlantic, December 29, 2017, https://www.theatlantic.com/business/archive/2017/12/suburban-poverty-a….

- 21According to a 2019 report from SafeWise: https://www.nbclosangeles.com/news/local/California-Safest-Cities-Safe-…