Read our press release on this research.

Introduction

The Low Income Housing Tax Credit (LIHTC) program is the largest federal housing program in the United States, redirecting hundreds of millions of dollars per year in funds towards the creation and preservation of low-income rental housing. Indirectly subsidized by federal coffers, states enjoy enormous discretion in administering the program, with each state establishing its own criteria for awarding the tax credit.

The Haas Institute for a Fair and Inclusive Society at UC Berkeley analyzed LIHTC data from the California Department of Housing and Community Development (HCD) and the California Tax Credit Allocation Committee (TCAC) on housing projects financed by the tax credit within the San Francisco Bay Area.1 The intention was to understand the temporal and spatial patterns of LIHTC developments from 1987–2014, including projects financed with both federal Four Percent (4%) and Nine Percent (9%) Tax Credits.2 To assess the state’s efficacy in promoting housing opportunities for low-income Californians in well-resourced, racially integrated neighborhoods, this report analyzes project categories by neighborhood opportunity and demographic composition:

Opportunity Analysis

Demographic Analysis

- Large Family5 projects

- Race-based analysis

We utilized UC Davis’ Center for Regional Change Regional Opportunity Index (ROI) methodology and their placebased data to recalculate the opportunity index for the Bay Area at the census tract level, as displayed in Map 1 in the Appendix.6 Additional data were gathered from the U.S. Census Bureau American Community Survey (ACS).

This comprehensive report shows that LIHTC developments in the Bay Area are relatively well spread across boundaries of opportunity. We also find that the Nine Percent Tax Credit outperforms the Four Percent in financing projects in higher opportunity neighborhoods. Furthermore, based on a 2015 report published by the United States Department of Housing and Urban Development Office of Policy Development and Research, California’s LIHTC funding allocation formula has reduced the number of LIHTC projects that are sited in areas with high concentrations of poverty.7 Upon deeper inspection, however, our analysis illuminates areas for improvement, including the need to provide more LIHTC developments in higher opportunity neighborhoods. Thus, TCAC should adopt Qualified Allocation Plan (QAP) criteria that will promote LIHTC projects in higher opportunity areas to ensure that households seeking subsidized rental housing have access to opportunity and upward mobility.

Background

California is in the midst of a housing affordability crisis, with over half of renters statewide considered to be “costburdened” and nearly a third considered to be “severely cost-burdened” according to federal criteria.8 Additionally, there is a 1.5 million unit shortfall of rental housing units that are affordable to very low- and extremely low-income renters. State criteria to determine which projects receive California’s limited amount of federal tax credits, as enacted in the, must be analyzed to ensure that the state is incentivizing the siting of low-income rental housing in high-opportunity areas.9 ,10

The QAP matters because it is a crucial determinant of where developers can receive public financing for Nine Percent Tax Credit projects, affecting whether projects are sited in neighborhoods with higher or lower opportunity and whether projects are built in racially integrated or segregated areas. It is vital to site LIHTC projects in high-opportunity areas—where quality resources and services enhance opportunity for residents. Understanding the patterns of community-level resource distribution and service provision surrounding LIHTC-financed projects provides insights as to whether government housing subsidies are fostering upward mobility and furthering fair housing for lowincome residents.

Two existing state-by-state research studies provide initial suggestions as to how California’s QAP has affected project siting within the state, though it should be noted that prior to this report’s publication no study has assessed LIHTC projects in the Bay Area relative to other metro regions. Most recently, an analysis in 2015 from HUD revealed that California is making moderate strides at reducing the poverty exposure of LIHTC units. There was a 13.1% decrease in the number of neighborhoods with LIHTC projects which had poverty rates over 30% between the 2003-2005 period and the 2011-2013 period.11 However, a study in 2006 indicated that California was not successful at promoting LIHTC projects in racially integrated neighborhoods. More than 70% of LIHTC projects in California’s metropolitan areas were sited in census tracts where the percentage of non-whites was greater than the percentage living in the respective metropolitan area, suggesting that projects were disproportionately sited in segregated neighborhoods.12 ,13

This report presents a series of tables, charts, and maps that display the analyses we performed to assess LIHTC projects, units, awards, construction types, and housing types in terms of neighborhood opportunity and demographic composition.

