The study, authored by Marc Joffe, examines the fees paid by local entities when bonds are offered. Fees come from a variety of services provided by private firms throughout the course of offering bonds.

Introduction

State and local governments incur a variety of costs when they borrow money by selling bonds. Among these costs, the most well-known is the amount in interest that must be repaid along with the principal.1 However, interest is not the only cost incurred by state and local governments seeking to borrow in the municipal bond market.

There are a variety of expenses associated with a bond issuance when a government sells bonds. The amount of funds borrowed is not equal to that received by the government due to the costs of issuance. Those costs are deducted from the bond proceeds before the bond proceeds reach the state or local level.

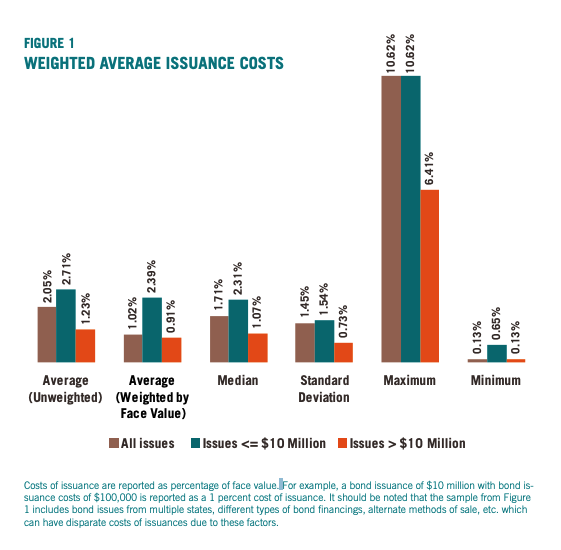

Based upon a study of the cost of issuance for 812 bond issuances since 2012, we found that costs of issuing bonds average 1.02 percent of the bond’s principal amount, but this percentage varied widely. There are examples of significant variance from this average. For example, a bond issuance for $2.1 million dollars for Dehesa School District incurred $200,138 in fees, over 9 percent of the principal amount. Had this issuance followed the 1.02 percent average, its issuance fees would have been nearer $21,000. In our findings, six California school districts incurred costs in excess of 8.5 percent.

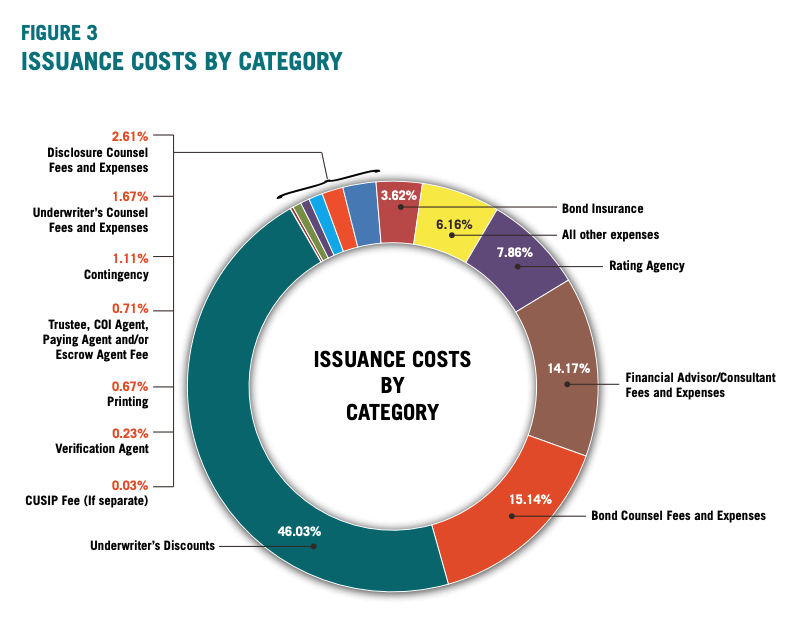

Among the many services that may be obtained by an issuer of bonds, the four services with the largest contributions to total issuance costs were from underwriting, legal consult, financial advising, and rating agency services.

This study provides:

- a description of the types of issuance costs local governments incur;

- an estimate of the size of issuance costs;

- implications for further inquiry related to this study; and,

- ideals for reducing issuance costs.

This report begins with a review of other data collected as measures of issuance costs. Our interest in the topic is not unique; however the data we have made available for the report represents a novel approach to collecting issuance cost data. Secondly, we discuss overall patterns and differences among the diversity of issuers included in the study. We then discuss prominent examples of outliers, where issuance fees were particularly high. This includes the high issuance costs of a California public school district to which we compare the issuance costs of a comparable issuance. Finally, we close with a synopsis of further areas of inquiry and a brief list of implications for policy and practice arising from the study.

attending to issuance cost data

Thoughtful inquiry into cost of issuance is important for two purposes.

First, studying cost of issuance can direct attention to critical areas that can reform practices associated with issuing municipal bonds. There are many different services that may be used in the process to issue bonds. In this paper we identify 13 categories of services (see SECTION 3 on Types of Issuance). Each of these services entails a fee. In this report, we begin an assessment of steps that are frequently used and the magnitude of fees charged for these services. Second, this preliminary study can shape issuer expectations about which service and fee structures are appropriate, necessary, and reasonable.

