Click to download a PDF of this report.

At the age of twenty-six, Alec Smith slipped into a diabetic coma and died, just one month after aging out of his mother’s insurance and learning his insulin and related supplies would cost $1,300 per month out of pocket.1 He began rationing his insulin supply in hopes of making it last until his next payday, an all too common practice among people with diabetes. According to a recent study, one in four people with diabetes ration or underuse their insulin due to cost-related reasons.2 The issue of rising insulin prices has prompted increasing public outcry over the past few years, frequently making headlines, provoking condemnation of drug companies by politicians, and, notably, catalyzing grassroots efforts demanding systemic changes and strategizing their own solutions for making insulin accessible.

Introduction

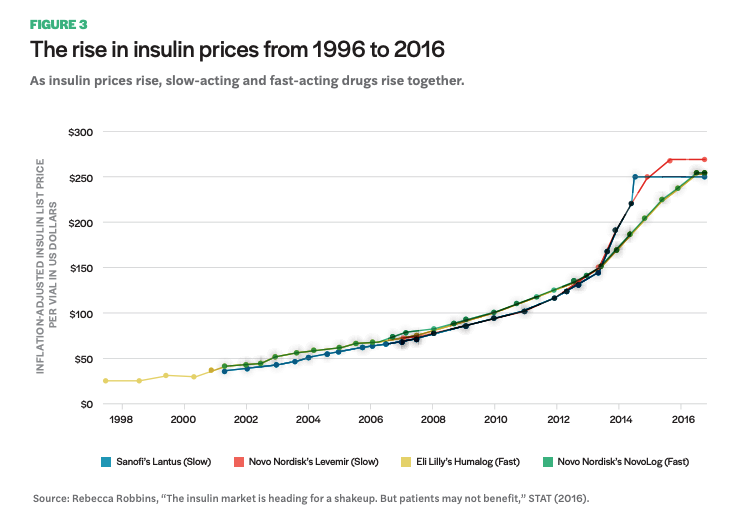

This brief examines the ethical injustices inherent in the way that drugs are made available to people in need in the United States, where profits persistently triumph over patient access. It articulates the pressing need for considering a new model of pharmaceutical production and distribution, such as a model proposed by a community-based initiative, the Open Insulin Project, to produce insulin by and for communities. Insulin has become increasingly difficult to access for many Americans due to rising costs. Prices of the most widely prescribed insulin types have risen dramatically in recent years, even tripling between 2002 and 20133 and doubling again by 2016. Three pharmaceutical manufacturers control the entire US insulin market and have been raising their prices concurrently, leaving many insulin-dependent diabetics in a terrifying position, uncertain whether they may be able to afford the lifesaving medicine they need.

This brief focuses, in part, on the current regulatory landscape that supports the pharmaceutical industry, specifically focusing on insulin and the factors contributing to its ever-increasing price tag, and proposes a pathway for drug development and production that is not directed by a profit-based system. Despite the industry purported idea that developing and producing drugs within a competitive market leads to better, more efficient advances than could be gained otherwise, the reality is profit takes priority over access in the drug market. Thus, the current system leads to vast health inequities and unpredictable access to medicine for many people. The question of who is benefiting when it comes to advancements in medicine, and at what cost, must be more central to discussions about the way the pharmaceutical system operates.

Insulin, discovered nearly a century ago yet unaffordable to many today, is a clear example of how an underregulated market system can, and in many cases does, fail to deliver affordable drugs over time. While industry executives and large investors reap the benefits of increased insulin prices, some diabetics and their families pay more than their mortgage for insulin in the US, and others travel to Canada and Mexico to afford the medicine, an option abruptly cut off with the COVID-19 pandemic.

The policy environment that promotes the specific kind of profitable pharmaceutical system we find in the US includes intellectual property laws, Food and Drug Administration (FDA) pathways that demand massive resources, and little regulatory attention to patent abuse tactics such as “evergreening,” where companies make small modifications to a molecule in order to extend patent life of a drug.4 With small modifications, pharma companies are granted a new patent and place the “new” drug on the market and, in some cases, withdraw previous versions, which, theoretically, should have been decreasing in price. This can occur despite little or no evidence of the new drug being more effective.

The History of Insulin

The discovery of insulin in 1921 as a treatment for diabetes was held up as a “wonder drug” of the twentieth century, as it was able to transform a disease that was an effective death sentence into a treatable chronic condition.70 Frederick Banting and his colleagues J. J. R. Macleod, Charles H. Best, and James B. Collip at the University of Toronto undertook research leading to the discovery and purification of the pancreatic secretion they initially referred to as “isletin,” extracted from farm animals.71 These extracts would be successfully injected into the first patient, Leonard Thompson, for the treatment of diabetes in 1922. Prior to this point, type 1 diabetes had often been treated with intensive calorie- and carbohydrate-restricted diets, extending diabetics’ lives temporarily and at significant personal expense.

In 1923, the Nobel Prize for the discovery of isletin was awarded only to Banting and Macleod, reflecting ongoing disputes among the team of researchers over claims of relative contribution and ownership. Notably, however, the struggles over ownership did not include intellectual property claims. Rather, the team saw their discovery as squarely in the interest of public good and, as such, were deeply reluctant to patent the innovation. In sharp contrast to today’s norms, academic medicine at the time viewed patenting of research products unfavorably.72

After being prompted by the pharmaceutical company Eli Lilly, the researchers ultimately conceded patenting was favorable as it would guarantee that someone else did not patent and then restrict its availability, as well as ensuring that companies could not produce and sell potentially harmful copycat products. The patent, then, was meant to protect the quality and widespread access of the new treatment. Despite their initial hesitancy, the research team eventually obtained patents in the US, Canada, and Europe, each selling their US patent rights to the University of Toronto for one dollar. The impetus to begin producing insulin in large quantities led to a partnership with Eli Lilly.

Since the initial discovery, a series of incremental changes to the drug formula have been developed that enhanced insulin’s efficacy for diabetics and led to a steady flow of patent protections into the twenty-first century. Between the 1930s and 1950s, regular insulin was molecularly altered to extend the length of time it could function in the body. This resulted in what is now known as intermediate-acting insulin. A form of intermediate insulin called NPH was patented in 1946. The early insulins were derived from animals, making them prone to certain issues that arise with animal-extracted tissue, including immune reactions in patients, impurities in the compound, and ongoing concerns related to sustainability of farm animals needed. Insulin products shifted considerably in the late 1970s when advances in biotechnology enabled insulin to be made through recombinant DNA technology—that is, produced in a lab using bioengineered (genetically altered) microorganisms such as bacteria and yeast to produce insulin.

Eli Lilly introduced the first recombinant insulins— Humulin R (regular) and N (NPH)—to the US market in 1982. Further advancements in the late 1980s resulted in the development of insulin analogs. These analogs more closely resembled how insulin naturally acted in the body and have been the standard for producing insulin since. Humalog (insulin lispro) was introduced as the first rapid-acting insulin in 1996. Lantus (insulin glargine), the first long-acting insulin, was first manufactured and sold in 2000. Notably, as subsequent insulin products entered the market, many older versions were withdrawn. While developments in insulin products have created real improvements in the lives of people with diabetes, they have simultaneously created a string of intellectual property protections that enable long-term exclusive control of the market.

This brief seeks to articulate how the current system that constitutes the pharmaceutical regime offers innumerous points for extracting profit. Since its fundamental orientation is profit motivated, incremental changes to policy will perpetually fall short of expanding access to medicine. A new model for drug development and production is needed. The following argument is separated in three sections. The first part provides background on diabetes and insulin therapies. This includes an in-depth look at the question of why insulin is so expensive in the US, focusing on two key factors underlying the issue: oligopoly control of insulin manufacturing and a complex system in which drugs are delivered to people and paid for. The second section underscores the role of policy and regulation in contributing to unaffordable medicine, focusing on patents and the FDA. The third and final section proposes a pathway forward for reimagining how insulin and other pharmaceuticals could be researched and produced. Using the community-led initiative Open Insulin as a case study, this section highlights both their current practices and future aims. This includes opportunities for drug research done in community biology labs, manufacturing alternatives outside of traditional industry pathways, and ways of organizing that mitigate the harmful conditions produced by profit-based business models, such as cooperative medicine.

Background: Diabetes and Insulin

Diabetes is a condition affecting more than 30 million people in the US,5 with approximately 7.4 million who use insulin.6 Diabetes is a metabolic disorder characterized by hyperglycemia, or increased glucose (a form of sugar) levels in the blood. The role of insulin, a hormone naturally secreted in the pancreas in nondiabetic persons, is to signal to muscle and fat cells to remove glucose from the bloodstream and use it for energy or storage. High concentrations of glucose in the blood cause damage to tissue by impacting blood vessels, leading to increased risk of damage to eyes/ vision, kidneys, nerves, the heart, and extremities. A common complication of untreated diabetes results in amputation of feet and/or hands. In more severe cases, or when an insulin-dependent diabetic cannot access insulin therapy, hyperglycemia will result in complications leading to death.