OPPORTUNITY ANALYSIS

To conduct the opportunity analysis, we used the ROI methodology to recalculate the Opportunity Index for each census tract in the Bay Area and divided these tracts into 5 quintiles based on the index value—higher values as higher opportunity and vice versa. The opportunity categories, ranking from highest to lowest opportunity scores, were labeled as Very High, High, Moderate, Low, and Very Low opportunity. The opportunity categories for each census tract are presented visually in Appendix Map 1. The following tables and charts present California LIHTC developments relative to opportunity, disaggregated by Four Percent and Nine Percent Tax Credits.

Analysis of LIHTC Developments by Opportunity

Our initial interpretation of the data on LIHTC projects, units, and total awards by opportunity shows that both Four Percent and Nine Percent Tax Credits are fairly evenly distributed across five categories of opportunity: Very High, High, Moderate, Low, and Very Low (Refer to Table 1 and Chart 1). There are more Four Percent Tax Credit projects than Nine Percent Tax Credit projects sited in the Bay Area (See Table 1 and Appendix Map 2). However, 64.9% of Four Percent Tax Credit projects are sited in the Moderate, Low, and Very Low opportunity areas. In addition, the opportunity category with the highest percentage of projects (24.9%) was the Low opportunity category, a trend that is seen throughout our Opportunity Analysis of LIHTC developments that received the Four Percent Tax Credits (See Chart and Appendix Charts 1b and 1c).

The performance of the Nine Percent Tax Credits stands in stark contrast to that of the Four Percent Tax Credits, due to a relatively high percentage of projects (25.7%), units (28.7%), and awards (25.9%) sited in Very High opportunity areas (See Chart 1; see also Charts 1b and 1c in the Appendix). For the Nine Percent Credit, the Very High opportunity category has the highest number of projects (25.7%); additionally, the allocation between Moderate and Low opportunity is comparable (20.9% and 22.8%, respectively). Thus, simply disaggregating projects by Four and Nine Percent Tax Credits shows that developments which received Nine Percent Tax Credits (which are awarded through the competitive application process according to QAP criteria) are far more likely to be sited in higher opportunity neighborhoods.14