In this study, we find the average issuance costs for bonds in our sample is 1 percent of principal value.2 The Securities Industry and Financial Markets Association (SIFMA) reports total municipal bond issuances of $382.4 billion in 2012, $334.9 billion in 2013, and $337.5 billion in 2014.3 One percent may not seem like a significant figure. However, 1 percent of 2012’s total issuance is $3.8 billion. A small percentage of a very large sum is significant. To put the $3.8 billion figure into perspective, in 2014 New York State decided to direct $1.5 billion to expand pre-K education across the state over the next five years. $300 million went to New York City for the 2014 roll out of the city’s universal pre-K program.4

This report represents an important step in asserting the importance of more thorough reporting on cost issuance and more accessible avenues of sharing this public data.

Annual issuance costs nationally are between $3 billion and $4 billion.5 Perhaps more importantly, these costs fall disproportionately on small issuers. In this study, these smaller issuers are disproportionately represented by poorer rural school districts that could undoubtedly use every extra dollar not consumed by financial industry interests.6

Gathering adequate data for a study that analyzes all the components of fees that comprise the full cost of issuance is difficult. This study uses a limited sample that is necessarily limited by this structural constraint.7 This report represents an important step in asserting the importance of more thorough reporting and more accessible avenues of sharing this public data. This report also signals important areas for public policy and further inquiry (see SECTION 5).

Attending to Issuance Cost Data: This study’s data

Total issuance cost data was obtained for 812 municipal bond offerings issued between 2012 and 2015. These costs were taken from Official Statement documents from the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access (EMMA) database.8 Official Statements include “Cost of Issuance” in the section of the document describing each bond offering, typically found in the section outlining the sources and uses of funds. The issuance costs recorded here were gathered into the current data set.

In addition, public record requests were sent to local governments issuing selected bonds. One hundred eighty four responses were received from these requests.9 The request asked for more cost of issuance detail than is typically provided in the official statement documents available on MSRB’s EMMA. For these 184 issuances, the dataset includes not only the total cost of issuance, but the components of the total cost.10

This approach is unique in that data gathered in this study more accurately represents the full suite of costs associated with bond issuances. The data available in other sources captures only a partial amount of issuance fees or aggregates different fees in such a way that obscures contributions from a number of transactions in a bond issuance. While gathering data—in the way we have for this study—is a more arduous and labor-intensive task, the results are more meaningful for assessing fees and the individual structures generating these fees. In this way, it can be a productive avenue for policy prescriptions and influence work to identify alternative processes.

Attending to Issuance Cost Data: Other Data Resources

This study is not the first attempt to collect cost of issuance data. Reviewed here are sources of cost of issuance data upon which other studies have been based.

OFFICIAL STATEMENTS

Official Statements reviewed for this study primarily reported issuance fees in two categories, underwriting fees and cost of issuance.

Underwriters are intermediaries between a bond issuer and a bond buyer. Investment banks serves as the intermediary and underwrite the bonds to assume the risk of purchasing newly issued bonds. Although private entities issue bonds, for the purposes of this report we focus on municipal issuers.11 The top four underwriters in 2014 were, according to ranking, Bank of America Merrill Lynch, JPMorgan, Citigroup, and Morgan Stanley.12 Underwriting fees are labeled as the “underwriter’s discount” as the fee is deducted from the proceeds of a bond sale and are reduce proceeds that would otherwise flow to the issuer. The “underwriter’s discount,” is the fee paid to the investment bank for selling the bonds.

The official statements also include a category classified as “costs of issuance.” This category reports the sum all other fees and expenses.

BLOOMBERG

New York’s financial software, data, and media company, Bloomberg Inc., reports issuance fees as a percentage of the amount borrowed, e.g. the face value of the bonds offered. Bloomberg gathers cost of issuance data from official statements, which are the same documents available on MSRB’s EMMA. This data is accessible to subscribers to Bloomberg Professional service.13 Bloomberg provides this data in aggregate through its Municipal Market website, which is accessible without subscription.

Bloomberg’s 2014 Municipal Market Stat Book showed an average nationwide cost of issuance of 0.513 percent. This figure means that 0.513 percent of the face value of bonds issued in 2014—the total amount borrowed from the bond market in 2014—was devoted to issuance costs.14 The Municipal Market Stat Book breaks down the issuance costs by state and shows variation across the US ranging from 0.200 to 1.002 percent in Wyoming and Arkansas respectively. 15

Bloomberg data does not appear to provide complete issuance costs. Official statements we reviewed most often include two categories of issuance costs: an underwriter’s discount, which is the fee paid to the investment bank for selling the bonds, and Costs of Issuance, a blanket category including all other fees and expenses. Bloomberg equates underwriting fees with cost of issuance.16

Reducing issuance costs to underwriting costs obscures the full cost of issuance.

