Municipal Bond Insurance Costs

DURING THE FINANCIAL CRISIS, most municipal bond insurers became insolvent or received multiplenotch downgrades. As a result, they ceased writing new policies. To the extent that bond insurers were rated lower than most municipalities, they could no longer offer government bond issuers the opportunity to achieve lower financing costs through a rating enhancement.

By late 2009, only one insurer was still active in the US municipal market: Assured Guaranty which had acquired Financial Security Assurance (FSA) earlier that year.17 Assured and FSA had higher ratings than other insurers and hoped that a merger would strengthen the combined entity’s case for retaining these relatively high ratings.

In October 2010, S&P downgraded the combined entity—Assured Guaranty Municipal (AGM) —from AAA to AA+. In November 2011, S&P imposed a further two notch downgrade to AA-, placing its assessment on a par with Moody’s, which rated AGM Aa3 at the time.18

The two agencies then diverged. In January 2013, Moody’s downgraded AGM by two notches to A2.19 In March 2014, S&P upgraded AGM one notch to AA,20 widening the gap between the two rating agencies to three notches. The S&P upgrade, together with a rating of AA+ from Kroll Bond Rating Agency is allowing AGM to expand its business.

According to AGM’s financial statements21 , the company insured $12.3 billion of US public finance securities in 2014, producing $127 million of premium income. AGM’s premiums thus represent just over 1 percent of the face value of the bonds it insured. (It is worth noting that this percentage reflects a one-time payment and is not comparable to the interest rate spreads discussed in the previous section.)

National Public Finance Guarantee Corporation (NPFG), a subsidiary of MBIA, began to issue new policies in late 2014, a few months after Standard & Poor’s upgraded the insurer from A to AA-.22 Moody’s also upgraded NPFG from Baa1 to A3, but that still left the firm’s rating below those of most US municipal bond issuers.23 By the end of the year NPFG had insured $400 million in new bonds24 with total premiums of $6.5 million.25

In 2012, a new insurer with a different organizational model entered the industry. The New York State Insurance Department licensed Build America Mutual Insurance Company (BAM) on July 23, 2012.26 On the same day, the firm received a Standard & Poor’s rating of AA.27 The new company, with no operating record, thus received a higher rating than thousands of municipal bond issuers, many of whom had been servicing debt obligations for several decades without missing any payments.

As its name implies, BAM is a mutual insurance company—which means that it is owned by its policyholders. A mutual insurance company does not have traditional stockholders, and its profits technically belong to the municipal bond issuers that buy policies. In fact, these municipalities are eligible to receive periodic dividends from the company.

This is an attractive model in theory because there is no redistribution of wealth from municipalities to third-party shareholders. But in practice, this distinction from traditional municipal bond insurance proves to be without a meaningful difference.

In 2014, BAM underwrote $7.8 billion of insurance and charged municipalities $31.7 million of premiums and “member surplus collections.”28 But it incurred $37.4 million in operating expenses, including $24.5 million in salaries.29 Consequently, BAM experienced an operating loss and was thus not in a position to make dividend payments.

Further, BAM does not retain a large portion of its premium revenue, but instead cedes it to a reinsurance company that would contribute to the settlement of any claims. BAM’s reinsurer is a subsidiary of White Mountains Insurance Group, a for-profit Bermuda-domiciled financial services holding company.30 In 2014, BAM ceded $11.8 million in premiums to this reinsurer.

Thus it is reasonable to treat BAM’s entire $31.7 million of revenue—representing roughly 0.4 percent of the face value of bonds it insured—as a cost to municipal issuers. Although BAM is a mutual company, it is likely that the firm’s reinsurer and management will continue to absorb all revenues—leaving nothing for its nominal owners (i.e. the insured governments).

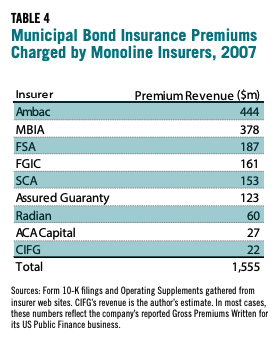

The three active insurers that wrote municipal bond insurance policies in 2014—AGM, NFPG and BAM —assessed a total of $167 million in premiums during that year. Although this amount reflects an increase from previous years, it is dwarfed by municipal bond insurance costs prior to the financial crisis, when more companies were active in the market and most had AAA ratings. Table 4 shows premiums charged by municipal bond insurers in 2007. The total exceeded $1.5 billion.