Analysis of Acquisition, Rehabilitation, and New Construction by Opportunity

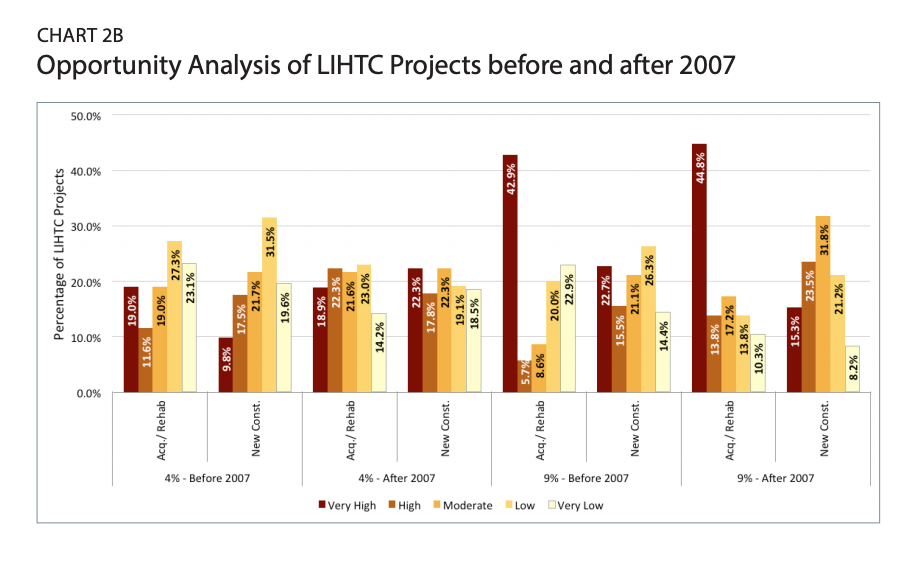

To understand the distribution of Acquisition, Rehabilitation, and New Construction developments, the data—which spanned the years 1987–2014—was divided into two categories: before 2007 and after 2007.15 This data is displayed visually in Appendix Map 3. Our data analysis revealed that before 2007, there were more Acquisition, Rehabilitation, and New Construction projects in the Four Percent Credit category located in lower opportunity areas. After 2007, however, more Acquisition, Rehabilitation, and New Construction projects were sited in higher opportunity areas.

For the Nine Percent Tax Credits, there were too many fluctuations and inconsistencies in the trends before and after 2007 to draw conclusions about how projects were sited relative to opportunity. The aggregated total of Four and Nine Percent before 2007, however, showed that about two-thirds of New Construction projects were sited in Moderate and Low opportunity categories. After 2007, the distribution of New Construction projects became fairly even except for the Moderate opportunity category, which had more projects than other opportunity categories (See Table 2).

Further assessments of the construction types before and after 2007 revealed there was a clear decrease in the percentage of projects that were sited in the lowest opportunity categories across program and project types (See Chart 2b). Prior to 2007, 71.3% of Four Percent Tax Credit projects of all types were sited in Moderate, Low, or Very Low opportunity areas. After 2007, this number dropped to 59.3%. As for the Nine Percent Credit, both before 2007 and after 2007, a plurality of Acquisition and Rehabilitation projects (42.8% and 44.9%, respectively) were in Very High opportunity areas; however, the proportion of projects in the lower four opportunity categories shifted dramatically over time. Whereas before 2007, nearly 43% of Acquisition and Rehabilitation projects were in the Very Low and Low opportunity categories, after 2007 this figure diminished to 24.1%, and a far greater percentage of projects were sited in High and Moderate areas. There was also an increase of New Construction projects in Moderate and High opportunity groups after 2007. However, the percentage of Nine Percent Credits New Construction projects in the Very High opportunity category declined significantly after 2007, falling from 22.7% to 15.3%.

Analysis of Four Percent and Nine Percent Tax Credits Timeline

The timelines in Charts 2c and 2d present data from 1987 - 2014 LIHTC developments and show the trajectory of both types of tax credits and the number of projects per year. For both the Four Percent and Nine Percent program, the number of Acquisition and Rehabilitation projects financed by tax credits has historically been lower than the number of New Construction projects. Chart 2c shows that the number of Four Percent Acquisition and Rehabilitation projects increased around 1996 and remained steady from 1998 - 2009. As seen in Chart 2d, there were very few Acquisition and Rehabilitation projects financed by the Nine Percent Tax Credit, though the number of these projects temporarily increased between 1998 and 2001, and again between 2011 and 2013.

In the early years of the LIHTC program, more New Construction projects were financed using the Nine Percent credit than the Four Percent credit, though this trend reversed in the early 2000’s, and in more recent years similar numbers of projects have been financed by the two programs. The trajectory of Nine Percent New Construction projects fluctuated throughout the time frame considered, as shown in Chart 2d. The numbers rose sharply after 1989, when there were zero projects constructed, but after 1995 New Construction projects dropped and never returned to the levels seen in the early 1990’s. As seen in Chart 2c, the number of Four Percent Tax Credit New Construction projects rose from 1995 to 2005 with a peak value in 2003, but the quantity of projects dipped and increased periodically.