Reducing issuance costs to underwriting costs obscures the full cost of issuance. Bloomberg’s issuance costs differ from the costs reported on official statements. Official statements report issuance fees with cost of issuance and the underwriter’s discount. And, of course, Bloomberg’s issuance costs also differ from data used in this study as they include the cost of issuance as only the underwriter’s discount.

INTERNAL REVENUE SERVICE

The Internal Revenue Service (IRS) requires municipal bond issuers to report new taxexempt borrowings on Form 8038-G and taxable borrowings on Form 8038. These forms ask issuers to report total bond proceeds and total costs of issuance—among other data points— on these forms. The IRS aggregates Form 8038/8038-G filing data on its SOI Tax Stats web pages.17 The latest data available are for the calendar year 2012.

For long-term tax exempt bonds, IRS reports total issuance of $324.287 billion and total costs of issuance at $2.690 billion—implying an average cost of issuance of 0.830 percent, which was higher than Bloomberg’s national average for 2014 of 0.513 percent.18 For longterm taxable bonds, issuance volume was $103.453 billion and costs were $686 million— yielding an average issuance cost of 0.663 percent.

Another data point in the Statistics of Income (SOI) disclosure suggests that these costs of issuance rates may also be understated. About 22,000 returns included issuance volume data, but only about 15,000 returns provided cost of issuance data. Since a zero cost of issuance is unlikely, the average cost factors derived from IRS aggregates do not seem to tell the whole story.

CALIFORNIA DEBT AND INVESTMENT ADVISORY COMMISSION

A third source we located was the California Debt and Investment Advisory Commission (CDIAC), a unit of the State Treasurer’s Office. State law requires California issuers to report costs of issuance to CDIAC, which then tabulates the results. Although we were unable to locate recent aggregates based on this data, a CDIAC research paper provides summary data for the period 2009–2011.19

CDIAC notes significant differences in issuance cost rates by issuance size, and thus reported aggregate cost rates by deal size bucket. Cost of issuance ranged from 0.741 percent for bond issues over $75 million to 3.096 percent for bond issues under $10 million. CDIAC included underwriter fees, legal expenses, and financial advisor fees in its calculations. While these are the three largest cost categories, the CDIAC figures would have been somewhat higher had other issuance cost elements been included. Despite this concern, and although the CDIAC results are older and limited to California, they are broadly consistent with our findings.

types of issuance costs

The public records responses we received used a variety of terms to describe various issuance costs. Most of this terminology is explained in industry guides such as the MSRB’s financing team leaflet and CIDAC’s California Debt Issuance Primer.20

It is useful here to reiterate the issuance costs that are included in data sources gathered from other resources. Recall that official statements record the cost of issuance in two categories: underwriting costs and costs of issuance—the second of which aggregates costs from a number of different fees. Bloomberg data records only the cost of underwriting. While it is unclear exactly what costs are accounted for within IRS SOI data labeled total costs of issuance, we have good reason to believe that the IRS data differs from SOI issuance costs. Lastly, CDIAC reports costs of issuance aggregated across established ranges of the dollar amounts issued.

Based on our review of issuance fees provided through public records responses and industry knowledge, we divided the range of issuance costs into the following categories:

Underwriter's Discount

Issuers usually hire an investment bank to sell their bonds. The investment bank, or underwriter, retains a portion of the sales proceeds as a commission for its services. This is the cost that Bloomberg reports as the cost of issuance.

Financial or Municipal Advisor (or Consultant) Fees and Expenses

CDIAC defines a financial advisor as “a professional consultant retained (customarily by the issuer) to advise and assist the issuer in formulating and/or executing a debt financing plan to accomplish the public purposes chosen by the issuer. A financial advisor may be a consulting firm, an investment banking firm, or a commercial bank.” MSRB uses the term “municipal advisor” and provides a bulleted list of their services and rules intended to dictate their conduct.

Bond Counsel Fees and Expenses

CDIAC defines the bond counsel as “the attorney or firm of attorneys that gives the legal opinion delivered with the bonds confirming that the bonds are valid and binding obligations of the issuer and, customarily, that interest on the bonds is exempt from federal and state income taxes.”

Disclosure Counsel Fees and Expenses

The disclosure counsel is the law firm that prepares the official statement, and in some cases, renders a “10b-5 opinion.” A “10b-5 opinion” indicates that the official statement is free of errors or material omissions. In many cases, the bond counsel and disclosure counsel are the same entity and charge a single fee.

Underwriter’s Counsel Fees and Expenses

In some cases, the underwriter hires its own law firm to prepare and certify the official statement. Although the firm is directly accountable to the underwriter in this circumstance, the underwriter may pass along its fees to the issuer.

Rating Agency Fees

Fees are paid to a nationally recognized statistical rating organization such as Moody’s or Standard & Poor’s. These agencies assign letter grades to bonds indicating their level of safety. Bonds with higher ratings are expected to pay lower interest rates than those with lower ratings or those that are unrated.