While industry executives and large investors reap the benefits of increased insulin prices, some diabetics and their families pay more than their mortgage for insulin in the US, and others travel to Canada and Mexico to afford the medicine, an option abruptly cut off with the COVID-19 pandemic.

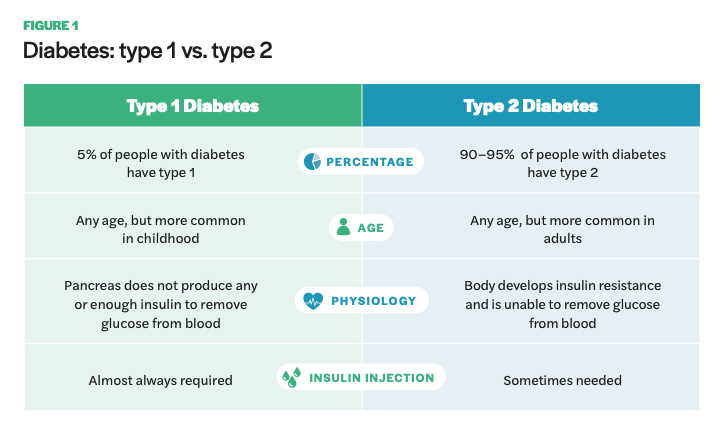

Diabetes is categorized into type 1 and type 2. Type 1 diabetes is an autoimmune disease, typically diagnosed in childhood, resulting in the pancreas unable to make insulin. It is also called insulin-dependent diabetes as nearly all individuals with type 1 will need to take insulin regularly. Type 2 is associated with later onset in life and results from a combination of insulin resistance in the body and deficient insulin secretion.7 Many type 2 diabetics are able to manage the condition through diet and exercise, although a certain subset require insulin supplementation through injections or insulin pumps. Approximately 5% of diabetics are type 1 and 90–95% are type 2.8 Additionally, a small proportion of diabetics acquire the condition from other causes, including gestational diabetes, hormonal diseases, medicines, and damage to the pancreas.

Insulin therapies vary based on a few characteristics, including duration, or the length of time they stay in the body and are able to lower glucose levels; onset, or the amount of time before the injected insulin enters the bloodstream and glucose levels are lowered; and peak time, meaning the time at which the insulin is at maximum strength and thus lowering glucose levels most significantly.9 The peak is important because just as hyperglycemia causes a range of complications, so does hypoglycemia, or low blood glucose levels. The brain relies on the glucose form found in the blood stream, making levels that are too low dangerous and increasing the risk of someone having a seizure or losing consciousness. In nondiabetic individuals, the body naturally secretes insulin in response to blood glucose levels, which vary throughout the day depending on meals, snacks, drinks, etc., and protects them from the negative physiological effects of high blood sugar. This is not the case for insulin-dependent diabetics, who must use injected insulin or insulin pumps to reduce glucose levels.

In order to mimic the natural insulin process, insulin drugs have been developed into long-acting and short-acting types, with some older versions such as NPH falling into a more intermediate range. Fast-acting insulins begin to lower glucose within fifteen to thirty minutes of injection, peaking after approximately one hour (two to three hours for certain drugs), and continue in effect for two to four hours.10 Long-acting insulin drugs do not reach the bloodstream until several hours after injection and work for twenty-four hours or more. Most type 1 diabetics must take both long- and rapid-acting insulin, while some type 2 diabetics may require only the rapid-acting type in order to supplement their body’s natural supply. Insulin is typically found at a strength of U-100, meaning 100 units of insulin per mL of fluid, in 10 mL vials. Insulin need varies among diabetics, and many diabetics need two to three vials per month, and those with higher insulin resistance may require six or more.11

Why Is Insulin So Expensive?

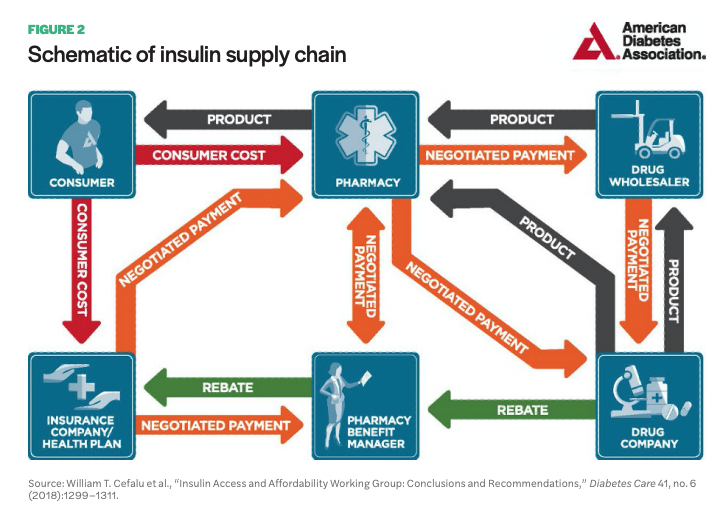

While most people who have sought health care in the US know the payment and insurance process is remarkably complex, the exact mechanisms that contribute to high drug prices are less publicly known. In 2018, the American Diabetes Association (ADA) published a white paper on the insulin supply chain, showing how insulin moves from manufacturer to consumer and the payment process behind it.12 The paper indicates a complex system with at least six key stakeholders involved: the drug company, drug wholesaler, pharmacy, pharmacy benefit manager (PBM), insurance company/health plan, and consumer (see Figure 2).

The insulin supply chain, like most other pharmaceuticals, follows a path from manufacturer to drug wholesaler to pharmacy. The wholesaler, who handles distribution to pharmacies, negotiates prices with the manufacturer, often purchasing drugs near the list price—the price manufacturers set for their drug. Manufacturers pay wholesalers a fixed-percentage fee based on list price, an incentive for taking pharmaceuticals off the manufacturers’ hands and facilitating distribution. Wholesalers then sell the drugs to pharmacies, often with a small markup. Sometimes the drug company will work directly with pharmacies, such as a major chain pharmacy, and prices will be negotiated often with discounts paid directly to pharmacies rather than a wholesaler. Pharmacies then sell to consumers, often billing insurance companies, and add a dispensing fee.

For the most part, the pathway for pharmaceutical products to move from manufacturer to consumer is fairly straightforward, notes the ADA, unlike the pathway for paying for drugs, which is substantially more complex and less transparent. PBMs have played an increasingly key role in negotiating and influencing drugs prices. As the amount and types of pharmaceuticals available have become more extensive, insurance companies and employers who provide health plans rely on PBMs to manage the pharmacy benefit part of health plans. PBMs compile companies’ drug formularies (the list of drugs covered by a plan) and negotiate prices with manufacturers and pharmacies. As clients of insurance companies and employers, they are paid a fee for their services. In addition to this, PBMs receive retroactive discounts, or rebates (also called kickbacks), from manufacturers after a health plan enrollee receives the drug company’s medication.13 Moreover, PBMs negotiate prices paid by health plan providers to pharmacies for medication. This places them in a uniquely central position for directing end costs for consumers, as they are responsible for constructing health plan formularies, setting pricing tiers for formulary drugs, and negotiating rebates from manufacturers that in turn incentivize the inclusion of medications in health plans.

According to pharmaceutical companies, these factors drive up the list price, as the net price—the price drug companies receive after fees paid to wholesalers, discounts to pharmacies, and rebates to PBMs and health plan providers—is substantially lower and must be offset by a higher list price.14 This largely impacts vulnerable populations, especially low-income individuals and families, who are most likely to be uninsured or underinsured and thus bear the full list cost.

It is important to note that while PBMs appear to hold a substantive negotiating position within the insulin supply chain, the real power they wield is less clear. Based on market control within the health-care industry, pharmaceutical and insurance companies hold considerably more market power, placing in question how much negotiating influence PBMs really have. The ADA report indicates on several occasions that the process is anything but transparent, and pricing, rebates, and fee negotiations are largely kept secret from the public as well as other stakeholders in the supply chain, making it difficult to pinpoint who is making out the best financially in this complex system. One thing is for sure, the end users—people with diabetes who rely on insulin to stay alive—are bearing the financial and physiological impacts of rising list prices.

A common argument for the high price tag of pharmaceuticals in the US is the research and development (R&D) costs, which undoubtedly are significant when considering the cost of clinical trials. However, the assertion that pharma companies are actually cycling a significant portion of revenue back into R&D has been challenged.15 According to Reinhardt and colleagues, the thirteen largest pharmaceutical companies in the US in 2002 allocated their sales revenue accordingly: “costs of goods sold, 25.3 percent; selling and administration, 32.8 percent; R&D, 14 percent; taxes, 7.3 percent; and net after-tax profits, 20.6 percent.”16 With just 14% of revenues going back into R&D, it is difficult to make the case that increasingly high drug prices are necessitated on the premise of R&D. The stated priority of R&D is not reflected in the proportion of sales they allocate to it.