DEMOGRAPHIC ANALYSIS

In this section we demonstrate how Large Family LIHTC developments were sited relative to opportunity as compared to other types of developments, and we subsequently discuss project siting relative to the racial/ethnic composition of neighborhoods. Prior to 2016, Large Family projects were defined by having at least 25% of units with three or more bedrooms, and with at least 1,000 square feet of living room space. These projects are important to consider independently from other kinds of housing because they are more likely to house families with children, and the consensus in the academic literature is that child well-being, as well as their lifetime opportunities, are correlated with the neighborhoods in which they are raised.16 Our racial and ethnic analysis demonstrated that there are a disproportionate number of LIHTC projects, units, and awards in neighborhoods where the population of non-whites is greater than 40%.

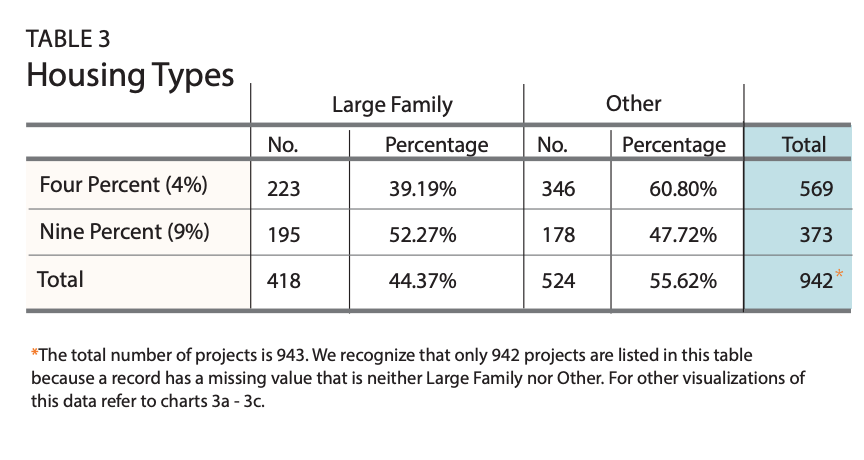

In order to better understand the spatial pattern of Large Family housing developments, we analyzed Large Family by neighborhood opportunity and demographic composition. In Appendix Map 4 we have displayed the spatial distribution of Large Family projects and “Other” types of LIHTC projects. Table 3 shows that the Four Percent Tax Credit financed a total of 223 Large Family projects (39.19%), whereas it financed 346 projects (60.80%) ‘Other’ projects. The Nine Percent category financed 195 Large Family projects, while 178 projects are classified as ‘Other’. When both federal tax credit programs are aggregated, there are fewer Large Family housing projects than all other housing types combined (See Table 3).

We recognize that aggregating all housing types that are not classified as Large Family as ‘Other’ does not show the distinctions between different LIHTC project types —which include at-risk, special needs, non-targeted, and SingleRoom Occupancy (SRO)—and we may therefore be overlooking or neglecting a variety of other dynamics. Yet, the process of combining these other categories allows us to draw clear distinctions between housing types that are likely to have smaller unit sizes and standards from Large Family housing.

Analysis of Large Family Projects by Opportunity

Analyzing tax credit projects by housing type reveals that Large Family projects in both Four and Nine Percent Tax Credit categories are disproportionately concentrated in low-opportunity areas – 46.9% of the total of Large Family projects are in Low and Very Low opportunity neighborhoods, as opposed to 36.1% of all ‘Other’ types of projects (see Table 2a in the Appendix). Furthermore, disaggregating Large Family projects and units by type shows that over 46% of New Construction projects and total units are sited in Low and Very Low opportunity neighborhoods.

It is concerning that New Construction Large Family housing projects are built in areas that are not ideal for families because resources, services, and amenities are limited or inadequate, and may be in areas with poorly-performing neighborhood schools, high crime, or environmental hazards. We urge that priorities must be given to siting Large Family developments in high-opportunity neighborhoods to benefit families with children and foster well-being and upward mobility (see Table 8, and Charts 3b and 3c in the Appendix).