Bond Insurance Premiums

Some issuers insure their bonds. The insurance company agrees to pay interest and principal in the event that the issuer defaults. When an issuer purchases bond insurance, its bonds receive a higher rating and the expectation of lower interest costs.

Verification Agent

A verification agent is a consultant that checks various calculations in bond documents. For example, when a local government issues refunding bonds to pay off a previous bond issue, a verification agent determines whether sufficient proceeds from the new bond issuance are being escrowed to fully pay the interest and principal on the original bonds.

Trustee, Cost of Issuance Agent, Paying Agent and/or Escrow Agent Fee

These are various names assigned to a bank or other financial institution that handles payments on behalf of the bond issuer. For example, a trustee ensures that bondholders receive their interest and principal payments on time and in full.

Printing

As described by MSRB, the printer “prints, or creates the electronic version of, the preliminary and final official statements for distribution to the marketplace.”

CUSIP Fees

Committee on Uniform Security Indentification Procedures (CUSIP) numbers are nine position alphanumeric identifiers that uniquely identify any given bond. The CUSIP numbering system is administered by CUSIP Global Services (CGS) and is a unit of Standard & Poor’s (S&P). S&P, through CGS, charges issuers for each CUSIP number assigned. According to the CGS web site, the fee is currently $165 for the first identifier, plus $20 for each additional identifier assigned to bonds in a given offering.21 A bond offering may include dozens of individual securities, each requiring a CUSIP identifier.

Contingency

This is a reserve for any unanticipated expenses. For the 184 bonds on which we had detailed information, this contingency represented on average about 1percent of total issuance costs.

All Other

Among the items we did not classify into standard categories were fees paid to state treasurers and attorneys general, and costs associated with the municipal employees’ time working on the issue. We also did not include a separate category for appraisal fees. Appraisal fees are incurred, for example, when debt service on a bond comes from a dedicated property tax. An appraiser may be required to assure that the property to be taxed will have a high enough total value to generate tax payments sufficient to service the bond.

findings

In the sample of 812 issuances, the median cost of issuance was 1.71 percent, while the average weighted by principal amount was 1.02 percent. Costs ranged from a low of 0.13 percent for an issue of tax and revenue anticipation notes in Salt Lake City, Utah, to 10.62 percent for a special tax bond issue from Jurupa Unified School District in California’s Inland Empire.

Issuance costs are higher for smaller bond issuances

When issuance costs are measured as a percentage of face value, they are higher. In short, when bond proceeds are smaller, a greater percent of the bond proceeds are directed to issuance costs.22

This finding supports an intuitive understanding that there are certain costs associated with bond issuance shared by issuances of any face value. These costs will logically represent a higher proportion of bond issuances with smaller face values.

Smaller issuers pay higher costs

In our data sample, the issuers with the seven highest costs were all in excess of 8.5 percent of face value.23

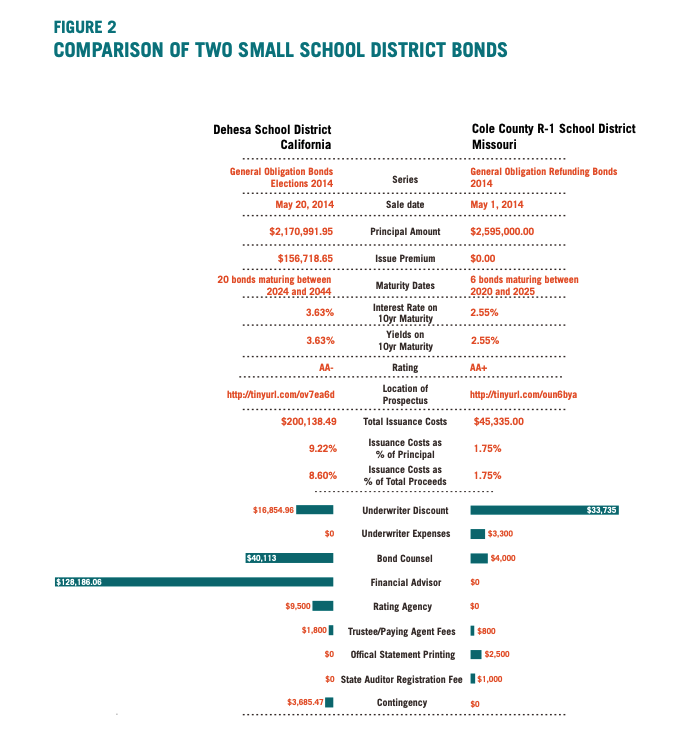

These issues were small offerings ranging from $1.8 million to $5 million. Our data set allows some comparisons between school district issuance costs in California and other states. Figure 2 compares an offering by Dehesa School District in San Diego County, CA with an offering of similar size from Cole County R-1 School District, Missouri.

The two bond issues were both offered in 2014 by small rural districts and have similar interest rates (for comparable maturities), so the bond and issuer characteristics don’t appear to justify the very large difference in issuance costs. Yet the California bonds were five times more expensive to issue than the Cole County R-I school district bonds.