“When I first came to the US from New Zealand in 2010, I received insurance through my university’s student health clinic, which was good coverage but also meant I had to get prescriptions from the campus pharmacy for them to be covered. I’ve had type 1 diabetes since age twenty-three. I take about 30 units of insulin a day; at the time, half of this was short-acting insulin and the other half was long-acting. One Friday shortly after arriving in the US, I dropped my last remaining short-acting insulin vial and it shattered on the ground. The campus pharmacy was already closed for the weekend, so I went to a CVS pharmacy and was told it would be $300 for one vial. In New Zealand, insulin costs $5 for a three-month supply. I could not afford the $300. I spent the weekend running and exercising nonstop and eating very little food trying to keep my blood sugar in a healthy range. For me, this was a scary weekend, but for some folks this is a constant reality. Without insulin, people with type 1 diabetes will die. That fear lives with me every day, but even more so here in the US.”

-Alex, type 1 diabetic and Open Insulin member

Another argument offered up by pharma companies: the US is picking up the tab for low-cost medicines in other countries, asserting that governments that negotiate for low-cost drugs for their countries are forcing people in the US to disproportionately bear the costs of R&D for new drugs.17 Again, this argument is premised on the taken-for-granted narrative that R&D is where pharmaceutical companies focus most of their resources.

Current State of Insulin in the US

Three companies—Eli Lilly, Sanofi, and Novo Nordisk—own 93% of the global insulin market18 and are currently the only companies serving the US market.19 The list price of insulin nearly tripled from 2002 to 2013,20 leading to much media coverage in recent years of individuals hoarding insulin, skipping doses, and, in certain cases, dying from lack of medicine.21 According to T1International, an international advocacy organization for type 1 diabetics, at least thirteen people have died in the US since 2017 from rationing their insulin.22 Despite insulin’s discovery nearly a century ago, no generic was available until 2016, when Eli Lilly produced a version (technically called a “follow on”) of Sanofi’s glargine insulin. Notably, the price of this “generic” insulin is just 15% lower than the brand name, whereas most generics are around 80% cheaper.23 A second generic24 insulin, Semglee, gained FDA approval as of June 2020. In their approval announcement, Mylan and Biocon Biologics, the drug’s manufacturers, note the product remains at risk for litigation.25 Additionally, this version of insulin would not be interchangeable at pharmacies, as traditional generics are, due to the FDA pathway it was approved under.

The following graph (Figure 3) was cited in a congressional letter to former attorney general Loretta E. Lynch and Federal Trade Commission Chairwoman Edith Ramirez in 2016. The letter begins with, “We write to ask the Department of Justice and the Federal Trade Commission to investigate whether pharmaceutical companies manufacturing insulin products have colluded or engaged in anticompetitive behavior in setting their drug prices.”26 They go on to state, “Not only have these pharmaceutical companies raised insulin prices significantly—sometimes by double digits overnight—in many instances the prices have increased in tandem.” The graph shows the list price—which ends up being close to what someone with no drug insurance or coverage that does not cover their specific medication would have to pay out of pocket—of the top-selling insulin brands on the market over the past twenty years. The steep price increase starting around 2012 is visible, but what is perhaps more striking is that competing brands for both fast- and slow-acting insulins have raised prices in lockstep, at nearly the same increments and at the same time. This practice could also be described as a phenomenon in business known as shadow pricing, where a product manufacturer increases their price to match a competitors’ pricing. This is what insulin manufacturers have argued is happening; however, it is unknown whether manufacturers are purposefully colluding or engaging in shadow pricing. In either case, such a practice in a situation where people’s lives are literally dependent on the product raises serious concerns and should undoubtedly be scrutinized from both legal and ethical standpoints.

In January 2019, the House Committee on Oversight and Reform and the Senate Committee on Finance held hearings to discuss the issue of high drug prices, focusing on insulin affordability as a top priority.27 A few months later in April, Congress heard from the three main insulin manufacturers—Eli Lilly, Sanofi, and Novo Nordisk—as well as from three major pharmacy benefits managers—CVS Health, Express Scripts (acquired recently by Cigna), and OptumRx28 —who, notably, manage approximately 70% of all prescription claims in the US.29 The focus was on list price, which the pharmaceutical companies argued was priced high due to rebates demanded by other stakeholders in the supply chain. While bipartisan agreement on how to address pharmaceutical, and specifically insulin, pricing is uncertain in the deeply divided political climate, the increasing congressional attention has been a clear signal of how the crisis has garnered visibility and widespread public outrage. In addition to legislative attention, lawsuits have been filed in at least four states against insulin manufacturers for price gouging, including Massachusetts,30 Minnesota,31 Oregon,32 and New Jersey.33

In reaction to public and government scrutiny over pricing, the pharmaceutical industry has offered a few remedies. However, under closer examination they fall short of real solutions. In March 2019, Eli Lilly released a statement declaring they would reduce the list price of one of their products, Humalog, by half, making it $137.35 per vial.34 For low-income individuals and families, whom are most likely to be uninsured or underinsured and pay list price, this is hardly a win. Many diabetics require multiple vials of insulin, and paying over one hundred dollars for a single vial remains largely unaffordable for them. When Humalog first entered the market in 1996, the list price for a single vial was $21, making such a price drop seem insignificant at nearly seven times the original cost.

A second press release was advertised a month later in April 2019 by Cigna and its pharmacy benefits manager Express Scripts. It stated they would offer a patient assistance program that ensured eligible patients would pay no more than $25 for a thirty-day supply.35 This would include individuals covered by certain plans that use Express Scripts. Such a program would not be accessible to uninsured people and thus offers a limited remedy. More importantly, these kinds of patient assistance programs, which many pharmaceutical companies offer for a variety of drugs, may be revoked or reduced at any point, making them an unsustainable option for addressing high drug prices.

In 2019, Colorado became the first state to enact legislation to address rising insulin costs. Colorado’s governor signed into law a groundbreaking bill that caps out-of-pocket insulin costs for insured individuals. The law requires that insurance providers cap the amount that a person pays for a thirty-day supply of insulin at $100, regardless of insulin type or quantity used. This legislation has catalyzed a handful of other states to draft similar bills seeking to place limits on insulin costs by insurance providers. Illinois became the second state to pass a similar law in 2020, capping monthly costs at $100. These types of legislative efforts are important and will make a significant impact for people who are covered by the bill (i.e., those with insurance that is subject to state regulation). However, others, such as uninsured persons and people with insurance that is governed by federal law, will not reap the benefits of these laws.

Inexpensive human insulin is arguably an option for emergencies— it is better than no insulin—but for sustained, widespread use, it is not the solution to endorse in the face of perpetual price gouging.

Another option promoted by some in the face of increasing insulin prices is the product ReliOn (also called NPH and Regular), a form of human insulin sold since 2010 by Walmart for as little as $25 per vial in most states and without the need of a prescription. This insulin has been suggested by some, including the ADA, as an option for those that cannot afford standard prescribed, superior insulin analogs. ReliOn, like other cheaper human insulins, is especially unpredictable compared to analog insulin, meaning the onset, duration, and particularly the peak is harder to anticipate and requires substantial planning with regards to diet and eating times.36 Additionally, with fluctuating insulin and blood glucose levels, it becomes vital to test glucose levels more frequently. This necessitates additional costs for purchasing glucose test strips and other supplies and additional doctor’s visits essential to support such a transition in medications, all of which can be prohibitively expensive for some. Long-term effects of over-the-counter insulin, such as rates of hypoglycemia associated with unexpected insulin peak times, is also unknown and has led to concern among physicians.37 In June 2019, a young man, Josh Wilkerson, died after switching to ReliOn.38 Josh aged out of his mother’s insurance and was unable to afford his usual prescribed insulin brand. He died at age twenty-seven, a few hours after taking the cheaper, over-the-counter insulin.

Inexpensive human insulin is arguably an option for emergencies—it is better than no insulin—but for sustained, widespread use, it is not the solution to endorse in the face of perpetual price gouging. The assertion that those who cannot afford the increasing price associated with commonly prescribed and utilized insulins should have to switch to more unpredictable forms should raise a red flag. As T1International notes, “The ADA’s suggestion that prescribing this [ReliOn] insulin should become a common money-saving practice also exacerbates a two-tiered system where the rich get the ‘better insulin’ and the poor are forced to use the older, and often more problematic, insulin.”39 With the price of insulin rising at shocking rates and a supply chain that promotes numerous points of profit extraction by health-care and pharmaceutical corporations, such an argument that places impetus on patients to make a change, especially one that is potentially harmful, undermines more equitable, structural solutions that should be sought.