With insurers now receiving rating upgrades, it is likely that the use of municipal bond insurance will grow in the coming years. That said, it is hard to see how the business can return to the levels that prevailed prior to the recession unless insurers can once again obtain AAA ratings

A relatively new entrant into the ratings space, Kroll Bond Rating Agency (KBRA), has assigned AA+ ratings to both AGM31 and NPFG32 – higher than S&P’s ratings and several notches above those assigned by Moody’s. It is possible that KBRA’s actions could result in competition among rating agencies to justify higher ratings for these firms. This phenomenon, known as ratings shopping, contributed to the inflated ratings of mortgage backed securities that triggered the financial crisis.

Monoline insurers have also restructured themselves in an effort to justify higher ratings. For example, MBIA formed NPFG to be a dedicated public finance insurer, with no exposure to structured finance securities.33 MBIA can thus make the case that NPFG is insulated from the CDOs and other unorthodox instruments that caused the company so much difficulty in 2007 and 2008.

Given these trends, annual municipal bond insurance revenues should rise well beyond their 2014 level in the years ahead—in absence of industry reform.

- 17Dan Seymour (October 15, 2009). Assured/FSA: Last One Standing. The Bond Buyer. http://www.bondbuyer.com/issues/118_199/assuredfsa-1002586-1.html.

- 18Robert Slavin (December 1, 2011). S&P Drops Assured Guaranty Two Notches to AA-Minus. The Bond Buyer. http://www.bondbuyer.com/news/assured-guaranty-downgrade-standardpoors-…

- 19Moody’s Investors Service (January 17, 2013). Moody’s downgrades Assured Guaranty; lead insurer to A2. https://www.moodys.com/research/Moodysdowngrades-Assured-Guaranty-leadi…

- 20Assured Guaranty (March 18, 2014). Press Release: S&P Upgrades Assured Guaranty’s Operating Subsidiaries to AA Stable. http://assuredguaranty.newshq.businesswire.com/press-release/other/sp-u….

- 21Assured Guaranty Mutual Corporation. Financial Supplement: December 31, 2014. http://assuredguaranty.com/uploads/PDFs/AGM_4Q14_Supplement.pdf.

- 22MBIA, Inc. (March 18, 2014). Press Release: S&P Upgrades National Public Finance Guarantee Corp. and MBIA Inc. http://www.marketwatch.com/story/spupgrades-national-public-finance-gua….

- 23National Public Financial Guarantee (May 22, 2014). Moody’s Upgrades National Public Finance Guarantee Corp. http://www.nationalpfg.com/pdf/RatingAgencyReports/Moodys_Upgrades_Nati…

- 24Amount obtained from a review of National Public Financial Guarantee insured portfolio at http://www.nationalpfg.com/insuredportfolio.

- 25National Public Financial Guarantee, Statutory-Basis Financial Statements. December 31, 2014. http://www.nationalpfg.com/pdf/Financials/2014_National_Audited_Stateme….

- 26New York State Department of Financial Services (July 23, 2012). Press Release: Governor Cuomo Announces Licensing of New Bond Insurer to Serve Small and Mid-Sized Municipal Projects. http://www.dfs.ny.gov/about/press/pr1207231.htm.

- 27Standard & Poor’s Rating Services (July 23, 2012). Build America Mutual Assurance Co. Rated ‘AA’; Outlook Stable https://www.standardandpoors.com/en_US/web/guest/article/-/view/type/HT….

- 28Build America Mutual. Quarterly Operating Supplement (December 31, 2014). http://buildamerica.com/wp-content/ plugins/statementUploader/uploads/ BAM_Operating_Supplement_Q42014. pdf. According to BAM’s web site, “member surplus contributions” are a portion of the policy cost that “which fund the growth of BAM’s claims-paying resources”.

- 29Annual Statement of the Build America Insurance Company of New York, for the Year Ended December 31, 2014. http://buildamerica.com/wp-content/plugins/statementUploader/uploads/BA…

- 30White Mountains (July 23, 2012). Press Release: White Mountains Funds a New Municipal Bond Insurance Platform, Build America Mutual and HG Re. http://investor.whitemountains.com/phoenix.zhtml?c=103286&p=IROLNewsTex….

- 31Kroll Bond Rating Agency (November 13, 2014). Press Release: Kroll Bond Rating Agency Assigns AA+, Stable Outlook, to Assured Guaranty Municipal Corp. (AGM). https://www.krollbondratings.com/announcements/952

- 32Kroll Bond Rating Agency (May 12, 2014). Press Release: Kroll Bond Rating Agency Assigns AA+, Stable Outlook, to National Public Finance Guarantee Corporation. https://www.krollbondratings.com/announcements/609.

- 33Elinor Comlay (February 18, 2009). MBIA shifts bond insurance business to new company. Reuters. http://www.reuters.com/article/2009/02/18/usmbia-sb-idUSTRE51H2TE200902….