Analysis of LIHTC Developments and Neighborhood Demographics

This section presents California LIHTC projects, units, and awards relative to racial or ethnic composition of census tracts disaggregated by Four Percent and Nine Percent Tax Credits. It is crucial to analyze these residential patterns relative to opportunity to determine whether LIHTC developments are reinforcing or exacerbating patterns of segregation.17 For a visual illustration of LIHTC projects and neighborhood demographic composition, refer to Map 5 in the Appendix.

To conduct this demographic analysis, we pulled data from the American Community Survey (2010 - 2014, 5-year estimates) and divided the population of non-whites into 5 categories with equal intervals of 20% each. These categories range from less than 20%, 20.01–40%, 40.01–60%, 60.01–80%, and above 80%.18

In 2014, the Bay Area has a total population of 7,360,487 residents. Of these, 1,743,954 residents identify as Hispanic or Latino; 3,050,293 as non-Hispanic white; 1,758,791 as Asian; 455,865 as Black or African American; and 351,584 as Native American, Pacific Islander, or mixed-race.19 Thus, non-whites are 58.56% of the Bay Area population and 41.44% are non-Hispanic whites (see Tables 6 and 7 in the Appendix). With this degree of diversity, it is challenging to assess whether the Bay Area is racially integrated or segregated and whether LIHTC plays a role in reinforcing or exacerbating segregation.

Limitations

While effort was taken to ensure that this analysis was performed as rigorously as possible, it is important to highlight several limitations. One limitations is our breakdown of project data from 1987–2014 into two groups. The “before 2007” category is a span of 19 years of data, meaning that there are far more projects, units, and awards in that category, whereas there is only 7 years’ worth of data for the “after 2007” category presented in table 2. To mitigate this issue, the charts display the percentage of projects; this standardizes the data by showing proportions instead of sums of 19 years’ and 7 years’ worth of data, respectively.

A limitation of our demographic analysis is our aggregation of the Hispanic, African American, Asian, and Other racial groups into the category of “non-white”. Combining several racial groups together may not provide a holistic evaluation of which racial group(s) receives the least affordable housing options and support from the federal housing program.

In addition, we classified Asians as “non-whites” for the purpose of the demographic analysis. Nationally, a high level of non-white segregation generally raises fair housing concerns because of the nation’s history of racial discrimination and exclusion. However, in the Bay Area context, the dynamics may be different for Asians because many neighborhoods—particularly those in close proximity to Silicon Valley—may have very high populations of Asians who are employed by nearby technology firms, which pay salaries above the regional median income. Currently, there is a lack of research on whether neighborhoods with high percentages of Asians experience lower levels of opportunity than whites with similar incomes—especially in areas where these groups have high-paying jobs.

Conclusion

Since the inception of the LIHTC program in 1986, research on the location of LIHTC projects in relation to opportunity have been mixed in their assessments on the efficacy of the program.20 Our analysis of LIHTC projects in the San Francisco Bay Area has revealed similar patterns to those historically observed, in addition to some novel trends.

After assessing tax credit housing locations in the Bay Area, the pattern of LIHTC developments seems to promote a larger-than-desired percentage of its affordable housing in low-opportunity areas non-whites comprise 50% or more of the population. While California has made improvements in ensuring that LIHTC units are not exposed to high levels of poverty in the last ten years, there are still areas for improvement, such as encouraging Large Family and New Construction projects in higher opportunity neighborhoods and maintaining the number and quality of Acquisition and Rehabilitation developments.21

Refer to page 24 in the U.S. Department of Housing and Urban Development Office of Policy Development and Research 2015 Effect of QAP Incentives on the Location of LIHTC Properties report.

- What levels of neighborhood opportunity were present at the time that LIHTC projects were constructed?

- Have neighborhoods with LIHTC projects gradually transitioned from having lower opportunity levels to higher levels, or vice versa?