Role of Policy and Regulation: Patents

Patents play a major role in drug development and drug pricing in our current system. Pharmaceutical companies, biotech companies, and universities that undertake drug development research all navigate the complex terrain of patents, looking to secure exclusive financial rights through patenting of biomedical innovations. As the industry argument goes, the period of patent exclusivity following drug innovation is necessary in order to recoup high R&D costs associated with innovating new drugs, as well as incentivize future expenditures on drug development.40 New drugs are given a monopoly and priced high. Market logic predicts that once the period of exclusivity has ended, prices will reduce substantially with the entrance of generics manufacturers and increased competition.41

What this simple narrative around the relationship of patenting to price fails to account for are tactics deployed by pharmaceutical companies to extend the life of drug patents past their term limit of twenty years. Such practices include patent thickets and “evergreening,” where pharma companies make minor modifications to the molecular structure of a drug and submit the “new” drug as a patentable innovation, without needing to demonstrate whether it improves safety or efficacy over older versions.42 Patent thickets occur when a company obtains many patents that surround, or create a thorny thicket around, the core technology or drug. Sanofi, for example, has taken out seventy-four patents on Lantus, a top-selling, long-acting insulin. Drug manufacturers argue that the filing of additional patents after the initial drug patent is secured, but prior to regulatory approval, is necessary to incentivize further drug development needed to bring it to market, and thus, should not be characterized as evergreening. Of the seventy-four patents filed on Lantus, 95% of these were filed after regulatory approval.43

The financial incentive to evergreen products creates a market of “me-too” drugs, where the difference in subsequent incarnations is trivial.44 The threshold for drug patentability entails a distinction in the chemical compound itself and/or in the process for producing it, but there is no stipulation with regards to greater clinical effectiveness. In other words, there is no need to show clear benefit for a patient over a previous iteration of a drug in the US (note there is variation between countries for such requirements). Thus, patents become a means-end for innovation; rather than patents fueling innovation toward new or better treatments and cures, with clear clinical efficacy, the bare minimum is done for obtaining a new patent to extend the life of a drug. The advent of “me-too” drugs is then supplemented by robust marketing schemes targeting consumers and physicians eager to provide the best possible medicines to their patients, ensuring they continue to sell despite other more affordable options that may be available.45

Thus, patents become a means-end for innovation; rather than patents fueling innovation toward new or better treatments and cures, with clear clinical efficacy, the bare minimum is done for obtaining a new patent to extend the life of a drug.

Jeremy Greene and Kevin Riggs, in their paper “Why Is There No Generic Insulin?” touch on the practice of evergreening but state that the progression of insulin therapies does not necessarily fall under this practice.46 Rather, subsequent generations of insulin have proven better than previous ones, albeit with some contestation on the extent of their superiority and whether or not newer drugs are worth the cost.47 As patents have expired, newer insulin therapies have successively replaced older types. One might expect that this would lead to a generics market of older drugs that could be more affordable for low-income patients. However, Greene and Riggs note that as newer drugs have been developed and made available, previous versions (such as those made through animal extracts) are removed from the US market and become obsolete. The incremental innovation that characterizes insulin’s history has sidestepped the creation of a generics insulin market, highlighting certain limits of generics competition as a framework for reducing drug prices and ensuring access.

Another concerning abuse of patents among big pharmaceutical companies happens through the phenomenon described as “pay-for-delay” (sometimes referred to as “reverse payments”). According to the Federal Trade Commission (FTC), pay-for-delay has been an increasingly serious problem with major impacts on drug prices and consumer costs:

One of the FTC’s top priorities in recent years has been to oppose a costly legal tactic that more and more branded drug manufacturers have been using to stifle competition from lower-cost generic medicines. These drug makers have been able to sidestep competition by offering patent settlements that pay generic companies not to bring lower-cost alternatives to market. These “pay-for-delay” patent settlements effectively block all other generic drug competition for a growing number of branded drugs. According to an FTC study, these anticompetitive deals cost consumers and taxpayers $3.5 billion in higher drug costs every year. Since 2001, the FTC has filed a number of lawsuits to stop these deals, and it supports legislation to end such “payfor-delay” settlements.48

In these cases, pharmaceutical companies, typically generics manufacturers, challenge a patent held by a brand-name company as a way to enter the market. The brand-name company then sues the generics company, delaying the process of the potential generic drug being made available. Rather than seeing the suit through, brand-name companies will settle patent litigation by paying large sums of money to the potential competitors, who in turn abandon the patent lawsuit.49 Brand-name companies literally pay generics companies to delay their entrance into the market. Assuming litigation would have been successful, the entrance of a competing drug in a monopolized market would have substantial effects for lowering the cost for patients.

Viewed from a different angle, patents may actually function to stifle much innovation and collaboration. This perspective has received considerably less attention yet offers a compelling argument for an open-source model.50 One conspicuous issue with patents is that they incentivize secrecy throughout the research process. Once information is placed in the public domain, it is no longer patentable (in the US there is a twelve-month grace period in which a product can still be patented). Similarly, sharing of information might enable someone else to patent an innovation before the innovator. Widely sharing scientific data and results, including negative outcomes, is disincentivized in this system. Rather, scientific knowledge is transformed into trade secrets and subject to the usual competitive practices inherent in most business and corporate structures, where sharing of results and procedures undermines the possibility of intellectual property claims and the accompanying financial reward.

The notion that financial incentives through patent exclusivity equate to the only, or the most promising and fruitful, path toward innovation in pharmaceutical development is clearly flawed, as highlighted by practices of evergreening, pay-for-delay, and secrecy necessitated for patent claims. As the initial discovery of insulin indicates, other systems of rewards—including prestige, awards, and general fulfillment through contributions to society—should not be underestimated. Patents impact access and affordability in troubling ways, orienting R&D priorities in directions often at odds with public need. If patents and profits are the prevailing rewards for research and innovation, then we have little hope of getting out of a cycle that promotes high drug prices, sometimes for decades as incremental innovation matches patent life, as is the case with insulin.

Food and Drug Administration

In considering pharmaceutical costs and access in the US, the FDA undoubtedly plays a major role in the issue. Pharmaceuticals posed for human use must be vetted through the gold standard for safety and efficacy: the FDA’s three-phase clinical trials in which costs increase substantially with each phase. The cost of bringing a new drug to market was estimated at $802 million in 2000, according to the report51 most widely cited by industry and government officials.52 This figure was updated to $1.32 billion, a 64% increase, in 2006.53 Although this number has been challenged as being much lower,54 the price tag for drug development with the FDA’s stamp of approval is without a doubt immensely expensive and, therefore, necessitates enormous capital to invest in the process. Because of this, drug development in the US often follows a path from smaller biotech companies and universities doing initial, upstream research and drug discovery, then licensing to downstream pharma companies who have the resources to move the drug through clinical trials and eventually into market.55

The FDA’s primary focus is on safety and protection of potential consumers; however, there have been efforts over the years to craft policies and regulatory pathways that aim to reduce drug prices. The enactment of the Drug Price Competition and Patent Term Restoration Act (also known as the Hatch-Waxman Amendments) in 1984 is a prominent example. This established the modern structure for generic drug regulation in the US, creating a more streamlined pathway for the promotion of competition and decreasing pharmaceutical costs for consumers. The generics pathway—which entails an abbreviated application and relies on safety data from previous studies, thus avoiding duplicate clinical trials and associated costs—has been in effect for decades. Generics (also called “small molecule” drugs) utilize a chemical process to create and contain the exact same active ingredient as the reference or brandname product. A different pathway, however, regulates biologics (also called “big molecule” drugs), which is the category of drug insulin falls under. Biologics are complex protein structures that are synthesized through living organisms, such as bacteria or yeast. Biologics are only able to be compared for molecular similarity, as opposed to exactness, making the process for assessing how they function in the body different and potentially more complex.

The regulatory pathway for “biosimilars,” as they’re called (the generics counterpart for biologics), has only been in effect since 2010, when the Biologics Price Competition and Innovation Act passed as part of the Patient Protection and Affordable Care Act. This allowed the FDA to create a shorter, lower-cost approval pathway for biosimilars designed to promote more competition among biologics manufacturers.56 Unfortunately, insulin fell into a gray area and was classified as ineligible for the biosimilar pathway. As of December 2018, a total of fifteen biosimilars had been approved through this pathway, and an additional sixty were in ongoing review. However, as former FDA commissioner Scott Gottlieb noted, “a lot of these drugs never launched owing to patent issues.”57 The FDA knows that pharmaceutical companies attempt to “game” the system, such as by taking actions that forestall the entry of biosimilars. In reaction, the FDA implemented a refined process for the regulation of biosimilars that took effect March 2020. Through this revised pathway, insulin can be regulated under biosimilars.