The three highest costs for the Dehesa School District were the financial advisor at $128,185.06; the bond counsel at $40,113.00; and the rating agency at $9,500. Cole County R-I School District did not use a financial advisor or rating agency, and their bond counsel costs were significantly lower.

Cole County appears to have achieved lower issuance costs and a higher bond rating because the state of Missouri offers a “direct deposit program” through its Health and Educational Facilities Authority.24 Under this program, the authority pays bond investors directly and deducts debt service costs from state aid payments remitted to participating districts.

Because the payee is effectively the state, the bonds can carry the state’s credit rating rather than the school district’s. This arrangement also avoids the payment of separate credit rating agency fees and municipal bond insurance premiums. California might replicate this program. However, further inquiry would be needed to measure the benefits of the strategy. Benefits may be diminished because California carries a lower credit rating than Missouri. For school districts with a higher rating than the state, the arrangement is less attractive.

The California bond was a “new money” issue while the Missouri bond was a refunding bond—meaning that the district was refinancing existing bonds with new debt in order to take advantage of a lower interest rate.25 Because the California issue was financing new construction that had to be approved by voters, the district incurred pre-election planning related costs (such as remunerating a bond counsel to prepare legal documents, and calling an election and a financial advisor to analyze the tax base). These expenses then become part of overall issuance costs. Consequently, a new money offering can be expected to have higher issuance costs than a refunding bond.

It should be noted that Missouri school district bonds traditionally have had a short call feature—in this case five years—for its bond issuances, meaning that the bonds can be refinanced in a shorter time frame than a typical 10-year call feature. The 2014 Missouri bond issue was the third refunding of a 1999 new money bond issue. One conclusion that can be drawn is that the frequency of issues by the Missouri school districts over the years increases the overall costs of issuance when compared to a less frequent issuer offering a longer call period like Dehesa School District.

public policy options & further inquiry

As discussed in the previous section, we obtained issuance cost details for approximately 184 bonds through public data requests. We bucketed these costs into categories outlined in SECTION 3. These results are reported in the Google sheet accessible from our website. FIGURE 3 shows the proportion of issuance costs associated with each category in our subsample.

In some cases, the “All Other” category includes items that are not services related to bond issuance. Further, contingency amounts are likely to not be spent in all cases. Consequently, the actual cost of issuance is slightly lower—perhaps 1 percent or 2 percent lower—than those shown in FIGURE 1.

As reported in FIGURE 1, weighted average issuance costs were 1.02 percent of principal value. We further found that this amount is slightly overstated due to the inclusion of unused contingency and irrelevant expenditures in the total costs of issuance. Thus an issuance cost rate 1 percent would seem appropriate.

The Securities Industry and Financial Markets Association (SIFMA) reports total municipal bond issuance of $382.4 billion in 2012, $334.9 billion in 2013, and $337.5 billion in 2014.26 Earlier, we referenced IRS data showing 2012 total long-term municipal debt issuance of $427.7 billion (taxable and tax exempt), so it is possible that the SIFMA issuance totals are understated.

Assuming that the SIFMA data are correct, annual issuance costs nationally are between $3 billion and $4 billion. Perhaps more importantly, these costs fall disproportionately on small issuers—which are often poorer rural districts that could undoubtedly use every extra dollar not consumed by financial industry interests.

These findings and others discussed in the paper suggest particular policy options, each of which may be furthered by additional inquiry.

In this section, we consider a variety of policy options that could reduce overall municipal bond issuance costs. Because the processes of creating and distributing municipal bonds invariably require some degree of human labor, issuance costs cannot be reduced to zero. That said, the high variability of costs—both in absolute terms and as a percentage of issue size—suggests that there is an opportunity to greatly reduce this overhead.

Greater Cost Transparency

A first step toward reducing issuance costs is to increase their transparency, as we have done in this study. We hope that other researchers will conduct similar investigations and that governments themselves will publish issuance cost details without the need for public records requests. The data we are releasing with this report can provide a starting point for other investigators, and a template for standardized reporting. If others wish to contribute data to our particular data set, instructions can be found on the Haas Institute’s website.

One positive step in the direction of cost transparency is the increasing availability of open government checkbooks. Several cities, including New York, Chicago, and San Francisco publish all their payments on line. Due to the existence of Chicago’s online payments system, The Wall Street Journal was able to report how much that city had paid Moody’s, Standard & Poor’s and Fitch to rate its bonds.27 Because online checkbooks vary in the details they provide, some are more useful for issuance cost research than others. In the bestcase scenario, bond issuance costs are disbursed from a dedicated bond fund and online checkbook entries are keyed to funds. When these conditions are in place, as they are in San Francisco, it is possible to obtain the issuance costs (together with a few extraneous items) from a single web query.

Cost transparency provides opportunities for cost reduction because it allows issuers to benchmark their expenses against peers. For example, if we can identify the one California school district that paid the lowest rate for bond counsel statewide, that rate can serve as a data point for use by other districts. Finance managers can cite that price observation when negotiating with attorneys over the cost of future issuance services. If district staff or board members don’t take the initiative to match the prices of low cost providers, community activists can reference this data when commenting at school board meetings or support alternative board candidates more willing to pursue savings.