- Have the most recently constructed projects been sited in higher opportunity areas than the projects that were constructed in the earlier years of the LIHTC program?

Below is a summary of our key findings.

Key Findings

- Housing projects financed by the LIHTC in the Bay Area were relatively well distributed across the boundaries of opportunity, although there was variability depending on program type, project year, and project type (See Charts 1, 2b, and 3a).

- Nine Percent Tax Credit projects outperformed the Four Percent Tax Credit in financing projects in higher opportunity neighborhoods. For example, Nine Percent Tax Credit projects were more likely to be sited in Very High opportunity neighborhoods than Four Percent Tax Credit projects (25.7% versus 17.5%) (See Table 1).

- More than 45% of Large Family projects were sited in Low and Very Low opportunity areas. In particular, Large Family New Construction projects and units were disproportionately placed in low-opportunity areas, where resources for families with children are inadequate to support healthy development and upward mobility (See Table 3 and Appendix Table 8).

- A large plurality of Nine Percent Tax Credit Acquisition and Rehabilitation projects were sited in Very High opportunity neighborhoods, and these projects robustly outperformed both Nine Percent New Construction projects and Four Percent Tax Credit projects of all types (See Chart 2b).

- While more Nine Percent Acquisition and Rehabilitation projects were sited in Very High opportunity neighborhoods than other project types, changes are needed to reduce the percentage of Nine Percent and Four Percent projects in both the New Construction and Acquisition and Rehabilitation categories that are sited in Low and Very Low opportunity areas (See Table 2).

- More than 61% of LIHTC developments and awards were dispersed in areas where over 60% of the population were people of color (See Table 4).

- In neighborhoods with populations that were majority-people of color, there were three times the amount of LIHTC projects than majority-white neighborhoods. Additionally, the ratio of Nine Percent Tax Credit units in majority-people of color neighborhoods to majority-white neighborhoods was 3.78:1. These findings demonstrated that there is much to be desired in terms of promoting LIHTC projects in racially integrated areas (See Tables 4 and 5).

Appendix

- 1The IRS administers the LIHTC program to states, while the California Tax Credit Allocation Committee determines how the two federal tax credits are allocated within California. Refer to page 2 of the Description of California Tax Credit Allocation Committee Programs via http://www.treasurer.ca.gov/ctcac/program.pdf.

- 2The Four Percent and Nine Percent Tax Credits indicate that housing projects are eligible for different levels of tax credit financing. For the Four Percent Credit, the dollar amount of the tax credits is 30% of the qualified costs of a housing project, while for the Nine Percent Tax Credit, the tax credit value is 70% of the qualified costs. See Novogradac, Michael J. 2002. Novogradac Renewable Energy Tax Credit Handbook-2010 Edition. Novogradac & Company LLP, June 1.

- 3Federal and state contributions were aggregated by multiplying federal awards by 10 years of tax credits and adding the one-time state award to obtain the sum of awards categorized as “Total Awards.”

- 4Acquisition/Rehabilitation and New Construction are the two different construction classifications that help determine the eligibility basis and building calculation. Novogradac, Michael J. 2002. Novogradac Renewable Energy Tax Credit Handbook-2010 Edition. Novogradac & Company LLP, June 1.

- 5Large Family is defined in the California Tax Credit Allocation Committee Code of Regulation Section 10325(g)(1)(A). Prior to 2016, Large Family projects were defined by having at least 25% of units with apartments that have three or more bedrooms. http://www.treasurer.ca.gov/ctcac/programreg/2015/20150121/regulations….

- 6The Regional Opportunity Index has two indices: People-based and Place-based. Our analysis used the place-based index because we are interested in understanding and assessing the spatial patterns of LIHTC developments at the census tract level. The 2014 ROI data are accessible via http://interact.regionalchange.ucdavis.edu/roi/data.html. The Haas Institute served on the peer review committee and assisted the Center for Regional Change in developing the ROI methodology

- 7Refer to page 24 in the U.S. Department of Housing and Urban Development Office of Policy Development and Research 2015 Effect of QAP Incentives on the Location of LIHTC Properties report.

