Municipal Bond Insurance

LOWER BOND RATINGS tend to be accompanied by higher interest rates. Thus, relatively harsh municipal bond ratings raise state and local government debt service costs. Governments have often ameliorated these extra costs by purchasing bond insurance. When a municipal bond issuer purchases bond insurance, its bonds carry the insurer’s rating. State and local government borrowers—which receive ratings lower than that of a given municipal bond insurer—may be able to reduce borrowing costs by purchasing an insurance policy.

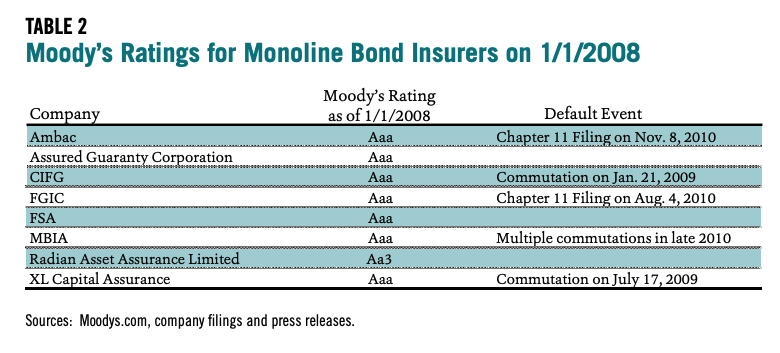

However, the performance of municipal bond insurers during the financial crisis was quite poor, and very inconsistent with their high ratings.10 The bond insurance business began with the formation of Ambac in 1971. By 2008, Moody’s rated eight of the nine active bond insurers.11 These ratings are shown in Table 2.

Seven of the eight insurers were rated Aaa at the beginning of 2008. Five of these seven were forced to restructure their obligations by the end of 2010. In two cases, the insurers declared bankruptcy. In the other three cases, they entered “commutation agreements” with certain creditors under which some of the insurers’ obligations were liquidated for less than 100 cents on the dollar

With the benefit of hindsight, it is clear that the ratings of states and bond insurers were highly inconsistent. Of course, rating agencies do not have the benefit of hindsight when publishing their assessments, so individual ratings cannot be guaranteed to be accurate. That said, the failure of a majority of Aaa entities within a given asset class should give cause for concern.

One fact that was obvious before the financial crisis was that bond insurers had a much shorter track record than US state and local governments. Lack of operating history for an organization or an industry should be seen as a source of credit risk. By the time the bond insurance industry began, US states already had three decades of pristine credit (a 1933 default by Arkansas was resolved in 1941), but many states were rated below Aaa. By contrast, a new bond insurer could obtain a rating agency’s highest rating shortly after opening for business. For example, CIFG—one of the failed insurers—formed in 2001 and received top ratings from all three agencies by 2002.12

Finally, criticism of Aaa bond insurer ratings pre-dates the financial crisis by several years. In her book, Confidence Game,13 Christine Richard documents the activist investor William Ackman’s efforts to convince rating agencies to downgrade bond insurer MBIA. Although Ackman clearly had a vested interest in the outcome—he was selling MBIA stock short—his research on the matter was quite thorough as can be seen from his 2002 report Is MBIA Triple-A.14

Given the relative performance of governments and bond insurers during the financial crisis, the economic benefit of insurance is subject to question. In particular, it is worth noting that bond insurance is not common in the corporate bond market. If corporations could reduce their borrowing costs by purchasing insurance, it would be rational for them to do so. So the absence of corporate bond insurance suggests the absence of an economic benefit. Seen from this vantage point, it appears that municipal bond insurers are taking advantage of rating scale discrepancies— effectively arbitraging between the relatively lenient standards for corporate bond issuers and the relatively harsh standards for municipal bond issuers.

In the next three sections, I estimate the cost of the credit rating system beginning with extra interest costs borrowers incur due to harsh ratings. After considering—but not quantifying—the impact of low ratings on interest rate swaps used by many issuers, I total up the insurance premiums paid by municipal bond issuers. Finally, I estimate the direct cost of the rating system which take the form of fees paid by issuers to the rating agencies.

- 10Moldogaziev, Tima (March 2013). “The Collapse of the Municipal Bond Insurance Market: How Did We Get Here and Is There Life for the Monoline Industry beyond the Great Recession?” Journal of Public Budgeting, Accounting, and Financial Management. Volume 25 Number 1. Pages 199-233.

- 11Another insurer, ACA was downgraded from A to CCC by Standard & Poor’s on December 14, 2007. It was not rated by Moody’s

- 12The 2002 rating analyses are available on the Internet Archive at https://web.archive.org/web/20021012090251/ http://www.cifg.com/fin_info/ratings.shtml. CIFC was wholly owned by a French bank that had a long operating history, but this bank was not legally responsible for CIFG’s obligations

- 13Christine S. Richard, Confidence Game, New York: John Wiley and Sons, 2010.

- 14Gotham Partners Management, Is MBIA Triple-A? A Detailed Analysis of SPVs, CDOs, and Accounting and Reserving Policies at MBIA Inc., December 9, 2002. http://www.briem.com/files/Ackman_MBIA_12092002.pdf