How far will these changes go? It remains unclear. Despite such progress, the regulatory hurdles for moving a drug through the FDA approval process is resource intensive, and therefore, big pharma companies are at a tremendous competitive advantage compared to smaller biotech and biomedical research institutions. Even with increased congressional and regulatory attention with regards to insulin prices, the proposed remedies remain narrow in a certain sense, focusing solely on market-based solutions in an industry that holds immense power and incentive to preserve the status quo.

To summarize, the factors contributing to an intolerably high price of insulin described thus far—a complex supply chain and numerous points of entry for profit extraction, patent abuse tactics, and FDA hurdles—offer myriad ways for understanding the problem and, in theory, points for intervention. One could address patent law and FDA policy, and the government could do more in regulating pharmaceutical companies that flood the market with drugs that offer little to no benefit over previous versions. However, these often equate to limited, incremental changes that leave the pharmaceutical industry as a whole largely unscathed. More importantly, they all assume a common pipeline to remain intact; that is, they keep drug production, manufacturing, and distribution all squarely within a profit-based market. Insulin is one of the clearest examples of the market failing to promote lower-cost drugs through competition. Nearly a century after its discovery, insulin has not declined in price but rather has risen at an alarming rate. When we only address one point of intervention, like the recent state laws to cap insulin costs for certain insured populations, we find that the complex system evolves accordingly and easily remains oriented toward profits.

An underregulated market system is fundamentally at odds with frameworks seeking to promote genuine, sustained access to medicines. Its orientation is toward financial return on investment, a profit-motivated system, positioned to lobby for and exploit a legal structure to this end. A pharmaceutical consultant once compared pharma companies to Apple Inc. and other smartphone corporations. If they do not come out with a new smartphone every few years and incentivize users to buy new products, such as by discontinuing the sale of older versions and heavily marketing the superior nature of newer versions (despite most components remaining largely unchanged), then these companies risk not delivering to expecting shareholders. Lifesaving medications should not be held captive to the same business practices and motives as iPhones. In short, medication access should not be conceptualized within a profit-based system as the sole mechanism for ensuring people get the medicines they need.

Community-based Medicine

Using the Open Insulin Project as a case study, this brief argues for a multifaceted approach that reimagines the pharmaceutical system through localized, community-based pharmaceutical production. Open Insulin is a group working in community biology labs to bioengineer insulin and develop a new model for affordable insulin production. Based primarily in the San Francisco Bay Area, the initiative challenges the current pharmaceutical system on multiple fronts.

First, the initial drug research is carried out in a community lab, which offers public access to a working biology wet lab and promotes principles of open science and citizen science engagement. Here, anyone can participate and drive research according to individual- and community-inspired aims. Such aims, like addressing the pressing problem of insulin access, might not otherwise be taken up in traditional biomedical labs, including industry and academic labs that must consider factors like profit margins, shareholders, publishability, funding terms, and so on.

Second, Open Insulin is attempting to take up a different model that is decentralized, recognizing the pharmaceutical regime garners substantial power from centralized production facilities—most manufacturing is done on a large scale by big companies—which necessitate immense capital to fund and operate. Their aim is to enable insulin production on a small-scale, localized level. Relatedly, Open Insulin seeks to make insulin available using an open-source model, so the process for bioengineering the drug is transparent and accessible to anyone.

Third, Open Insulin has considered organizing structures for community-based pharmaceutical production, namely, cooperative-based medicine. Such a model has the potential to use organizational precedents recently implemented by the marijuana industry, an area not discussed in depth here but rich for future research. The long-term aim of Open Insulin is to enable insulin production, and other biopharmaceuticals in theory, by and for communities. The idea is that people who need and use insulin could also have the capability to control the means of production and distribution. For instance, a diabetes advocacy organization might also have the means to produce insulin themselves for their constituents.

The following section is separated into three parts to illustrate the different pieces involved in such a system: 1) initial drug research in community biology labs or other research centers that use an opensource approach; 2) manufacturing pathways, with particular emphasis on small-scale production and distribution; and 3) organizational structures that enable decentralized, community-based or patient-owned production. Some parts are currently being undertaken and others are more speculative and need further formulation and testing.

I. Community Biology Labs and Open-Source Pharmaceutical Research

Dozens of community biology labs have popped up around the world in the past decade.58 They offer wet ab spaces open to the public, where members can learn, tinker, and undertake research projects in biology, biotechnology, and bioengineering. Other terminology used to describe this type of space or work includes biohacking, makerspace, citizen science, garage science, and do-it-yourself (DIY) bio. These terms are used to describe the use of molecular biology and biotechnology tools by those without formal training and/or undertaken outside of “official” spaces, such as institutions or professional laboratories, and brought into nontraditional venues, such as public or shared community spaces.59 The Bay Area, which encompasses Silicon Valley and the biotech capital of North America, is home to two community labs: Counter Culture Labs, where Open Insulin predominantly operates, and BioCurious. BioCurious was one of the first community labs, founded in 2011 through a Kickstarter campaign that raised enough money to rent and equip the lab space. Counter Culture Labs was founded soon after in 2013. The labs have a range of active projects from bioengineered vegan cheese, to fermentation and mushroom science, to insulin research. Both labs have members that contribute to Open Insulin, in addition to other labs in different parts of the US and internationally.

There are two key aspects to community biology labs that are valuable for considering their role in research of biopharmaceuticals. First, their funding structure is different from institution-based labs. This offers both challenges and points of opportunity. The obvious challenge is that funding streams are more tenuous and less robust than academic and industry labs. They often rely on volunteers to run the lab, teach classes (which functions as both a funding source and community engagement), and drive projects. They also rely on donated or used lab equipment in many cases, which can be limiting as maintenance becomes more of an issue. On the other hand, funding is not tied to typical institutional motives, such as publication value, patentability, and profit margins. There is much literature that demonstrates the impact funding sources have on research, including how research questions get constructed, which projects get taken up (and which don’t), influence on methodological choices, and how interpretations and applications of results vary depending on who is producing and consuming scientific knowledge.60 Being untethered to institutional funding means that any research question can be asked and, in theory, be pursued, including questions and aims that significantly challenge the status quo.

Second, the ethos underlying community labs draws upon community engagement and open science. This offers a fundamental departure from pharmaceutical research steeped in secrecy and directed with little or no public input. Groups like Open Insulin not only produce and share scientific knowledge in novel ways, they direct research according to goals and models, such as open-source, that have the potential to challenge the prevailing biomedical system. The current system has been critiqued as being hyperfocused on producing cutting-edge innovation regardless of price and access and leading to further entrenchment of healthcare inequalities.61 In contrast, community-based pharmaceutical projects may be better positioned ideologically to direct endeavors focused on genuine access. In other words, both from a financial and philosophical standpoint, the incentive system in a community biology lab is inherently different from academic and industry labs, thus making its goal for pharmaceutical research that serves the common good noteworthy.