In a 2011 paper for the Hamilton Project, Andrew Ang and Richard Green proposed a new institution they called CommonMuni that would pool knowledge from government bond issuers to make their funding operations more cost effective.28 An issuance cost database would be a logical service for such an entity.

Open Security Identifiers

Municipal bond issuers pay millions of dollars each year to obtain CUSIP numbers for their bonds, even though these identifiers are not freely redistributable. The benefits provided by the CUSIP service bureau, such as the avoidance of duplicates, consistency, and resistance to transcription errors (through the check digit scheme), do not appear to merit the costs—especially in today’s environment of connectivity and automation.

Domain name registrars provide analogous services to the CUSIP service bureau at a small fraction of the cost, and the Internet names they provide are freely redistributable. Meanwhile, the federal government has issued hundreds of millions of social security numbers and employer identification numbers since the late 1930s at no cost to recipients and with relatively limited problems. Within the financial industry, governments across the world have been advancing the concept of a non-proprietary Legal Entity Identifier (LEI). A natural extension of LEI would be a non-proprietary instrument identifier.

In the municipal market, non-proprietary security identifiers could be issued by the MSRB, a new not-for-profit entity, or by the US Treasury Department. Since Treasury also houses the IRS, centralizing identifier issuance in this department could prove useful in enforcing tax collections on taxable municipal securities.

Higher, Model-Driven Municipal Credit Ratings

At least some rating agencies persist in violating the Dodd Frank Act and SEC Regulation 17g-7 by rating municipal bonds more harshly than they rate corporate and structured finance debt securities. This disparity provides the opportunity for municipal bond insurers to effectively sell their ratings to government bond issuers without creating concomitant economic value.

Further, rating agencies charge governments hundreds of millions of dollars each year. Much of these fees fall to agencies’ bottom line while a significant portion would appear to support an analytical process that is unnecessarily labor intensive given the rarity of defaults. We propose the municipal bond rating system could be replaced by a modelbased approach that provides generally higher ratings, yet flags at-risk governments using an index of accounting and economic metrics possibly supplemented by web content analysis.

Migrating to a new municipal rating system may require new legislation or regulatory mandates. For example, federal or state governments could impose caps on rating fees within their jurisdictions—effectively obliging issuers and rating agencies to seek lower cost alternatives. Regulators could also set up an alternative rating mechanism. Bank regulators and the Department of Education have scoring systems for banks and universities respectively. A municipal scoring system could be implemented by the Securities and Exchange Commission (SEC) or MSRB.

Alternatively, an existing for-profit rating agency or a new not-for-profit rating agency could adopt a model-driven approach. Any such alternative institution would likely require a period of evangelization and live testing to gain investor acceptance. Unless investors use an alternative rating system in their decision-making process, the new ratings will have no market impact. Since some municipal bonds are purchased by governments and by government-run pension funds, an initial user group for a new rating system could conceivably emerge from the public sector.

Federal and/or Federal Reserve Involvement

A number of observers have advocated Federal Reserve purchases of municipal bonds. During the period of quantitative easing, the Federal Reserve purchased mortgage-backed securities for its portfolio in addition to the US Treasury instruments it normally buys. In a 2012 New York Times op-ed, Joseph Grundfest and two Stanford Law colleagues argued that Federal Reserve purchases of municipal bonds would be a better option to buying mortgage securities. They reasoned that municipal bonds more directly target the nation’s infrastructure needs and create jobs.29

More recently, Saqib Bhatti of the Roosevelt Institute argued for Federal Reserve purchases of municipals, noting that the Federal Reserve already has the legal authority to buy these instruments as long as they mature within six months.30 Bhatti advocates federal legislation to remove this maturity limit. Frigon and Roy-César note the existence of a similar limitation faced by the Bank of Canada, but they also observe that the Canadian Central Bank could circumvent this restriction by rolling over its holdings of Canadian Provincial bonds every few months.31 A similar option may be available to the Federal Reserve.

With the ending of the quantitative easing program, the near term window for Federal Reserve lending to US local governments may be effectively closed.32 But it is worth considering, and perhaps adding to the Federal Reserve’s toolkit, as future economic downturns will inevitably trigger calls for further monetary stimulus. Also, even though the absolute size of the Federal Reserve’s balance sheet is no longer increasing, it is possible for the bank to trade some of its existing holdings of mortgage-backed and Treasury securities for municipal securities.

If the Federal Reserve were to purchase traditional municipal bonds in the primary or secondary market, there would be no direct impact on issuance costs. However, if Federal Reserve financing took the form of direct loans or special issue non-negotiable bonds (with limited documentation requirements), the Central Bank could reduce issuance costs for state and local governments to which it offered credit.

As far as these authors can determine, the federal government does not incur issuance costs analogous to those shouldered by US state and local governments. A review of the Department of the Public Debt’s budget showed no funds allocated to underwriters, attorneys, financial advisors, rating agencies or other service providers. That said, some of these services are provided by in-house staff. The federal government’s cost of issuance is undoubtedly positive—but most likely far less on a percentage basis than any other government in the US.