- 8California Department of Housing and Community Development, 2016. “California’s Housing Future: Challenges and Opportunities.” Statewide Housing Assessment 2025 Public Draft.

- 9The Qualified Allocation Plan is defined in Regulation Section 10302(ee). https://casetext.com/regulation/california-code-of-regulations/title-4-…

- 10The QAP applies only to the Nine Percent Tax Credit, meaning that developers must compete with one another for Nine Percent Tax Credit awards by proposing housing developments which meet the greatest number of criteria in the QAP.

- 11U.S. HUD Office of Policy Development and Research, 2015. “Effect of QAP Incentives on the Location of LIHTC Properties.”

- 12In this study, California LIHTC neighborhoods were roughly as segregated as those in Texas, where the Supreme Court determined in a 2013 landmark case that the segregated siting pattern of LIHTC properties created a disparate racial impact, and was therefore a violation of the Fair Housing Act. See Brief of Housing Scholars as Amici Curiae, supporting Respondent. Texas Dept. of Housing and Community Affairs v. The Inclusive Communities Project, Inc., 135 S. Ct. 2507 (2015). Texas is also a useful comparison state because it receives the second highest number of LIHTC funds after California, and because at the time data was collected, metro areas in California and Texas had roughly the same percentage of non-white residents. See Exhibit 10 in Khadduri, Buron, & Climaco, 2006. “Are States Using the Low Income Housing Tax Credit to Enable Families with Children to Live in Low Poverty and Racially Integrated Neighborhoods?” http://www.prrac.org/pdf/LIHTC_report_2006.pdf

- 13While the findings here on racial segregation in LIHTC neighborhoods can neither confirm nor deny the 2006 findings with respect to racial segregation because of divergent methodologies, it is important to conduct additional research statewide to understand whether the Bay Area is an exception to the trends found in 2006 study, or whether LIHTC neighborhoods have become less segregated over the last ten years in California.

- 14See page 4 in California Tax Credit Allocation Committee http://www.treasurer.ca.gov/ctcac/program.pdf.

- 15The reason for this choice was that legislation enacted in the wake of the economic crisis of 2008 had important implications for LIHTC, namely the Housing and Economic Recovery Act (HERA) of 2008 and the American Recovery and Reinvestment Act (ARRA) of 2009. See Novogradac 2012.

- 16See, for example, Chetty, Hendren, Kline, and Saez. 2014. “Where is the Land of Opportunity? The Geography of Intergenerational Mobility in the United States.” The Quarterly Journal of Economics 129:4.

- 17Within the academic literature on the “neighborhood effects” of poverty, and within more recent research on lifetime opportunity, there is a consensus that segregated, impoverished, non-white neighborhoods are areas of concentrated disadvantage that reduce social mobility over time. See, for example, Chetty et. al. 2014.

- 18We gathered data for the total population and subtracted non-Hispanic whites to obtain the non-white population, comprised of Hispanics, Blacks, Asians, Native Americans, and mixed-race groups.

- 19The demographic analysis of Bay Area’s nine counties—Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma—is done at the US Census Burea census tract level using the 2010-2014 ACS 5-year-estimates. The racial/ethnic categories are also based on the US Census Bureau demographic classification. We addressed this categorization in the limitation section

- 20Lance Freeman, 2004. Siting Affordable Housing: Location and Development Trends of Low Income Housing Tax Credit Developments in the http://www.brookings.edu/research/reports/2004/04/metropolitanpolicy-fr…

- 21Refer to page 24 in the U.S. Department of Housing and Urban Development Office of Policy Development and Research 2015 Effect of QAP Incentives on the Location of LIHTC Properties report.