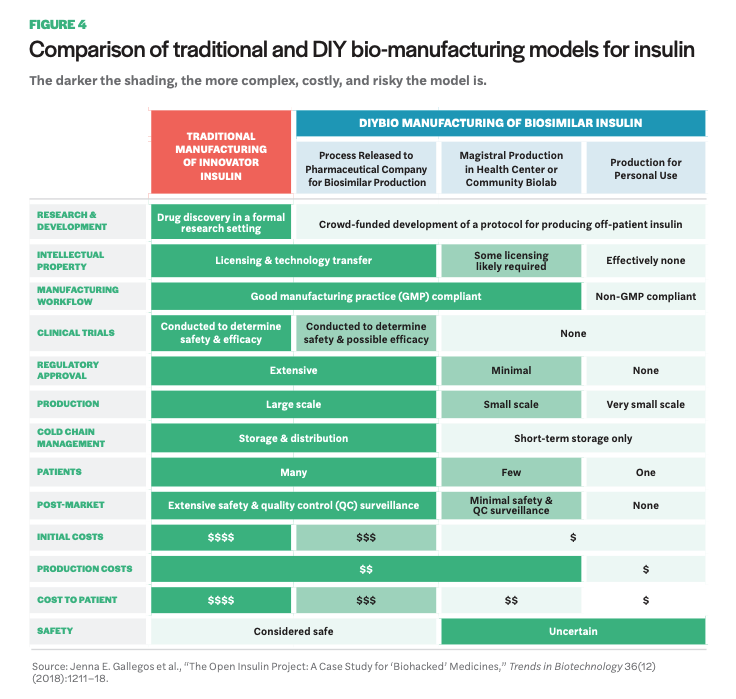

Beyond Open Insulin, there are a handful of other initiatives (not based in community labs) engaged in open-source pharmaceutical research. One is Open Source Malaria, a project that operates without a lab home, per se, but that has an open lab book online where scientists contribute data, knowledge, and research from their respective labs toward development of new malaria medicines.62 No drugs from the project have made it through clinical trials yet, but there has been promising progress. Perhaps most noteworthy, they have embraced the full meaning of open source by placing all research in the public domain throughout the process, foregoing patent rights. Another initiative is Medicine for Kids (M4K) Pharma, the first ever open-source drug discovery company, located in Canada. Their commitment to open-source practices comes in the form of no patents. As a company advancing drug research for childhood diseases, they do, however, rely on regulatory exclusivity for a certain period of time as a means for recouping R&D costs. More recently, an offshoot of M4K has launched—M4ND Pharma (Medicine for Neurodegenerative Diseases)—utilizing the same regulatory exclusivity, but for rare nervous system disorders, as a means for a sustainable open-source business model that foregoes patents. Lastly, there is a biohacker in the Bay Area who published DIY instructions for an EpiPen (called the EpiPencil).63 There are compelling reasons to consider an opensource model for pharmaceutical R&D. Namely, it offers much for the sharing of data and ideas, allowing input from a larger number of people with expertise in a variety of fields, effectively accelerating research potential that is otherwise encumbered by patents and other motives of secrecy, such as publication privileges.64 It shifts the incentive system by prioritizing collaborative scientific work, and, more importantly for projects like Open Insulin, it enables others to reproduce scientific work without fear of patent infringement, including for the production of lifesaving medicines like insulin. For a more in depth discussion on the advantages associated with open-source drug development, see Manica Balasegaram and collaborators’ paper “An Open Source Pharma Roadmap.”65 II. Manufacturing Once the initial laboratory research phase has concluded, community-based and open-source pharma projects will need to consider manufacturing possibilities, which entails various forms of regulatory oversight depending on different directions pursued. A recent article by Gallegos and colleagues discusses Open Insulin as a case study for biohacked medicines, offering insight on the various paths and accompanying regulatory and monetary hurdles a community project like Open Insulin faces.66 The paper outlines three pathways for manufacturing. The following table (Figure 4) provides an overview of the different pathways and looks comparatively at various components such as production costs, regulatory approval, and safety.

The first pathway is DIY individual-use insulin therapy. This would circumvent the FDA and be the least burdensome in terms of expense and regulation. The FDA does not regulate medicine a person produces for personal use, thus avoiding the resources needed for navigating regulation and especially clinical trials. This option, however, raises significant concerns around safety. It is also limited in terms of the number of diabetics likely reached. The second pathway, magistral production, entails small-scale production of drugs, which currently happens in certain hospitals and pharmacies. This would require more regulatory approval efforts than personal-use DIY, but it is unclear how burdensome the process would be; small-scale production is not a widespread practice at present. The third pathway involves partnering with a generics manufacturer. This would assume full regulatory oversight via the FDA pathway for biosimilars, including the high price tag for clinical studies and extensive time commitment for bringing a biosimilar to market.

Despite the greater resources needed for smallscale production compared to personal-use DIY, and given the lower amount of resources a community project has compared to pharmaceutical companies, there remains a case to be made for pursuing the small-scale, community-based production model. Not everyone will want to produce their own medicine. Although enticing for the low regulatory burden, the idea of “home-brewed” insulin could have limited reach in promoting widespread access, especially as people may be skeptical about injecting themselves or family members with medicine that has not been vetted by the FDA. On the other hand, partnering with a generics manufacturer, while tempting as it utilizes the robust distribution system currently in place for delivering medicine to people, places production back in the complex supply chain that promotes the extraction of profit at many points. Additionally, as noted earlier, generic biologics (biosimilars) have not had the same success at reducing drug costs as small molecule generics; the generic insulin (technically a follow on) Basaglar is priced just 15% below the brand name. In terms of small-scale manufacturing technology and hardware, there has been promising progress in this area. For example, a biopharmaceutical manufacturing system developed by researchers at MIT that fits atop a lab bench and produces clinical grade biologics was recently introduced.67

Upstream R&D processes, such as publicly funded research in academic institutions, some of which do hold goals of developing affordable therapies, eventually are funneled into downstream pharmaceutical companies as the only way to get drugs “to market,” making them always already oriented toward the reproduction of a system that keeps drugs unaffordable.

Why attempt to formulate a novel pathway for small-scale, community-owned biopharmaceutical production? One answer is that it challenges the current market system that is fundamentally at odds with promoting affordable medicine. It attempts to remove the production of medicine from a profit-based system and place it into a system that emphasizes collective values to promote access. This connects to the importance of decentralized production. Open Insulin sometimes makes the analogy to microbreweries to help conceptualize their effort, as both the process of brewing beer and bioengineering insulin uses similar mechanisms for growing microorganisms to make the end product. In the early half of the twentieth century, brewing beer was dominated by large, centralized manufacturers who supplied most of North America. In recent decades, there has been an explosion of microbreweries, essentially transforming competition and delivery of beer through innumerable local breweries. Similar in effect, Open Insulin has proposed the need for localized ownership of insulin and other biopharmaceuticals, calling for decentralized production and distribution.

The accompanying barriers for this model, especially as it concerns safety and regulation, will need to be further fleshed out. Recent scholarship has presented the decentralized model as potentially more burdensome for regulation.68 Nonetheless, the importance of working toward a fundamentally new system of pharmaceutical production and distribution remains significant. As the current system functions, through profit-driven practices and underregulated market structures, it undermines all research that attempts to develop drugs for the sole objective of getting medicine to people free, at cost, or without profit. Upstream R&D processes, such as publicly funded research in academic institutions, some of which do hold goals of developing affordable therapies, eventually are funneled into downstream pharmaceutical companies as the only way to get drugs “to market,” making them always already oriented toward the reproduction of a system that keeps drugs unaffordable.

An important caveat to note is that this paper is presenting a case for certain biopharmaceuticals, such as certain forms of insulin, to be produced at the community level. There are innumerous types of pharmaceuticals, many of which undergo complex mechanisms to be made. This brief is not suggesting that all pharmaceutical production can, nor should, be converted to a small-scale or community-based medicine model. Rather, certain drugs, such as certain forms of insulin (and other biopharmaceuticals that utilize a similar production and purification system), may be ideal for establishing a pathway and system for safely manufacturing at a localized level.

III. Organizational Structure

While Open Insulin is still in the initial research phase, it is useful to consider the type of organizing structure such a project would take down the line in order to get insulin to people. If widespread access to insulin is the goal, then what types of business models might counter or mitigate the problems caused by drugs produced within a profit-based system? One such structure could be a cooperative model, where people who use insulin also manufacture it. The marijuana industry offers a thought-provoking precedent for medicines produced and distributed utilizing a cooperative structure. This area offers much for future consideration, especially in terms of policy and regulation.

A second idea is to partner with states such as California who recently enacted the first policy to make their own generic drugs. Signed into law in September 2020, the California law would allow the state to make and distribute their own generic and biosimilar drugs, including biosimilar insulin, in order to promote increased access to affordable medicine.69 The state of New York proposed a similar bill, Senate Bill S9020, in October 2020.

A third consideration is nonprofit structures. This pathway was pursued by the nonprofit pharmaceutical organization Civica (previously Civica Rx). Formed in 2018, a consortium of hospitals banded together to create a nonprofit generics company to supply their hospitals. They now offer twenty drugs to their patients. Both cooperative and nonprofit models carry pitfalls as well as opportunities, and the formation of a new way of organizing also adds a layer of complexity to an already unprecedented road ahead. Nonetheless, if we recognize the fundamental problem underlying insulin and other medicine access as rooted in the current economic conditions, then we must speculate about and pursue an alternative model.

Conclusion

The high cost of pharmaceuticals in the US is a well known issue. The ever-increasing price of insulin, despite its discovery nearly a century ago, is a clear example of how a profit-based market fails to yield low-cost drug options for certain lifesaving medicine over time. A number of factors contribute to the pharmaceutical industry’s ability to preserve a system that promotes increasingly expensive, profitable drugs at the expense of widespread access, including a complex supply chain, patents, FDA regulation— which favors large, centralized manufacturers with the capital to invest in drug development—and a lack of government oversight on drug efficacy in order to prevent flooding of the market with “me-too” drugs. Given the state of this system, the extensiveness of the issues and fundamental causes undergirding it, it is imperative to envision solutions that would address the multitude of points that enable drugs to consistently remain inaccessible for many. Such thinking entails building a solution that addresses the market and enables research, production, and delivery of drugs to people without being funneled through an economic system that is inherently parasitic.