To the extent that municipalities can leverage or emulate the federal government’s debt issuance process, they may be able to reduce issuance costs. A possible precedent for this exists in Germany, where the country’s federal government recently issued bonds jointly with several German states, and shared the proceeds.33 Because of the German government’s strong credit profile, some German states can achieve lower interest costs through this group financing technique. US Treasury bonds that were partially used to fund state and local infrastructure projects might also enjoy strong market acceptance, but the tax exemption issue discussed earlier could be a barrier to actually achieving lower interest costs.

conclusion

Our research suggests that municipal bond issuers face upwards of $4 billion of issuance costs annually. This represents taxpayer and ratepayer money diverted from infrastructure development and service provision to a variety of financial industry interests. Moreover, the burden falls most heavily on smaller—often less financially capable—bond issuers.

Greater transparency can reduce these costs, as can greater involvement in municipal investment by the Federal Reserve and federal government. Whether policy makers choose market-based or government-oriented approaches to constraining issuance costs— or some combination of both—those of us benefiting from municipal investment stand to see substantial rewards.

- 1Interest cost is often discussed as the “cost of borrowing”. The cost of borrowing is determined by the interest rate. The interest rate, in turn, is heavily influenced by the credit rating of the government. The credit rating serves as a measure of risk taken on by investors. Higher costs come with lower credit ratings, signaling a greater risk for investors, and higher interest rates. This system accounts for news articles raising alarm when a city’s credit rating is lowered. This system also creates collective relief when a government’s credit rating is raised or maintained at higher levels.

- 2As reported in Figure 1, weighted average issuance costs were 1.02% of principal value. We reason this amount is slightly overstated due to the inclusion of unused contingency and irrelevant expenditures in the total costs of issuance.

- 3See http://www.sifma.org/uploadedFiles/Research/Statistics/StatisticsFiles/… Later we reference IRS data showing $427.7 billion of total issuance in long term municipal debt in 2012. This includes taxable and tax exempt bonds. It is possible that the SIFMA calculations are understated.

- 4This is not enough money for the state to create sufficient universal pre-K education. We use the number to simply put into scale the cost of public serves in relation to costs of issuance. To read more about the strengths and weaknesses of New York State’s pre-K expansion and New York City’s universal pre-K program see The Century Foundation’s “Lessons from New York City’s Universal Pre-K Expansion: How a focus on diversity could make it even better,” http://www.tcf.org/assets/downloads/TCF_LessonsFromNYCUniversalPreK.pdf & University of California Berkeley’s Institute on Human Development in “Expanding Preschool in New York City—Lifting Poor Children or Middling Families?” http://gse.berkeley.edu/sites/default/files/users/bruce-fuller/NYC_PreK…

- 5This estimate is based upon SIFMA data. As we noted earlier SIFMA data may underestimate issuance costs. Therefore, this figure is a conservative estimate.

- 6According to the national school funding report card by Rutgers University & the Education Law Center, 19 states have flat school funding systems, including California. These flat systems fail to provide any appreciable increase in funding to address uneven needs that exist in high poverty school districts. This is one among many outstanding needs within California’s high poverty school districts. See: http://www.schoolfundingfairness.org/ and http://www.schoolfundingfairness.org/National_Report_Card_2015.pdf

- 7Because we used a convenience sample, our estimates of overall issuance costs are subject to significant error. But, given the large size and heterogeneity of the sample, we believe our estimates serve as a good starting point for further research.

- 8MSRB’s EMMA database is a searchable database for many documents related to municipal finance. While it is a valuable repository of public documents, the data within the documents is not digital or searchable. Therefore, the data on bond issuance fees for a particular bond series is publicly available data, but not open data. MSRB’s EMMA fails to meet the standards for open data advocated by the open data community, namely Data Transparency Coalition and Sunlight Foundation.

- 9Formal requests were submitted under the Freedom of Information Act (FOIA). For a sample of a FOIA request for the cost of issuance from a local municipality, see this document’s Appendix.

- 10Sheet 1 of the data includes total issuance costs for each issuance in the study. Sheet 2 details the individual costs that, in sum, constitute the total cost of issuance. The data includes this detailed data for a subset of the 750 cities, as the data was only available through individual FOIA requests.

- 11For example other asset classes include corporate, sovereign, financial, and structured asset. There is a notable disparity between the mechanics of bond issuance between the municipal market and those of private issuances. Among these differences is disparate treatment of measuring issuers’ credit rating. In effect, a measure of risk associated with purchasing bonds. Municipal issuers are rated more harshly than other asset classes and this difference increases the cost of borrowing for public issuers. Lower credit ratings can result in higher interest rates that will be paid by public issuers. Measuring the impact of additional costs placed on municipal issuers is the subject of a forthcoming Just Public Finance report “Doubly Bound: The Costs of Unfair Municipal Credit Ratings” authored by Marc Joffe. The paper estimates the additional cost incurred by municipalities and offers an alternative method that may more accurately measure municipal issuers’ credits.