This brief proposes community-based pharmaceutical production, using the Open Insulin Project as a case study, as a means for imagining such a system. The emerging world of community biology offers space for pharmaceutical research situated in a different system of incentives and values compared to typical research institutions, one that values truly open science and is not reliant on intellectual property protections in order to sustain and promote research. There are different routes Open Insulin can take in order to achieve their goal of producing inexpensive, open-source insulin. The pathway discussed at length here involves developing a model for smallscale, decentralized manufacturing that can be done by and for communities, with the idea that diabetics have the means to produce and control insulin production for themselves.

Lastly, the organizational structure for community-based pharmaceutical production would need to be developed. The marijuana industry offers a possible precedent for conceptualizing a cooperative or collective ownership model for medicine. The current pharmaceutical system—from R&D to manufacturing to distribution channels—is robust and will likely remain as the primary way pharmaceuticals are delivered to people who need them, regardless of successful efforts at establishing a community-based medicine model in the near future. However, as this brief has explored, there is a serious need to consider a vastly different system for pharmaceutical production, one that truly promotes access over profit.

- 1Bram Sable-Smith, “Insulin’s High Cost Leads to Lethal Rationing,” NPR (September 1, 2018), https://www.npr.org/sections/health-shots/2018/09/01/641615877/insulins….

- 2 Darby Herkert et al., “Cost-Related Insulin Underuse Among Patients with Diabetes,” JAMA Internal Medicine 179, no. 1 (2019): 112–14, https://doi.org/10.1001/jamainternmed.2018.5008.

- 3 Xinyang Hua et al., “Expenditures and Prices of Antihyperglycemic Medications in the United States: 2002–2013,” JAMA 315, no. 13 (2016): 1400–1402, https://doi.org/10.1001/jama.2016.0126.

- 4 Andrew W. Hitchings, Emma H. Baker, and Teck K. Khong, “Making Medicines Evergreen,” British Medical Journal 345, no. 7886 (2012): 18–20.

- 70John Christopher Feudtner, Bittersweet: Diabetes, Insulin, and the Transformation of Illness, Studies in Social Medicine (Chapel Hill: University of North Carolina Press, 2003).

- 71Michael Bliss, The Discovery of Insulin (Chicago: The University of Chicago Press, 1982).

- 72Jeremy A. Greene and Kevin R. Riggs, “Why Is There No Generic Insulin? Historical Origins of a Modern Problem,” New England Journal of Medicine 372, no. 12 (2015): 1171–75, https://doi.org/10.1056/NEJMms1411398.

- 5Centers for Disease Control and Prevention, “National Diabetes Statistics Report” (2017), https://www.cdc.gov/diabetes/data/statistics/statistics-report.html.

- 6William T. Cefalu et al., “Insulin Access and Affordability Working Group: Conclusions and Recommendations,” Diabetes Care 41, no. 6 (2018): 1299– 1311, https://doi.org/10.2337/dci18-0019.

- 7 Saul Genuth, Jerry Palmer, and David Nathan, “Classification and Diagnosis of Diabetes,” in Diabetes in America, 3rd ed., ed. C. C. Cowie et al. (Bethesda, MD: National Institute of Health, 2018).

- 8 Centers for Disease Control and Prevention, “National Diabetes Statistics Report.”

- 9 American Diabetes Association, “Insulin Basics” American Diabetes Association, (2018), http://www.diabetes.org/living-with-diabetes/treatment-andcare/medicati….

- 10 Ibid.

- 11David M. Tridgell, “Insulin Is Too Expensive for Many of My Patients. It Doesn’t Have to Be,” Washington Post, (June 22, 2017).

- 12Cefalu et al., “Insulin Access and Affordability Working Group.”

- 13Ibid.

- 14House of Representatives U.S. Congress, “Priced Out of a Lifesaving Drug: Getting Answers on the Rising Cost of Insulin,” Committee on Energy and Commerce (2019), https://republicans-energycommerce.house.gov/hearings/priced-out-of-a-l….

- 15Janet Spitz and Mark Wickham, “Pharmaceutical High Profits: The Value of R&D, or Oligopolistic Rents?” American Journal of Economics and Sociology 71, no. 1 (2012): 1–36, https://doi.org/10.1111/j.1536-7150.2011.00820.x.

- 16Uwe E. Reinhardt, Peter S. Hussey, and Gerard F. Anderson, “U.S. Health Care Spending in an International Context,” Health Affairs 23, no. 3 (2004): 10–25, https://doi.org/10.1377/hlthaff.23.3.10.

- 17Ibid.

- 18Hans V. Hogerzeil and Sterre Recourt, “The Importance of Insulin Donations for Children in 43 Low- and Middle-Income Countries,” Journal of Public Health Policy 40 (January 9, 2019): 253–63, https://doi.org/10.1057/s41271-018-00159-w; Lisa S. Rotenstein et al., “Opportunities and Challenges for Biosimilars: What’s on the Horizon in the Global Insulin Market?” Clinical Diabetes 30, no. 4 (October 1, 2012): 138–50, https://doi.org/10.2337/diaclin.30.4.138.”

- 19Cefalu et al., “Insulin Access and Affordability Working Group.”

- 20Hua et al., “Expenditures and Prices of Antihyperglycemic Medications in the United States.”

- 21Sable-Smith, “Insulin’s High Cost Leads to Lethal Rationing.”

- 22 T1International, “In Memory: T1International,” accessed February 18, 2020, https://www.t1international.com/in-memory/.

- 23Jenna E. Gallegos et al., “The Open Insulin Project: A Case Study for ‘Biohacked’ Medicines,” Trends in Biotechnology 36, no. 12 (2018): 1211–18, https://doi.org/10.1016/j.tibtech.2018.07.009.

- 24Semglee is technically a “follow on” biologic, not a generic drug. The distinction is based on different FDA drug approval pathways and is discussed in the section on FDA regulation. Semglee’s manufacturers have filed for “biosimilar” designation with the FDA but have yet to gain approval.

- 25Mylan, “Mylan and Biocon Announce U.S. FDA Approval of SemgleeTM (Insulin Glargine Injection)” (June 11, 2020), http://newsroom.mylan.com/2020- 06-11-Mylan-and-Biocon-Announce-U-S-FDA-Approval-of-Semglee-TM-insulin-glargine-injection.

- 26Bernard Sanders and Elijah Cummings, “Sanders, Cummings Request DOJ and FTC Investigate Cost of Diabetes Products,” House Committee on Oversight and Reform (November 4, 2016), https://oversight.house.gov/news/press-releases/sanders-cummings-reques….

- 27 Yasmeen Abutaleb, “Congress Holds First Hearings on Insulin, High Drug Prices,” Reuters (January 30, 2019), https://www.reuters.com/article/us-usa-healthcare-drugpricing-idUSKCN1P….

- 28Robert Pear, “Lawmakers in Both Parties Vow to Rein in Insulin Costs,” The New York Times (April 11, 2019), https://www.nytimes.com/2019/04/10/us/politics/insulin-prices-legislati….

- 29Cefalu et al., “Insulin Access and Affordability Working Group,” 1303.

- 30Eric Sagonowsky, “Insulin Pricing Lawsuit against Sanofi, Novo Nordisk and Eli Lilly Moves Forward,” FiercePharma (February 19, 2019), https://www.fiercepharma.com/pharma/insulin-pricing-class-action-lawsui…

- 31Mike Bunge, “Minnesota Sues Over High Insulin Prices” (October 16, 2018), https://www.kimt.com/content/news/Minnesota-sues-over-high-insulin-pric….

- 32Nigel Jaquiss, “Oregonians Pay Way More Than They Should for Insulin. One Couple Is Fighting to Change That,” Willamette Week (November 14, 2018), https://www.wweek.com/news/2018/11/14/oregonians-pay-way-more-than-they….

- 33Katie Thomas, “Drug Makers Accused of Fixing Prices on Insulin,” The New York Times (December 22, 2017), https://www.nytimes.com/2017/01/30/health/drugmakers-lawsuit-insulin-dr….

- 34Eli Lilly, “Lilly to Introduce Lower-Priced Insulin,” Eli Lilly and Company (March 4, 2019), https://investor.lilly.com/news-releases/news-release-details/lilly-int….

- 35Cigna, “Cigna and Express Scripts Introduce Patient Assurance Program to Cap Out of Pocket Costs at $25 Per 30-Day Insulin Prescription,” Cigna (April 3, 2019), https://www.cigna.com/newsroom/news-releases/2019/cigna-and-express-scr….

- 36Kasia J. Lipska, Irl B. Hirsch, and Matthew C. Riddle, “Human Insulin for Type 2 Diabetes: An Effective, Less-Expensive Option,” JAMA 318, no. 1 (2017): 23–24, https://doi.org/10.1001/jama.2017.6939; Nicki Nichols, “Why Walmart Insulins Aren’t the Answer to High Insulin Prices,” Insulin Nation (blog) (September 16, 2016), https://insulinnation.com/treatment/why-walmart-insulins-arent-the-answ….

- 37Jennifer N. Goldstein, Madeline McCrary, and Kasia J. Lipska, “Is the Over-the-Counter Availability of Human Insulin in the United States Good or Bad?” JAMA Internal Medicine 178, no. 9 (2018): 1157–58, https://doi.org/10.1001/jamainternmed.2018.3332.

- 38Antonio Olivo, “He Lost His Insurance and Turned to a Cheaper Form of Insulin. It Was a Fatal Decision,” Washington Post (August 3, 2019), https://www.washingtonpost.com/local/he-lost-his-insurance-and-turned-t….

- 39T1International, “T1International Statement on Walmart Insulin” (June 1, 2018), https://www.t1international.com/blog/2018/06/01/t1international-stateme….

- 40F. M. Scherer, “The Pharmaceutical Industry—Prices and Progress,” New England Journal of Medicine 351, no. 9 (2004): 927–32, https://doi.org/10.1056/NEJMhpr040117.

- 41Greene and Riggs, “Why Is There No Generic Insulin?”

- 42Hitchings, Baker, and Khong, “Making Medicines Evergreen.”

- 43I-MAK, “Overpatented, Overpriced Special Edition: Lantus (Insulin Glargine)” (October 30, 2018), https://www.i-mak.org/lantus/.

- 44Roger Collier, “Drug Patents: The Evergreening Problem,” CMAJ 185, no. 9 (2013): E385–86, https://doi.org/10.1503/cmaj.109-4466.

- 45Joseph Dumit, Drugs for Life: How Pharmaceutical Companies Define Our Health, Experimental Futures (Durham, NC: Duke University Press, 2012).

- 46Greene and Riggs, “Why Is There No Generic Insulin?”

- 47Goldstein, McCrary, and Lipska, “Is the Overthe-Counter Availability of Human Insulin in the United States Good or Bad?”; Greene and Riggs, “Why Is There No Generic Insulin?”; Karl Horvath et al., “Long-Acting Insulin Analogues Versus NPH Insulin (Human Isophane Insulin) for Type 2 Diabetes Mellitus,” Cochrane Database of Systematic Reviews, no. 2 (2007): CD005613, https://doi.org/10.1002/14651858.CD005613.pub3; A. W. Logie and J. M. Stowers, “Hazards of Monocomponent Insulins,” BMJ: British Medical Journal 1, no. 6014 (1976): 879–80; Bernd Richter, Gudrun Neises, and Karla Bergerhoff, “Human Versus Animal Insulin in People with Diabetes Mellitus: A Systematic Review,” Endocrinology and Metabolism Clinics of North America 31, no. 3 (2002): 723–49, https://doi.org/10.1016/ S0889-8529(02)00020-8; Robert E. Slayton, Ruth E. Burrows, and Alexander Marble, “Lente Insulin in the Treatment of Diabetes,” New England Journal of Medicine 253, no. 17 (1955): 722–25, https://doi.org/10.1056/NEJM195510272531704.

- 48Federal Trade Commission, “Pay for Delay” Federal Trade Commission (July 23, 2013), https://www.ftc.gov/news-events/media-resources/mergers-competition/pay….

- 49C. Scott Hemphill, “Paying for Delay: Pharmaceutical Patent Settlement as a Regulatory Design Problem,” New York University Law Review 81, no. 5 (2006): 1553–1623.

- 50Manica Balasegaram et al., “An Open Source Pharma Roadmap,” PLOS Medicine 14, no. 4 (2017): e1002276, https://doi.org/10.1371/journal.pmed.1002276.

- 51Joseph A. DiMasi, Ronald W. Hansen, and Henry G. Grabowski, “The Price of Innovation: New Estimates of Drug Development Costs,” Journal of Health Economics 22, no. 2 (2003): 151–85, https://doi.org/10.1016/S0167-6296(02)00126-1.

- 52Donald W. Light and Rebecca Warburton, “Demythologizing the High Costs of Pharmaceutical Research,” BioSocieties 6, no. 1 (2011): 34–50, https://doi.org/10.1057/biosoc.2010.40.

- 53PhRMA, “Pharmaceutical Industry Profile 2009” (Washington, DC: Pharmaceutical Research and Manufacturers of America, April 2009), http://www.phrma-jp.org/wordpress/wp-content/uploads/old/library/indust….

- 54Light and Warburton, “Demythologizing the High Costs of Pharmaceutical Research”; Vinay Prasad and Sham Mailankody, “Research and Development Spending to Bring a Single Cancer Drug to Market and Revenues After Approval,” JAMA Internal Medicine 177, no. 11 (2017): 1569–75, https://doi.org/10.1001/jamainternmed.2017.3601.

- 55Kaushik Sunder Rajan, Biocapital: The Constitution of Postgenomic Life (Durham, NC: Duke University Press, 2006), 23.

- 56Andrew W. Mulcahy, Jakub P. Hlavka, and Spencer R. Case, “Biosimilar Cost Savings in the United States,” Rand Health Quarterly 7, no. 4 (2018), https://www.rand.org/pubs/perspectives/PE264.html.

- 57Food and Drug Administration, “Statement from FDA Commissioner Scott Gottlieb, M.D., on New Actions Advancing the Agency’s Biosimilars Policy Framework,” US Food and Drug Administration (December 11, 2018), https://www.fda.gov/news-events/press-announcements/statement-fda-commi….

- 58DIYbiosphere, “Browse Labs,” DIYbiosphere, accessed December 7, 2019, https://sphere.diybio.org/.

- 59Robert Bolton and Richard Thomas, “Biohackers: The Science, Politics, and Economics of Synthetic Biology,” Innovations: Technology, Governance, Globalization 9, no. 1–2 (2014): 213–19, https://doi.org/10.1162/inov_a_00210; Christopher M. Kelty, “Outlaw, Hackers, Victorian Amateurs: Diagnosing Public Participation in the Life Sciences Today,” Journal of Science Communication 9, no. 1 (2010): 1–8, https://doi.org/10.22323/2.09010303.

- 60Phil Brown, “Popular Epidemiology and Toxic Waste Contamination: Lay and Professional Ways of Knowing,” Journal of Health and Social Behavior 33, no. 3 (1992): 267–81, https://doi.org/10.2307/2137356; Sandra G. Harding, Whose Science? Whose Knowledge? Thinking from Women’s Lives (Ithaca, New York: Cornell University Press, 1991); Vicente Navarro, “Work, Ideology, and Science: The Case of Medicine,” International Journal of Health Services 10, no. 4 (1980): 523–50, https://doi.org/10.2190/6EAJ-HEXP-UBQG-GK4A; Adriana Petryna, Life Exposed: Biological Citizens After Chernobyl (Princeton, New Jersey: Princeton University Press, 2002); Rajan, Biocapital.

- 61Jeremy Freese and Karen Lutfey, “Fundamental Causality: Challenges of an Animating Concept for Medical Sociology,” in Handbook of the Sociology of Health, Illness, and Healing: A Blueprint for the 21st Century, ed. Bernice A. Pescosolido et al., Handbooks of Sociology and Social Research (New York: Springer New York, 2011), 67–81, https://doi.org/10.1007/978-1-4419-7261-3_4.

- 62Open Source Malaria, “Open Source Malaria,” accessed May 17, 2019, http://opensourcemalaria.org/.

- 63Four Thieves Vinegar, “FAQ,” accessed April 26, 2020, https://fourthievesvinegar.org/faq.

- 64Jim Oldfield, “Open-Science Model for Drug Discovery Expands to Neurodegenerative Diseases,” University of Toronto Faculty of Medicine (February 15, 2019), https://medicine.utoronto.ca/news/open-science-model-drug-discovery-exp….

- 65Balasegaram et al., “An Open Source Pharma Roadmap.”

- 66Gallegos et al., “The Open Insulin Project.”

- 67Laura E. Crowell et al., “On-Demand Manufacturing of Clinical-Quality Biopharmaceuticals,” Nature Biotechnology 36, no. 10 (2018): 988–95, https://doi.org/10.1038/nbt.4262.

- 68Richard P. Harrison, Qasim A. Rafiq, and Nicholas Medcalf, “Centralised versus Decentralised Manufacturing and the Delivery of Healthcare Products: A United Kingdom Exemplar,” Cytotherapy 20, no. 6 (2018): 873–90, https://doi.org/10.1016/j.jcyt.2018.05.003.

- 69Skylar Jeremias, “California’s Governor Signs Bill for State to Produce Its Own Biosimilars, Insulins,” The Center For Biosimilars (September 29, 2020), https://www.centerforbiosimilars.com/view/california-s-governor-signs-b….

![Facebook photo by Right Care Alliance with caption: “These are the Americans (that we have [sic] know of) who have died recently from rationing insulin.” Alec Smith is shown top, center.](/sites/default/files/screen_shot_2020-11-17_at_6.54.48_pm.png)