- 12See Bloomberg’s 2014 Muni StatBook, page 18. The top 10 underwriters are reported within 3 domains: Overall underwriters, negotiated underwriters, and competitive underwriters. The top 4 underwriters are the same investment banks and follow the same rank.

- 13A Bloomberg Professional Terminal subscription costs $2,000 per month. Bloomberg terminals are available some universities with imposed data limits that does not allow full unfettered access to its data.

- 14See Bloomberg’s “Bloomberg Briefs: Municipal Market StatBook 2014,” page 19. http://www.bloombergbriefs.com/content/uploads/sites/2/2015/01/2014-Mun…

- 15See Bloomberg’s “Bloomberg Briefs: Municipal Market StatBook 2014,” page 19. http://www.bloombergbriefs.com/content/uploads/sites/2/2015/01/2014-Mun…

- 16This conclusion was reached by reviewing selected data points and contacting Bloomberg’s help desk.

- 17See the Internal Revenue Service’s “SOI Tax Stats—Tax-Exempt Bond Statistics” http://www.irs.gov/uac/SOI-Tax-Stats-TaxExempt-Bond-Statistics

- 18See Bloomberg’s “Bloomberg Briefs: Municipal Market StatBook 2014” http://www.bloombergbriefs.com/content/uploads/sites/2/2015/01/2014-Mun…

- 19When publishing this paper in December 2015 the authors learned that the California Debt and Investment Advisory Commission (CDIAC) collects and expects to publish full issuance cost data on all California municipal bonds. Current data available from CDIA is available http://www.treasurer.ca.gov/cdiac/debt.asp

- 20See the California Treasury’s “California Local Agency General Obligation Bond Cost of Issuance 2009-2011” by Doug Chen. See also MSRB’s “Municipal Securities Rulemaking Board, Roles and Responsibilities” The Financing Team in an Initial Municipal Bond Offering. http://msrb.org/msrb1/pdfs/Financing-Team.pdf

- 21https://www.cusip.com/cusip/request-anidentifier.htm

- 22This is consistent with costs gathered from CDIAC data.

- 23The data sample for this study includes a great number of school district issuances. There was no intentional strategy to consider a high number of school district issuances. Their large representation in the study may be due to the larger number of school districts relative to cities and counties. For example, while California contains 481 sub-county municipal governments, Ed-Data reports that the state contains 560 elementary, 87 high school, and 330 unified school districts. Additionally, we estimate the median of municipal bond issuances to be $5.5 million. In selecting samples for this study we focused on issuances under this figure to include smaller issuers. It may be that school district issuances are disproportionately represented in issuances under $5.5 million.

- 24See the Missouri Department of Elementary and Secondary Education’s “Guidelines for Program for the Issuance of General Obligation Bonds by Missouri School Districts” https://dese.mo.gov/sites/default/files/ddp.pdf

- 25This observation was provided by a school finance expert who reviewed the paper.

- 26This is the link to download the data’s excel file. http://www.sifma.org/uploadedFiles/Research/Statistics/StatisticsFiles/…

- 27See Timothy W. Martin and Mark Peters (May 22, 2015) “Chicago Snubs Moody’s for Restructuring—City’s decision to choose S&P and other rating firm rivals followed downgrade to junk status” in The Wall Street Journal, Page C-1. The authors report that “Chicago has paid Moody’s $824,000 since January 2014, versus $605,000 to S&P and $77,000 for Fitch over the same time period, according to the city’s vendor, contract and payment information database.”

- 28See The Hamilton Project’s “Lowering Borrowing Costs for States and Municipalities Through CommonMuni” by Andrew Ang and Richard C. Green. https://www0.gsb.columbia.edu/faculty/aang/papers/THP%20ANG-GREEN%20Dis…

- 29See Joseph A. Grundfest, Mark A, Lemley and George G. Triantis’ “Getting More Bang for the Fed’s Buck” in the New York Times. (October 23, 2012) http://www.nytimes.com/2012/10/24/opinion/why-the-fedshould-buy-munis-n…

- 30See Saqib Bhatti (January 5, 2015). Let the Fed Lend Directly to Cities and States to Save Taxpayers Billions. Next New Deal Blog. http://www.nextnewdeal.net/letfedlenddirectlycitiesandstatessavetaxpaye…

- 31Mathieu Frigon and Édison RoyCésar (April 2015). Canada and the Eurozone: What Distinguishes the Two Currency Unions? Hill Notes. https://hillnotes.wordpress.com/2015/04/07/what-makescanadas-currency-u…. The authors raise Bank of Canada lending to Provinces as a theoretical possibility in the event of a potential default; currently the Bank of Canada does not purchase sub-sovereign Canadian debt securities.

- 32The Federal Reserve purchased debt securities with newly created reserves under the quantitative easing program.

- 33Eva Kuehnen (June 20, 2013). Germany tiptoes into new territory with federal-regional bond. Reuters. http://www.reuters.com/article/germanybond-idUSL5N0EW20720130620